Market Turbulence Affecting Indiana VC but Stabilization Signs are Emerging

The first half of 2025 demonstrated early signs of stabilization across the U.S. venture market, but several market conditions continue to reshape investor behavior and capital activity. Fundraising remains slow, exits are limited and liquidity continues to lag. Additionally, Artificial Intelligence (AI) is driving a clear divergence in outcomes: capital and valuations are increasingly concentrated in a small group of companies while mega-rounds, like OpenAI’s $40 billion fundraise, continue to distort averages and drive value concentration at the top.

Deal Activity

Due to lagging liquidity, the venture capital market continues to see an imbalance between capital supply and startup demand, especially in late-stage and venture-growth segments. According to PitchBook, as of May 2025, the capital demand-supply ratio remains above long-term trendlines despite early improvements in deal value and deal count.

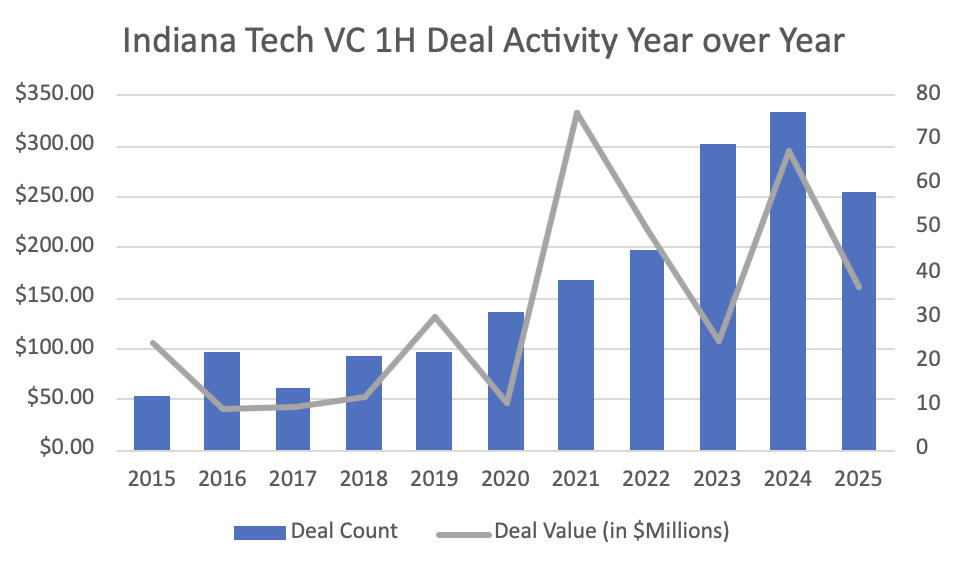

Through June, TechPoint recorded 58 tech-focused venture deals totaling $161.7 million in disclosed capital. While deal volume is pacing below 2024, this reflects a broader national deceleration rather than state-specific weakness. Indiana’s deal activity aligns with national patterns of cautious but persistent capital deployment.

Fundraising and Valuations

Venture fundraising remains constrained. Across the U.S., only $23 billion was raised through May 2025, tracking well below PitchBook’s $90 billion base-case forecast. The average period between fundraising rounds has stretched to 2.9 years, the longest in over a decade. While some unicorn IPOs and large M&A deals have helped, meaningful improvements in LP liquidity may not materialize until 2026 and beyond. In the meantime, fundraising will likely remain below pre-2022 levels.

Pitchbook reported modest increases in valuations, particularly in early- and mid-stage financings. Series B companies saw annualized valuation growth of 36% through May, a marked improvement from the previous two years. However, this growth is still low by historical standards and valuations remain bifurcated. AI companies raising Series A rounds are tracking close to 2021 levels, while later-stage companies outside of AI continue to face slower growth and less investor interest.

