10 Software-as-a-Service Industry Trends Highlighted at the SaaStr Conference

In the early days of March 2020 I was registered to attend the SaaStr Annual conference to be held in the Bay Area. Of course, it didn’t happen as the country shut down in the Middle of March due to the Global Covid pandemic. Three years later, I was finally able to attend and glean some industry trends.

SaaStr Annual bills itself as the world’s largest SaaS community event on the planet, with over 12,000 executives, founders and VCs coming together in the Bay Area for three days of tactical sessions from world-known founders, new voices, and up & comers, along with incredible networking opportunities. The SaaSter community was started in 2012 by Jason Lemkin, a former founder, tech executive and attorney, with the goal of helping founders grow SaaS businesses from $0 to $100M ARR with less stress and more success. In addition to conferences, the organization offers an incredible breadth of content that should appeal to anyone working with software companies.

Of course, I was not the only member of the Indiana tech communityin attendance at SaaStr Annual. I ran into a handful of Indiana tech leaders looking to grow their networks and expand their businesses. Specifically, our friends from High Alpha participated—hosting a happy hour and proudly serving up Jeff Reekers on one of the SaaStr stages. Jeff is the former CMO of AirCall, an NYC-based telephone and communication software platform, and now the co-founder and CEO of Indianapolis-based Champion.

Here are some of the digital innovation trends I noticed during my time at SaaStr. Note that some of these points may slightly contradict others on this list as they came from different speakers and experts.

1. Artificial intelligence is everywhere. Of the 130+ staged presentations that took place during SaaStr, at least 20 featured “AI” in the title of the presentation. I don’t recall many sessions that took place where AI was not mentioned. Companies and sponsors with booths promised AI solutions. Moreover, while we are accustomed to seeing billboard ads along the road for things like beer, plumbing and law firms, those along the Bay Area featured products and services related to AI.

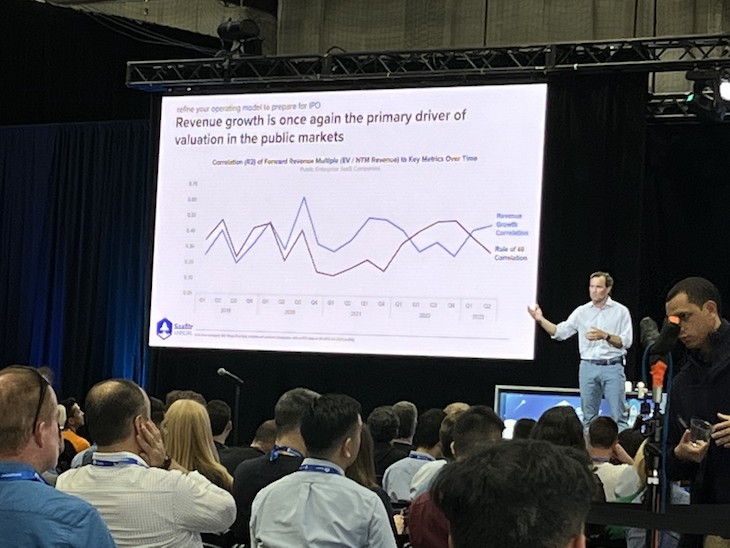

2. SaaStr CEO Jason Lemkin notes that while revenue generation has historically been the primary driver of valuation in the public markets, efficiency rose to the top level in the past year as venture capital investment going into companies dwindled. The trend is now turning back to revenue as these indicator companies have become more efficient.

3. Lemkin believes tech layoffs at large indicator tech companies nationwide has likely bottomed out. This is consistent with Susan Orr’s findings related to Indiana tech companies in her recent IBJ article. These tech layoffs that have taken place in the past year have more to do with companies getting efficient with capital and less to do with the overall performance of companies. Lemkin also notes that these same Indicator tech companies are starting to hire again.

4. Tech investors, in general, are still devaluing companies, driving them (especially early-stage tech companies) to be more efficient with capital as they lean more on revenue. This should bode well with Indiana tech companies and Indiana startups that have a history of boot-strapping and doing a lot with a little.

5. Lemkin and others note the incredible VC investment dollars experienced in 2021 and 2022 were NOT normal. While investments are likely to pick up again, we will probably not see these types of numbers anytime soon. Indiana venture capital has grown as well, but we are not likely to experience the boom and bust given the smaller fund sizes managed by the local fund managers.

6. For the first time in nearly two years there are a host of tech companies filing IPOs and getting ready to officially go public. According to Lemkin, the last significant tech IPO took place in December of 2021. Klaviyo, a martech company based in Boston, is poised to go public in the coming months. Note that the last Indiana-based tech company to go public was ExactTarget in 2011.

7. There doesn’t appear to be mass interest in later stage venture raises here at SaaStr Annual. Scale Venture Partners (https://www.scalevp.com/) presentation on raising a Series B was incredibly informative but only drew an audience of about 20 people in a room set up for at least 300.

8. Neil Sequiera, founder and partner with defy VC, warns founders to do their homework when talking to potential investors. Don’t assume the VC you’re currently meeting has capital to invest in your company. Most of the VCs in his network are not currently writing checks because they don’t have money in their funds. Moreover, the firms that DO have capital are looking for growth rates of at least 300%. He urges founders to manage their businesses tightly and not to put their faith in VCs.

9. Sequiera offers some tips for companies raising capital who are having a hard time getting warm introductions to investors. First, make an effort to partner with successful companies who have great investors. The success you have with these companies can open the door to having a quality conversation with their investors.

10. Speaking of having quality conversations, the Indiana Venture Summit returns the week of June 17 here in Central Indiana. This is your opportunity to participate in events like Venture Connect to meet potential investors through our partnerships with the Next Level Fund’s Annual Summit and Venture Club of Indiana’s Innovation showcase. Mark this down on your calendar now. If you’re an early-stage founder, take a few minutes to check out TechPoint’s Venture Support page. Complete the form so we can hear your pitch and help you along your way to scale! Consider this your front door to getting connected with the Indiana tech startup ecosystem. We want to provide you with the tools you need to scale your company and we look forward to meeting you.