Q2 2023 Indiana Tech Venture Report: Steadying Pace Towards Market Equilibrium Between Startups and Investors

By Ting Gootee, CFA, CAIA and Roger Shuman

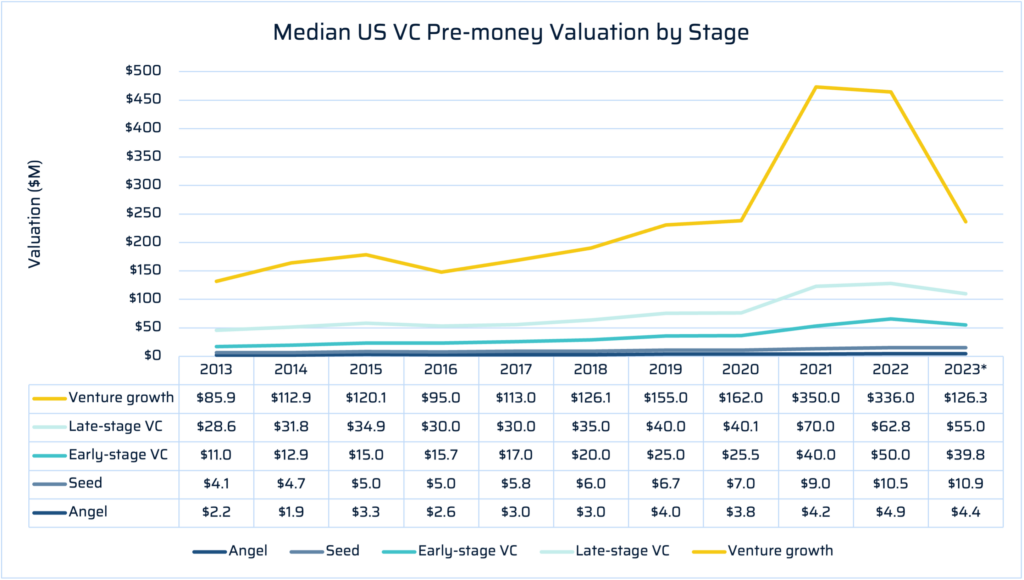

The venture capital landscape today, with regards to deal flow, looks similar to that of the early months of the pandemic in 2020. Crunchbase data showed global venture funding in Q2 2023 fell 18% quarter over quarter to $65 billion, down 49% compared to the second quarter of 2022, when startup investors spent $127 billion. The first half of 2023 is down by similar proportions. In H1 2023, global funding reached $144 billion, marking a 51% decline from the $293 billion invested in H1 2022 and a 10% decline from the second half of 2022.

The Q2 results, like Q1, do not fully report all that was invested in Indiana tech companies, as some companies do not disclose the financial terms of their capital raises–particularly those with challenging financial terms. In Q1, other sources of financing, for example, would have elevated the quarterly investment to nearly $200 million. Five of the second quarter’s 36 deals did not disclose financial details.

“The trickle-down market effect from later-stage deals now to the seed and early-stage deals, especially around decreased valuation, has been shaping this year’s activities,” explained TechPoint President and CEO Ting Gootee. “This has a significant impact on an emerging venture community like ours where most founders are still relying on seed-stage funding to prove out market traction and compete for early-stage investments. The more investor connections we can create through events like our Venture Connect, IU Founders & Funders Network Venture Summit, 50 South’s Indiana Next Level Fund Summit, the Venture Club’s Innovation Showcase and Rally, the more opportunities we are creating collectively for our founders.”

