Q1 2024 Indiana Tech Venture Report: Indiana Kicks off 2024 by Outpacing National VC Investment Activity

In the first quarter of 2024, the national venture capital (VC) landscape presented a mixed picture, with investment levels at a five-year low based on PitchBook data, despite a slight uptick in valuations and exit activity compared to last quarter. In contrast, Indiana emerged as a bright spot, displaying growth in VC activities across various metrics at the highest level since at least 2015

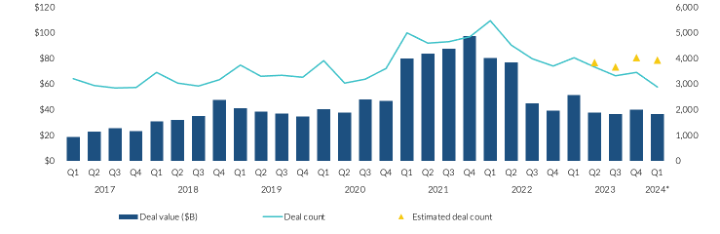

Nationwide, total VC investment reached $36.6 billion in Q1 2024, a 26 percent decrease from the same period in 2023. The number of VC deals nationwide also saw a 28 percent decline, totaling 2,882 in Q1 2024. This downturn reflects a cautious investment climate, influenced by many factors, including continued uncertainty around economic performance and how artificial intelligence (AI) will influence existing sectors.

U.S. VC Deal Activity by Quarter*

Source: PitchBook *As of 3/31/2024

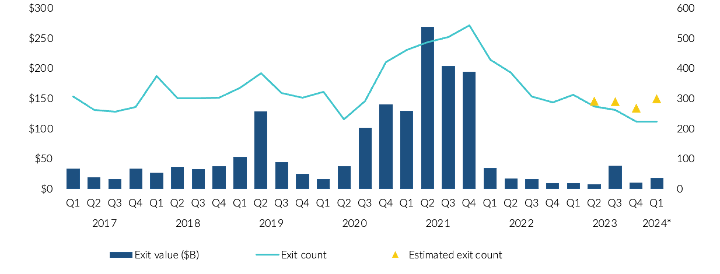

The national exit market almost doubled the exit value of Q1 2023, although there were fewer deals in Q1 2024. In March, two large initial public offerings (IPOs) – Reddit and Astera Labs Inc. accounted for 73 percent of the total exit value generated in 2024.

U.S. VC Exit Activity by Quarter*

Source: PitchBook *As of 3/31/2024

Indiana bucked the national trend, with VC investment overall (tech sector plus other sectors) rising to $491.93 million, a marked increase from Q1 2023’s $126.51 million. Mirroring the nationwide exit activity, two Indiana deals offered the lion’s share of that total. Carmel-based Sudo Biosciences raised $147 million, and Fort Wayne-based *Mammoth Technology raised $270 million in Q1.

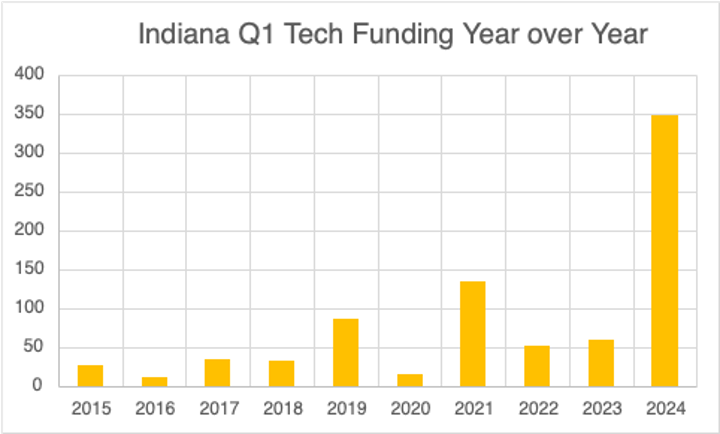

$349 million in deal value came from tech sector companies through 29 deals, which is the highest-performing quarter since TechPoint started measuring this data in 2015.

Deal Value in $Millions

There was also a significant increase in tech merger and acquisition (M&A) and IPO activity. In the calendar year 2023, there were 19 Indiana M&A/IPOs. In Q1 2024, there were nine. This growth underscores the state’s expanding innovation ecosystem and investor confidence.