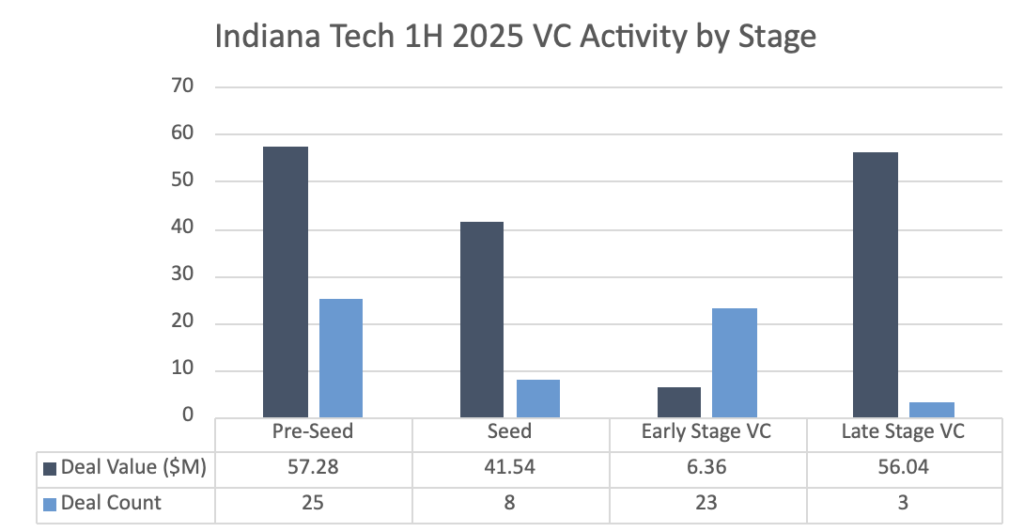

In Indiana, pre-seed, seed, and Series A investments remain the strongest segments. Of the 58 deals completed, early-stage rounds accounted for the majority of both count and value. The average deal size was $3.7 million, modest by national standards but consistent with the state’s historical benchmarks. This pattern reinforces Indiana’s role as a regional hub for emerging tech ventures.

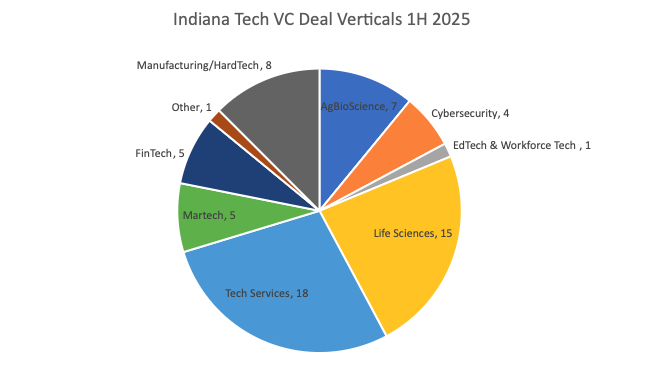

While AI and life sciences led Indiana’s tech venture activity in 2024, early 2025 data reflects continued sector diversity. AI/ML remains prominent, but deal flow spans digital health, enterprise SaaS, sports tech, and data infrastructure. These trends mirror national patterns of concentrated growth in high-performing verticals, with Indiana startups showing healthy alignment with investor demand.

Exits & Liquidity

In a continuation of a trend that emerged in late 2024, Indiana has not recorded many high-profile M&A deals, and only one IPO, in the first half of 2025. This is consistent with national exit trends, where acquisitions have become the dominant path but remain scarce. While national firms are increasingly exploring small-scale M&A, Indiana-based exits have been limited in count so far this year, with 15 deals taking place and an undisclosed total value.

Despite more favorable buyer-side conditions, the market is operating cautiously. Capital is being deployed slowly and selectively while LPs wait for meaningful liquidity to return. With IPO activity subdued, M&A has become the primary exit route. PitchBook reported through midyear, acquisitions accounted for 73.7% of all VC-backed exits, the highest share since 2017. A total of 372 acquisitions closed in the first half of 2025, putting the market on track to slightly exceed 2024 totals.

Many of these transactions are driven by well-capitalized VC-backed companies acquiring smaller peers. As of May, 36.3% of all VC-backed M&A deals involved a buyer that was also venture-backed. This marks a new high and reflects how AI startups and others are using M&A to accelerate growth or consolidate talent. Despite this progress, the exit environment is still not strong enough to fully restart the venture flywheel.

