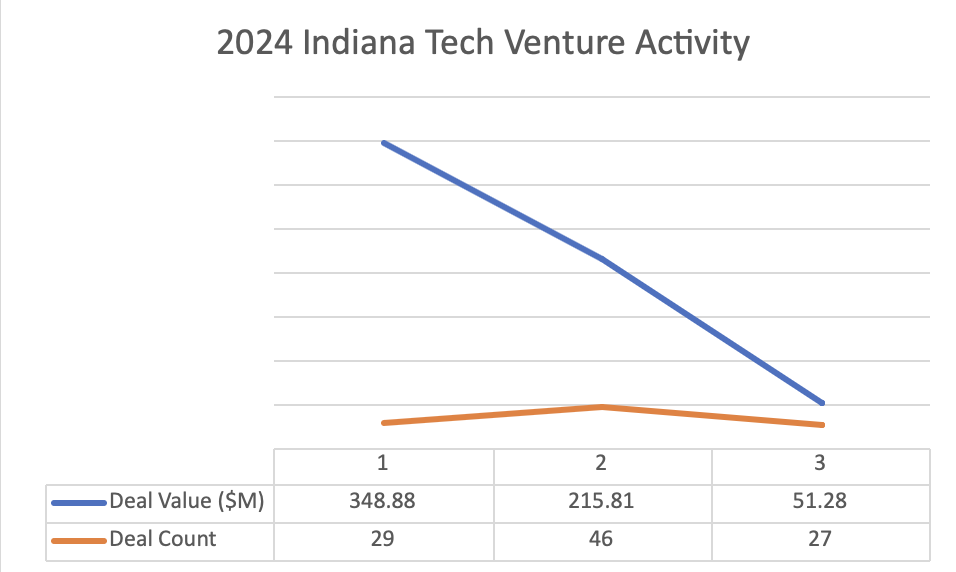

Indiana Tech Investments Down in Q3

The third quarter of 2024 saw significant fluctuations in the venture capital (VC) landscape, marked by shifts in investment strategies, regional hotspots of activity, and a renewed focus on technological advancements. Tech VC investment in Indiana decreased in the third quarter of 2024 in both total dollars and number of deals.

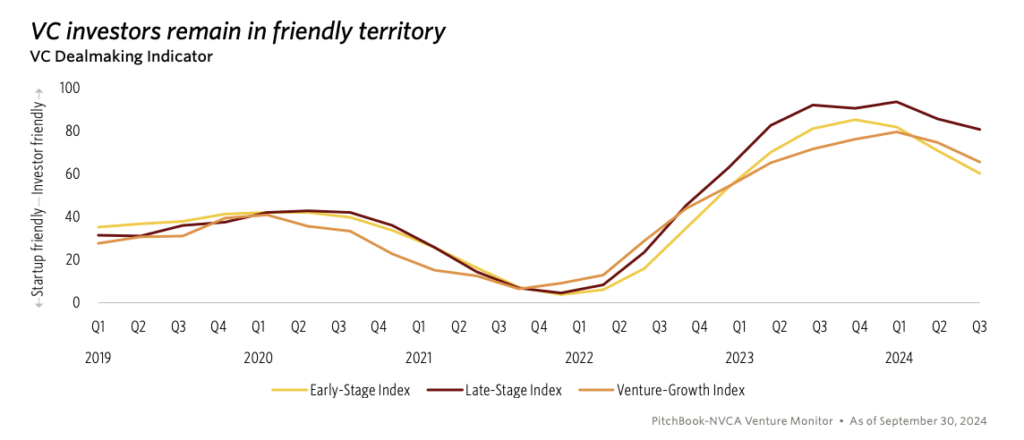

Recent shifts in economic policies, particularly adjustments in interest rates and tax reforms, have had a pronounced impact on venture capital funding. The Federal Reserve’s policy changes aimed at stabilizing inflation have resulted in cautious investment strategies, with VCs showing a preference for more mature, lower-risk ventures. This has led to a decline in seed-stage funding and slightly less of a slow-down in later-stage investments, demonstrating a strategic pivot towards stability amid economic uncertainty.

