Humanness Connects Us All

An Indiana Tech Founder Seeks to Make an Impact on Workplace Well-Being

I first got to know Alicia Mckoy when she was seeking investment to build her tech startup, Peak Mind and I was serving in my venture investing role at the beginning of 2020. That was when digital health had a lot of venture investor market momentum. Amongst all direct-to-consumer delivery model powered by telehealth and venture investment rounds, mental health had started to become a practice area that seemed to lend itself to riding such market wave. Personalized care fueled by tech-enabled data and insights were finally on the verge of fulfilling the promise of better patient experiences and better outcomes.

Peak Mind, Alicia’s company, was one of those digital health startups that seeks to address a mental well-being crisis, burnout and turnover, with the help of a cutting-edge AI-enabled technology platform. I remember asking Alicia the usual investor-probing questions, having seen a few different startups trying to solve more or less the same problem, like: How do you know your technology actually improves mental wellness? Do you have efficacy data? What is user experience like? And how do you go about acquiring users and driving meaningful user adoption? One question, although in the back of my mind, that I did not ask was how would you go about raising the capital needed to quickly scale this as an underrepresented founder? For all of us in that room including her, we knew we didn’t ask because none of us had ready and compelling answers.

Little did we know then how the world would change in a way almost unimaginable. By April 2020, about half of the world’s population was under some form of lockdown, with more than 3.9 billion people in more than 90 countries or territories have been asked or ordered to stay at home by their governments. The resulting stress level has gone up across the board. “The current U.S. Surgeon General has now listed workplace stress and well-being as a Top 5 public health crisis in America,” says Alicia, “recognizing that most of us can no longer hide or want to keep our personal stress separate from our working relationships.”

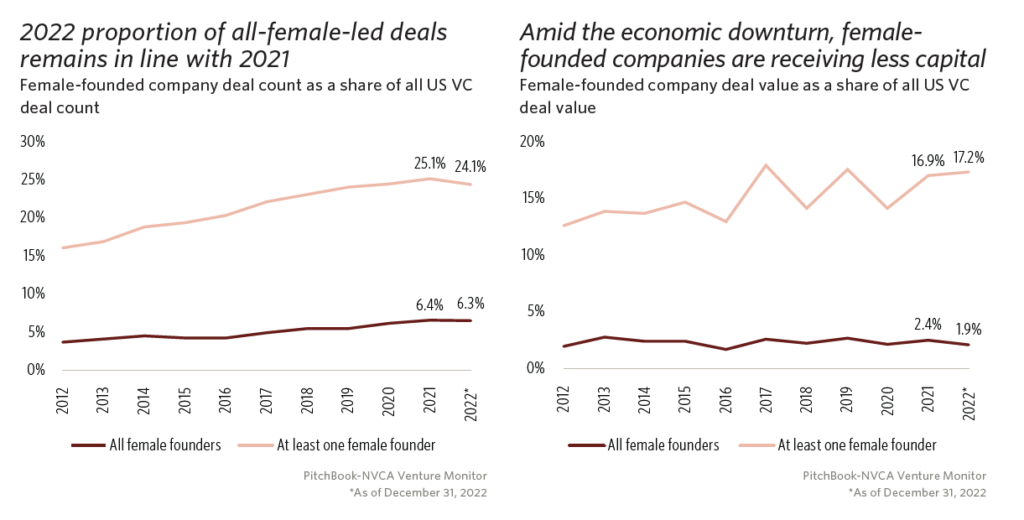

With the market problem increasing, the pathways to providing solutions through companies like Peak Mind did not get easier. For capital, seed and early-stage investors became more risk averse, while late-stage investors saw their portfolio heavily impacted by limited valuation increase or exits through public markets or private acquisitions. While the number deals for female founder have been trending up nationally, the amount of capital invested as an indication of venture growth, has not moved meaningfully in the last decade.