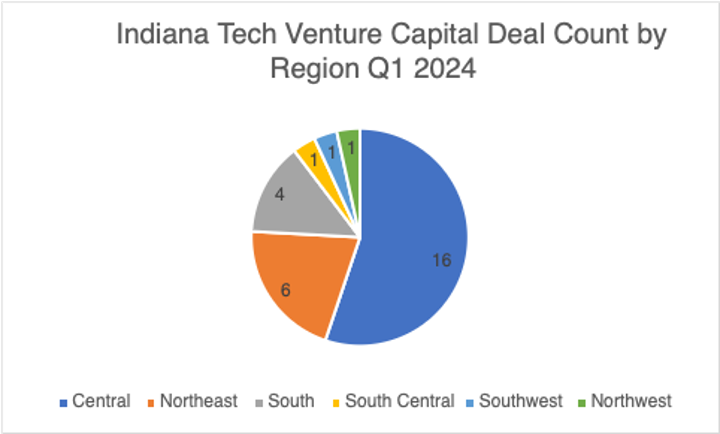

This quarter, we observed consistency in the distribution of deals across the state, with the majority of deals closing in Central Indiana and Northeast Indiana. We continue to see activity in all regions, which demonstrates the proliferation of tech across Indiana.

| Region | Deal Count | Deal Value ($M) |

|---|---|---|

| Central | 16 | 71.17 |

| Northeast | 6 | 272.55 |

| South | 4 | 4.38 |

| South Central | 1 | 0.73 |

| Southwest | 1 | 0.05 |

| Northwest | 1 | Undisclosed |

The types of tech businesses receiving capital, again, were diverse across sectors, with Life Sciences, AgBioScience, Manufacturing/HardTech, and EdTech/Workforce Tech seeing the most activity. We continue to see lagging investment activity in Indiana’s AI/ML sector, demonstrating we have work to do on AI innovation and adoption across the state.

| Vertical | Deal Count | Deal Value ($M) |

|---|---|---|

| AgBioScience | 6 | 46.8 |

| HR Tech | 1 | 3.5 |

| CyberSecurity | 1 | Undisclosed |

| Manufacturing / HardTech | 4 | 8.9 |

| EdTech & Workforce Tech | 6 | 5.63 |

| Life Sciences | 5 | 3.43 |

| Mobility | 1 | Undisclosed |

| E-Commerce | 1 | 4.78 |

| Tech Services | 1 | 0.01 |

| Martech | 2 | 5.83 |

| Fintech | 1 | 270 |

Six of this quarter’s 28 tech deals had undisclosed investor lists. Based on the available data, Elevate Ventures led the way again in terms of deal count with 10. IU Ventures, Flywheel Fund, and HG Ventures were all also listed in more than one deal this quarter.

The table below notes Indiana tech deal distribution for the first quarter by stage. As a reminder, this data does not fully report all that was invested in Indiana tech companies, as some companies do not disclose the financial terms of their capital raises.

| Deal Stage | Deal Value ($M) | Deal Count |

|---|---|---|

| Seed | 4.28 | 5 |

| Early Stage VC | 24.16 | 12 |

| Pre-Seed | 1.39 | 6 |

| Late Stage VC | 319.05 | 4 |

| Undisclosed | – | 2 |

| Total | 348.88 | 29 |

The stages of venture investment

Investment stage definitions are primarily based on PitchBook with minor adjustments according to Indiana’s venture investors’ mandates.

Pre-seed

Less than $500,000, without identifiable investment by professionally-managed pool of capital for financial returns

Seed

$500,000 to $5 million without identifiable investment by professionally-managed pool of capital for financial returns.

Early-stage

$1 million –$10 million with identifiable investment by professionally-managed pool of capital for financial returns.

Late-stage

$10 million or more with identifiable investment by professionally-managed pool of capital for financial returns.

Regional definitions follow those used by the Indiana Department of Workforce Development.

Continue reading for the Q1 2024 month-by-month listing of publicly shared investments, grants, and acquisitions involving Indiana technology companies.

January

DriverReach, a recruiting and compliance management system for the trucking industry, announced the closure of its Series B funding round led by Fulcrum Equity Partners, an Atlanta-based growth equity fund. This strategic investment marks a significant milestone in the company’s journey to modernize and revolutionize driver recruiting and compliance in the trucking industry. The round includes participation from Fulcrum as well as other strategic investors.

Marlabs LLC., a digital solutions company with offices in New Jersey, Brazil and India, announced their acquisition of Indianapolis-based Onebridge to accelerate its growth in AI and data analytics space. Financial details of the transaction were not shared.