High Alpha, Allos Ventures and other institutional players remain active across 2025 Indiana tech venture deal activity. University-affiliated investors and corporate arms, such as Elanco’s, also have been active this year. Together, these players continue to serve as critical anchors for the state’s innovation economy.

With 58 tech venture deals and $160 million in disclosed tech venture funding through midyear, Indiana is on pace for another strong showing in 2025. Barring macroeconomic setbacks, the second half of the year could see increased capital deployment, particularly if national liquidity improves and exits begin to materialize. For now, the state’s ecosystem continues to show disciplined growth and sector breadth, based on TechPoint‘s analysis.

Continue reading for the H1 2025 month-by-month listing of publicly shared investments, grants, and acquisitions involving Indiana technology companies.

January

Ekkobar, an Indianapolis-based sports-tech company, secured a strategic investment from Elevate Ventures in its pre-seed funding. The company’s platform is used to understand social media beyond statistics, enabling brands to act on decisions with confidence and clarity. In addition to their capital raise, the company has created a number of strategic partnerships with companies and organizations including SportsTech HQ, Data 317 and the Indiana University – Indianapolis Sports Innovation Institute.

Indianapolis-based hc1 accelerated growth with $6.25 million in new financing after its successful acquisition of Accumen in October 2024. The funding will support launching enhanced solutions that couple hc1 + Accumen’s market-leading technology and expertise. This strategic growth initiative advances hc1’s mission of driving healthcare progress through predictive insights, personalized care, and increased efficiencies. Existing investor, Health Cloud Capital, led the investment with participation from health tech investment firm A1 Health Ventures. Arsenal Capital Partners also joined the investor base in the combined platform via its ownership stake in Accumen.

Mark Cuban, owner of the Dallas Mavericks and Indiana University alum, invested in Motion, a Bloomington-based sports tech company. Built by former college coaches, athletes, and administrators, Motion was created to help athletic departments and programs run smarter, from scheduling and communication to compliance and NIL.

myTickets, a Notre Dame-based sports tech company working to recreate the way fans purchase tickets to events, raised nearly $300K. “We started with our family and friends, and we raised about $17k that way,” notes Kenan Wursthorn, co-founder & CEO of myTickets. “We had a couple angels come on…and we’ve also worked with Platform Venture Studios and Elevate Ventures, which is what gets us to the $282k mark.”

Stellar, an AI-driven business solutions provider based in Indianapolis, announced a $2.7 million seed raise. The new capital will be used to expand the company’s sales and marketing capabilities and expand its data engineering team, enabling Stellar to further its mission of helping businesses integrate generative AI, Large Language Models, and machine learning across their operations. “This funding is a testament to the transformative potential of AI in solving real-world business challenges,” said Brett Flinchum, co-founder and CEO of Stellar. The funding round was led by venture capital firm Ground Game, with additional participation from Elevate Ventures. Both Ground Game and Elevate Ventures joined as investors in the oversubscribed seed round.

February

Details from February’s deals were not disclosed.

March

Entegrata, a legal technology company focused on transforming how law firms manage and utilize data, announced their most recent seed round, bringing the company to $4.5 million in total funding. The round was led by Chicago Ventures with participation from OnDean Forward and The LegalTech Fund.

Valio, an Indianapolis company that automates rebate compliance for hospitals and suppliers to help hospitals maximize savings and suppliers drive profitable growth, participated in the Techstars AI Health accelerator in Baltimore, MD. This Techstars accelerator received support from Johns Hopkins University and CareFirst BlueCross.

April

Ateios Systems of Newberry received a $1 million investment from the TitletownTech start-up draft competition held in Green Bay, Wisconsin. The prize also included $350,000 in Microsoft Azure credits. The company’s innovative technology produces battery components with enhanced performance, cost reduction, and minimizing environmental impact.

Vsimple of New Albany announced a Series A funding round led by Silverton Partners. Vsimple connects workflows by bringing documents, tasks, approvals, and communication together in one simple, AI-powered platform.

