Meet Justin Bates, Director of Finance at SmarterHQ

Employer: SmarterHQ

Job Title: Director of Finance

Degree Path: Ball State University – Entrepreneurship & Accounting, CPA

Hometown: Carmel, IN

Current City: Fishers, IN

What led you to your getting into tech and this occupation? What was your first job in tech?

I grew up around technology and always had a strong interest in it. My mom was a computer and math teacher and my dad was in software sales and ultimately started his own technology business. I took a coding course in college and ultimately enrolled in the Entrepreneurship Program at Ball State University where my business plan was a software and technology-focused business. I doubled majored in accounting largely because I was good at math and if you understood the financials you would understand how the business actually operates. Out of college, my first job was at a big 4 accounting firm, KPMG, where I was fortunate to be able to work on the ExactTarget engagement team which is where I fell in love with technology companies and the people that work in them.

What has been your career path so far?

My career path after college started off in what might seem the antithesis of startup and technology. I worked at a big 4 accounting firm as a CPA. However, in college, I had internships in IT, accounting, marketing, and sales which gave me a strong foundation of skills for later career opportunities. After my time at KPMG, I worked at a subsidiary of CNO Financial called 40|86 which is a little-known investment company managing the $25B in CNO assets. Here I spent a lot of time teaching myself Microsoft Access while learning about managing databases, developing custom reports, and finance & insurance. I moved on to an accounting manager position at a publicly traded bank focused on managing the P&L and cash of the bank, but shortly after this I felt compelled to get back into technology. I started doing free work (not freelance) on nights and weekends for some startup companies, including ModalLogix, helping them to build financial models. Shortly thereafter, I had an opportunity to take a huge risk and start a tech company with a partner and MaxTradeIn was born. My partner and I built this marketplace across 5 states and had over 100 car dealers and 10,000 cars being listed every month and raised over $2M in capital. These stories do not all end well, however, and we had to close our doors but I immediately got the opportunity as the Controller to come back to one of the companies I had helped for free, ModalLogix, which is now called SmarterHQ.

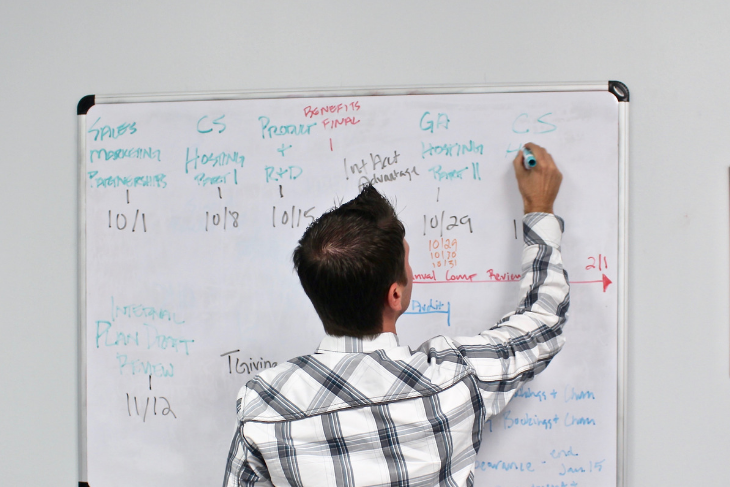

When you think of a day in your life, what are the main work activities you do or responsibilities you have?

Number one is to focus on cash. How much do we have and when are we running out? Everything else fundamentally stems from that. Ultimately, that manifests itself through the use of a 4 year projected financial model that is used to help guide the leadership team’s strategic decisions and answer two basic question: where are we going and how did we get where we are. In early-stage technology companies, everyone on the team is a doer (no managers here) and every role is critical. There isn’t a lot of extra money to hire people for operations, facilities, IT, legal, HR, etc., and as a result of a lot of these duties fall to the shoulders on the modern finance person. This can come in the form of putting together customers contracts, making sure all the companies systems are working together, ensuring everyone has the information they need, figuring out where people sit and what equipment they need, managing the company through office space searches, running payroll, and the list goes on and on.

Help us picture your work environment.

My work environment is very dynamic and was even more so in the early days of SmarterHQ. Most days offer a good mix of working with different teams in the company in meeting settings to solve problems or quietly working through financial models and accounting. Our office environment is very flexible with work arrangements overall, but we have also built our systems and infrastructure in a way that if you need to work at home or away from the office it is very easy to do so.

What do you love about the work you do?

I love that I get to see the fruits of my effort every day. Building a company is very hard work and requires a significant effort from a lot of people to make it successful. When a company is small and growing your work translates into something always has the opportunity to be meaningful and you can rapidly see improvements or failures play out. Technology companies are built on change and as such no idea is an idea unheard, so your voice and ingenuity can be heard and felt from day one.

Which personality traits, interests, and abilities are important or common for a person to succeed in and enjoy this occupation?

To be in finance & accounting at a startup technology company, you really need to be a flexible and creative problem solver. This fly’s right in the face of the traditional rule following, rigid, bean counter persona that accountants have earned over the years. It’s critical to be able to thrive in high-stress situations well and with poise, as well as be able to frequently get in front of people and talk.

Which tools/technologies or technical skills are particularly important for a person in your job to be proficient in?

Advanced Excel skills is a must, but more importantly is just having the aptitude and curious mind required to learn new systems frequently and understand how systems and data need to flow together. This is critical to be able to ensure the company is getting the reporting and data points they need to make the right decisions quickly.

Which soft skills (aka general business skills or employability skills) are particularly important for a person in this occupation to be proficient in?

What sets someone apart in this role is their soft skills. They have to be poised and comfortable pitching the company to investors or talking to the board. They have to manage endless lists of things to do and be able to prioritize and reprioritize on the fly as the business changes. Strong communication skills and teamwork is critical because in this role you are typically the first person to recognize a problem and need to inform the rest of the team and present the options or guide the team to uncovering them. Given this, you also must be comfortable having difficult conversations often.

From your experience with new grads applying for and beginning jobs in this occupation, are they missing any particular knowledge, skills, or experiences that hold them back? Please describe.

Maybe the biggest problem for new grads is actually overconfidence. The real world is a lot more “gray” than college textbooks would have you believe and that’s where experience comes in to play – knowing when to apply something one way vs another or how to apply it in different ways given the specific situation. Human behavior and pressures will play a much larger role than you can imagine, so you need to be comfortable talking with all different types of people and getting up out of your chair to learn.

Which resources, people, books, websites, etc. would you recommend to those who want to learn more or advance their skills in this occupation?

TechPoint is a great resource, but groups like Launch Fishers, universities, and Powderkeg are great as well. All of these represent communities and the key is to get out there to be a part of it. I think accountants and finance people are well read and educated by nature but the one thing they tend to neglect is the networking and relationship building that is the ultimate path to success.

What encouragement or advice would you offer to others considering this occupation or wanting to stand out amongst others?

To really stand out you need to be a well-rounded business person. You can’t just be really good at accounting and/ or finance. You have to understand sales, marketing, technology, HR, legal, etc and how those teams make decisions. You also have to be comfortable in front of people and be willing to carry a lot of stress while still being extremely effective. The biggest danger to any company is running out of money. This is never truer than for startups and you own this responsibility.