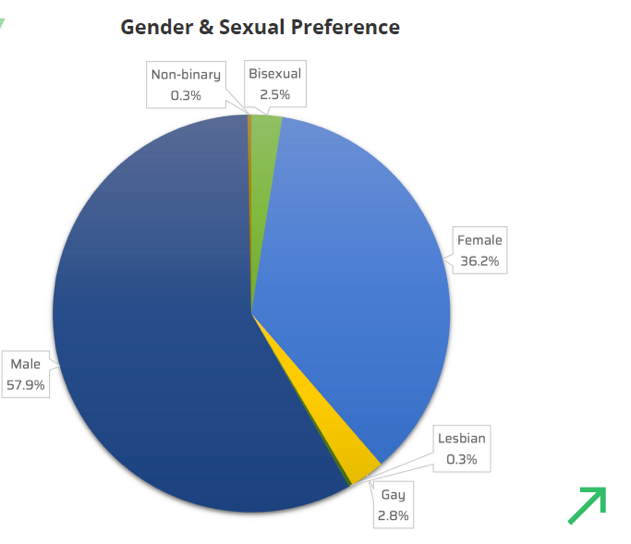

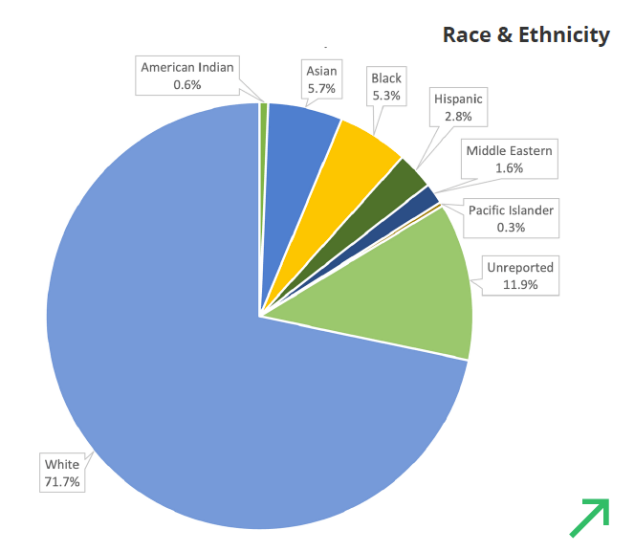

In Indiana, health tech is in the top 3 tech investments for 2022, accounting for $36 million across 19 deals (2022 Indiana Tech Venture Report). The same report also highlighted, for the first time through comprehensive survey data, the opportunity to support the development of more diverse founders, operators and investors in our tech venture ecosystem.

Their customers, healthcare providers, were busy with adjusting to the new work/life mode and new priorities. For a startup with no tangible products to demo or data to support user adoption or product efficacy, the risk was simply too high to champion at the time. Alicia certainly experienced first-hand. “The timing of the Pandemic on our business outreach was a struggle to say the least. If a purchasing executive is drowning in their own life crisis and fear, they cannot fully hear what someone is trying to sell a new solution to them. This has led to repeated attempts to gain the focus and attention of those whom we need to greenlight our product.”

It’s often said that venture building is all about the team. That’s particularly true for the earliest stage when founders need to both sell the why, the who, the what and the how, and still execute. That’s why strong conviction and persistence matter. More importantly, a deep understanding of how to balance that against a practical approach to getting buy-in and make progress would eventually separate out achievers from dreamers. That’s what I admire the most about Alicia, having interacted with thousands of founders in my venture investing career.

Fast forward three years, despite not yet venture-backed, she’s now having a functional prototype with integrated AR/VR hardware and proprietary software loaded with social-emotional learning tools, experts and simulations.

She’s now hosting customer briefing sessions at the Emerging Manufacturing Collaboration Center at 16 Tech. She’s tapped into Innovation Voucher and SBIR programs managed by the Applied Research Institute and Elevate Ventures. She’s leveraging the talent base through data analytics interns from AnalytiXIN and Xtern and on the path to getting efficacy data. She’s participated in multiple TechPoint Venture Connect sessions with potential investor base and remains in close contact with local investors like Sixty8 Capital.

“I check all the diversity boxes, I spent decades in the corporate environment, and I have worked hard for years to build personal relationships and bridges across organizations” Alicia says. “Can you imagine the challenges of other diverse founders who are much less connected than I am?” Support organizations like The Startup Ladies play a crucial role in providing that close peer network, and so do other health innovation assets like BioCrossroads and Indiana Health Industry Forum in opening more points of access. Alicia’s approach to building her own venture success and to enabling others particularly diverse founders is through leading with actions and building bridges. “It’s the humanness that connects us all,” she states, and we could not agree more.