Conversely to the national data, Indiana’s earliest stages of investments (Pre-Seed and Seed) were more active than later stage, with the majority taking place in Early Stage VC rounds. Indiana has always seen more activity at the early stages due to research from our R1 universities and our numerous entrepreneurial support resources focused on early and idea stage ventures. It’s clear that Indiana needs to continue to build similar support systems and identify capital pathways for our later stage ventures to become more competitive with those around the nation.

| Deal Stage | Deal Value ($M) | Deal Count |

| Pre-Seed | 2.09 | 9 |

| Seed | 2.1 | 4 |

| Early Stage VC | 20.49 | 12 |

| Late Stage VC | 26.6 | 2 |

| Total | 51.28 | 27 |

Investor sentiment this quarter has been notably influenced by global economic conditions, with a marked increase in investment in sectors deemed ‘recession-proof,’ like healthcare and technology. Venture capitalists are diversifying their portfolios to include industries with steady demand, such as renewable energy and AI-driven technologies, reflecting a strategic shift towards sectors with long-term growth potential.

*Source: PitchBook

The rapid advancement in technologies like artificial intelligence (AI), machine learning, and biotechnology has catalyzed significant VC interest. AI startups, especially those in machine learning, data analytics, and autonomous systems, have seen a spike in funding, driven by their potential to disrupt multiple industries. Biotech ventures focusing on personalized medicine and genomics have also attracted substantial investments, underscored by the ongoing global health challenges and the push for innovative healthcare solutions. Indiana continues to support tech across industries with VC deals spanning 11 verticals this quarter.

| Vertical | Deal Count | Deal Value ($M) |

| Agtech | 1 | Undisclosed |

| HR Tech | 1 | 1.06 |

| CyberSecurity | 1 | 1.11 |

| Manufacturing / HardTech | 2 | 2.5 |

| EdTech & Workforce Tech | 3 | 4.25 |

| Medtech | 7 | 8.47 |

| Mobility | 2 | 0.5 |

| Tech Services | 5 | 0.3 |

| Martech | 3 | 32.34 |

| Fintech | 1 | 5 |

| Other | 1 | Undisclosed |

Q3 2024 has been a quarter of strategic realignment for venture capital, reflecting broader economic trends and shifts in investor priorities. As the VC landscape continues to evolve, the focus on technology, sustainability and diversity is likely to shape the future trajectory of investments. Moving forward, understanding these trends will be crucial for startups seeking funding and investors looking to capitalize on emerging opportunities.

The majority of the state’s VC deals closed in Q3 were in Central Indiana followed by Northwest Indiana. Pitchbook’s data did not indicate any deals in any other region of the state, which we’re not sure is an accurate portrayal of deal data based on historical trends. If you’re aware of a tech startup raising venture capital outside of Central and Northwest Indiana in Q3, let us know!

Seven of this quarter’s tech deals had undisclosed investor lists. Based on the available data, Elevate Ventures remained the most active investor in the state, making eight tech investments this quarter. This is a large decrease from Elevate’s 23 deals last quarter, but is on trend with past years’ data, demonstrating less robust activity overall in Q3.

Continue reading for the Q3 2024 month-by-month listing of publicly shared investments, grants, and acquisitions involving Indiana technology companies.

July

Nearwave, winner of the Innovation of the Year Award at the 2021 Mira Awards, participated in the Tampa Bay Wave HealthTech X Accelerator from July through September. The South Bend-based company produces a device that could potentially be used for medical diagnoses.

August

Gripp, an agtech company based in Indianapolis, was selected to Plug and Play Topeka. Plug and Play is an accelerator with programs all over the globe. The Topeka accelerator includes 14 agtech startups and 11 animal health startups for the fall 2024 cohort. Gripp creates mobile software to effectively scale agricultural operations. The company is working to change the agricultural industry by empowering operations teams to be data informed.