Growth equity investment firm Edison Partners led a $43 million growth investment in 120Water, a cloud-based water management and testing system based in Zionsville, with continued participation from Allos Ventures. The new funds will be used to further expand the 120Water team, technology investments, and go-to-market efforts.

Innovaccer Inc., with offices in San Francisco and Boulder, announced their acquisition of Cured, an Indianapolis-based digital marketing and CRM platform for healthcare. Financial details were not shared.

Vanair, a mobile power solutions product and technology provider based in Michigan City, announced their acquisition of Grip Idle Management, a company recognized for its patented and leading technology in advanced vehicle engine idle reduction. Grip Idle Management, presently based in Ontario, Canada, will be relocated to Vanair’s headquarters. The company did not share financial details regarding the transaction.

Mobile reCell of Indianapolis was acquired by Apkudo of Baltimore. The combination of Mobile reCell’s software-driven recovery of corporate-owned IT assets and Apkudo’s existing solution portfolio sets a new standard for the connected device supply chain. Financial details of the acquisition were not disclosed.

Lake City Heat Treating, based in Warsaw, Indiana, was acquired by Bodycote for $66 million. Bodycote is a global provider of subcontract thermal processing services based in the United Kingdom. Lake City Heat Treating provides hot isostatic pressing (HIP) and vacuum heat treatment services, primarily supplying the orthopedic implant market and civil aerospace.

February

Flaunt announced a $1.8M raise to accelerate their growth. Since its initial launch in 2023, Flaunt has built a powerful next-generation loyalty cloud harnessing AI-powered insights, personalized campaign creation, and social integrations, enabling enterprise marketers to create first-of-their-kind loyalty experiences. This latest round of funding, led by High Alpha with participation from Square Deal Capital, Service Provider Capital, executives at Roblox, and others, will be used to grow and accelerate the product and bring the next generation of Roblox, Shopify Plus, and gamified loyalty cloud offerings to market.

Cook Biotech Incorporated of West Lafayette was acquired by RTI Surgical of Alachua, Florida. RTI’s acquisition of Cook Biotech is backed by its main shareholder, Montagu, who is increasing its investment in the group and contributing carve-out experience and capabilities to the transaction. Financial details were not included in the announcement.

Central Indiana Hardware, Inc. Co. (CIH), a subsidiary of APTURA Group, announced its acquisition of Tinder Lock and Security Solutions, a renowned Indianapolis-based company specializing in comprehensive locksmithing and security solutions. The acquisition, finalized on February 16, 2024, marks a significant milestone for both companies, further solidifying CIH as the leading service provider in the Division 8, 10, and 28 commercial openings sectors. Financial details of the transaction were not shared.

GrazeCart, an e-commerce technology solution built specifically for farmers in Roanoke, Indiana, was acquired by POS Nation of Charlotte, North Carolina. The acquisition enables GrazeCart to expand its reach to farm-to-fork food suppliers looking to improve their direct-to-consumer (D2C) marketing and sales. The terms of the deal were not disclosed.

March

VinSense, LLC has announced a capital raise led by Boyd Street Ventures of Norman, Oklahoma. VinSense’s software system is designed to empower agricultural crop producers to optimize the usage of essential resources, such as water and fertilizers, while significantly improving crop output and quality. The company works with notable wineries in California and Washington, showcasing the technology’s effectiveness in the wine industry. It was also announced that VinSense will move its headquarters to Norman, Oklahoma.

Everon, a Boca Raton, Florida-based security integrator and provider of commercial security, fire, and life safety solutions in the U.S., announced it has acquired Indianapolis-based DIGIOP, a software development company specializing in video and business intelligence solutions. Through the acquisition, Mike Compton, President and Chief Executive Officer of DIGIOP, will join the Everon executive leadership team as Chief Technology Officer.

———

TechPoint has reported tech investments and M&A activity involving Indiana technology companies since 2015. Our innovation and entrepreneurship program portfolio has grown. Below are many ways you can engage with us as entrepreneurs, operators or investors:

Share your funding deals with us by emailing Roger Shuman at Roger@TechPoint.org.

Post job openings on the TechPoint Job Board.

Access industry expertise and additional connectivity through Venture Support

Share with your peers through the Indiana Founders Network

Gain executive insights from Indiana CIO Network

Monetize your Indiana Venture Capital Tax Credit through the VCI Marketplace

Stay connected to the TechPoint Index by subscribing to our weekly newsletter for additional information and insights on Indiana’s tech sector.

See prior quarterly reviews and the 2023 Indiana Tech Venture Report here.

* Reported by PitchBook, and subject to further data validation.