May

Arrive AI, a company specializing in autonomous delivery networks, completed a direct listing on the Nasdaq Stock Exchange on May 15, 2025, with the ticker symbol ARAI and received a $40M capital infusion from Streeterville Capital. Arrive AI’s technology focuses on “AI-powered Arrive Points” for secure and autonomous package delivery.

Nirvana Labs is a high-performance cloud purpose-built for Web3 that delivers bare metal speed, dedicated infrastructure, and radically cheaper bandwidth for the world’s most demanding blockchain workloads. The Indianapolis company raised a $6 million seed extension co-led by Crucible Capital and Jump Crypto.

Olio announced the closing of an $11 million Series B funding round. Fulcrum Equity Partners led the round with participation from Mutual Capital Partners, a growth equity firm specializing in scaling innovative healthcare and B2B software companies. Olio, based in Indianapolis, makes complex care more organized, coordinated, and effective by requiring mutual participation in processes that work to improving patient outcomes.

Prediction Guard of Lafayette raised $3.7 million in an oversubscribed seed funding round. This investment fuels the company’s growth and enable them to expand their product adoption in regulated industries or where security is a top priority. The round was led by Sovereign’s Capital with participation from Blu Ventures, Noblis Ventures, K Street Capital, WaterStone Impact Fund, Ringbolt, BHB Fund, M25, Launch Factory, Service Provider Capital, Flywheel Fund, Overlook VC, and key strategic angels. This investor syndicate brings deep expertise in enterprise software, cybersecurity, regulated industries, and cutting-edge R&D. Prediction Guard is a secure, scalable GenAI platform that can be self-hosted, safeguards sensitive data, prevents common AI malfunctions, and runs on affordable hardware.

June

Fiber Global, a Brownsburg-based pioneer in sustainable building materials raised $20 million in Series A funding. The round was led by DBL Partners, with Founder and Managing Partner Ira Ehrenpreis joining the Board of Directors. The capital supports Fiber Global’s mission to transform abundant global waste streams into scalable, sustainable building materials, starting with expansion of its U.S. manufacturing footprint.

____________________________________________________________________________

TechPoint’s Venture Report Methodology:

The stages of venture investment:

Investment stage definitions are focused on current round size, primarily based on PitchBook with minor adjustments according to Indiana’s venture investors’ mandates.

| Pre-Seed | Less than $500,000, without identifiable investment by professionally managed pool of capital for financial returns. |

| Seed | $500,000 to $5 million without identifiable investment by professionally managed pool of capital for financial returns. |

| Early Stage | $1 million –$10 million with identifiable investment by professionally managed pool of capital for financial returns. |

| Late Stage | $10 million or more with identifiable investment by professionally managed pool of capital for financial returns. |

Verticals:

Verticals are primarily based on PitchBook with minor adjustments according to Indiana’s venture investors’ mandates.

| Agbioscience | E-Commerce |

| HR Tech | Tech Services |

| CyberSecurity | Martech |

| Manufacturing / HardTech | Fintech |

| EdTech & Workforce Tech | Real Estate Technology |

| Life Sciences | Other |

| Mobility |

____________________________________________________________________________

TechPoint has reported tech investments and M&A activity involving Indiana technology companies since 2015. Our innovation and entrepreneurship program portfolio has grown. Below are many ways you can engage with us as entrepreneurs, operators or investors:

Share your funding deals with us by emailing Roger Shuman at Roger@TechPoint.org.

Post job openings on the TechPoint Job Board.

Access industry expertise and additional connectivity through Venture Support.

Build peer relationships through the Indiana Founders Network.

Gain executive insights from the Indiana CIO Network.

Learn about AI and build a peer network of AI practitioners through the Indiana AI Innovation Network.

Monetize your Indiana Venture Capital Tax Credit through the VCI Marketplace.

Stay connected to the TechPoint Index by subscribing to our weekly Index newsletter for additional information and insights on Indiana’s tech sector.

Review prior Indiana Tech Venture Reports here.

This industry insights are brought to you by TechPoint team members Chelsea Linder, Roger Shuman, Samantha Ginther and Mary Dougherty.

Media contact: Lara Beck, lara@beckcommunicationsgroup.com