Prediction Guard of West Lafayette received an undisclosed investment from M25. Prediction Guard is a secure, scalable GenAI platform that safeguards sensitive data, prevents common AI malfunctions, and runs on affordable hardware.

Bereave, an Indianapolis-based startup dedicated to transforming how individuals navigate death, has secured pre-seed funding led by Bloomington’s Paragraph Ventures in their debut as a new studio, with additional investment by Flywheel Fund and IU Angel Network. This funding will accelerate Bereave’s growth and drive the co-development of its enterprise software with Paragraph Ventures. Together, they are creating a platform that empowers employers to deliver continuous, compassionate care that benefits both employees and the business. Specific details of the raise were not shared.

Indianapolis-based startup Reportwell secured $1.1 million in pre-seed funding to develop its regulatory compliance platform. The funding round included investment from Detroit Venture Partners, the Charter School Growth Fund, Ruthless for Good Fund, Everywhere Ventures, Techstars, and Duo Security founder Dug Song. Reportwell, which launched in 2023, emerged from the founders’ experience at PilotED Schools, where they faced significant challenges managing regulatory filings. This led to the creation of an online platform designed to simplify compliance reporting for schools, and potentially other regulated industries. The company’s platform, tested over the past 14 months, has already garnered interest from early adopters, including New Orleans Public Schools and the State of Missouri.

Your Money Line announced a $4.5M Series A funding round, led by Allos Ventures, with participation from First Trust Capital Partners, CareSource, and Elevate Ventures. The funding will accelerate the development of Your Money Line’s financial wellness solution and their mission to improve financial stability and confidence for all.

September

Highfive, an edtech startup based in Indianapolis has raised $250,000 from Roosh X, an investment firm based in Ukraine. Highfive’s platform is used to enable well-being and positive relationships within every school community.

Champion, the AI-powered customer advocacy platform, announced the closing of its oversubscribed $3.3 million Seed round led by Flyover Capital, with continued investment from High Alpha and participation from Bread & Butter Ventures and Stage 2 Capital. This investment will fuel Champion’s mission to drive efficient growth for businesses by identifying and activating hidden customer advocates. Champion is a High Alpha Studio company and is located in Indianapolis.

Methodology:

The stages of venture investment:

Investment stage definitions are primarily based on PitchBook with minor adjustments according to Indiana’s venture investors’ mandates.

| Pre-Seed | Less than $500,000, without identifiable investment by professionally-managed pool of capital for financial returns. |

| Seed | $500,000 to $5 million without identifiable investment by professionally-managed pool of capital for financial returns. |

| Early Stage | $1 million –$10 million with identifiable investment by professionally-managed pool of capital for financial returns. |

| Late Stage | $10 million or more with identifiable investment by professionally-managed pool of capital for financial returns. |

Regional definitions:

TechPoint follows those used by the Indiana Department of Workforce Development.

Verticals:

Verticals are primarily based on PitchBook with minor adjustments according to Indiana’s venture investors’ mandates.

| Agtech | E-Commerce |

| HR Tech | Tech Services |

| CyberSecurity | Martech |

| Manufacturing / HardTech | Fintech |

| EdTech & Workforce Tech | Real Estate Technology |

| Medtech | Other |

| Mobility |

TechPoint has reported tech investments and M&A activity involving Indiana technology companies since 2015. Our innovation and entrepreneurship program portfolio has grown. Below are many ways you can engage with us as entrepreneurs, operators or investors:

Share your funding deals with us by emailing Roger Shuman at Roger@TechPoint.org.

Post job openings on the TechPoint Job Board.

Access industry expertise and additional connectivity through Venture Support.

Share with your peers through the Indiana Founders Network.

Gain executive insights from the Indiana CIO Network.

Monetize your Indiana Venture Capital Tax Credit through the VCI Marketplace.

Stay connected to the TechPoint Index by subscribing to our weekly newsletter for additional information and insights on Indiana’s tech sector.

See prior quarterly reviews and the 2023 Indiana Tech Venture Report here.