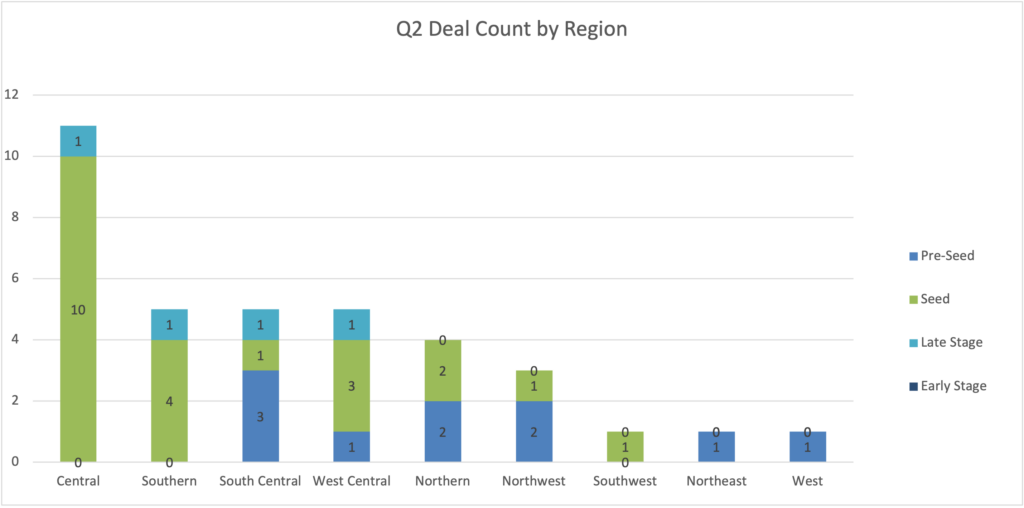

There were 36 deals involving Indiana tech companies in the second quarter for a total of a little more than $47 million in investments. Five of these deals did not include financial details. The TechPoint analysis of Q2 activity in Indiana showed that Elevate Ventures, the state’s venture development organization, participated in at least 16 of the Q2 deals, with many of these investments taking place as part of their Nexus Pitch Competitions. Flywheel Fund of Bloomington continues to be active in the state with six investments this quarter. High Alpha was involved in two deals that included the launch of two new studio companies.

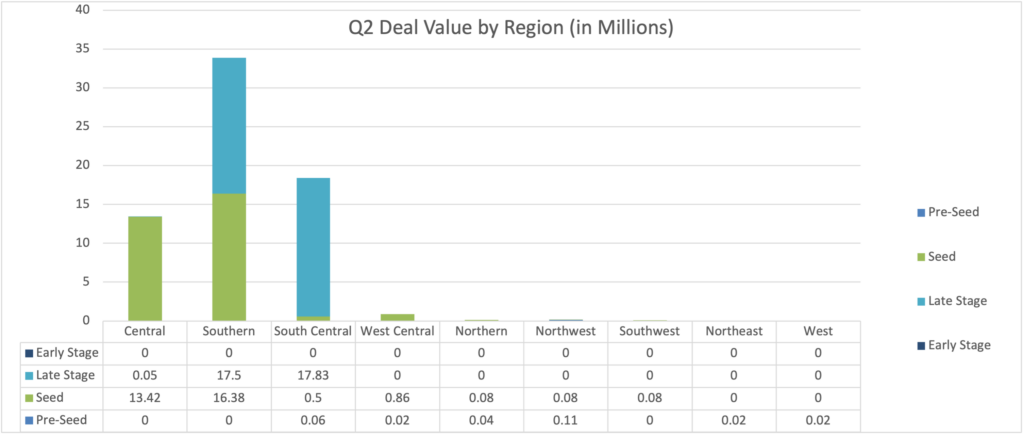

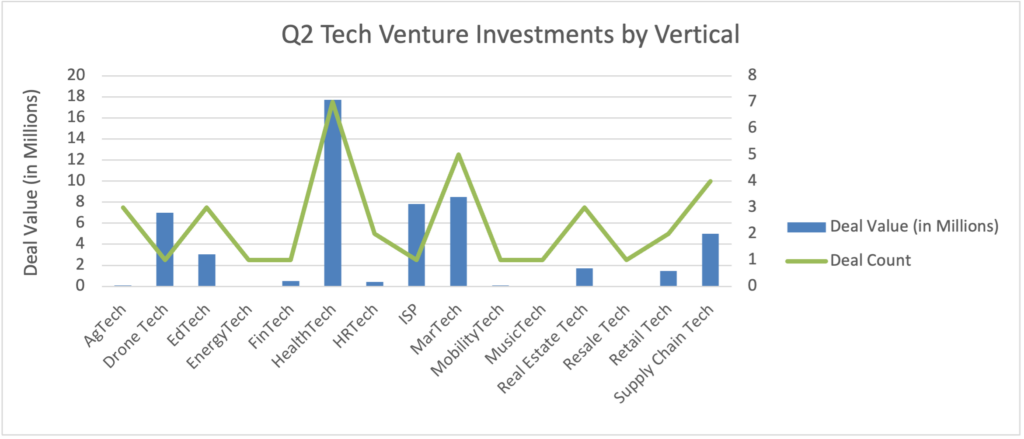

Distribution of deals was spread out among the state. While Central Indiana still garnered most of the activity with more than 30% of the deals, other regions held their own with 11 deals spread out among three of the southern regions and eight spread out among three northern regions. HealthTech led the way this quarter with 7 deals recorded, followed by MarTech and Supply Chain Tech with five and four deals reported respectively.

Merger and acquistion activity continues to be slow with just four deals recorded. Indiana tech deal distribution for the second quarter by stage is noted in the table below.

| Deal Stage | Deal Count | Deal Count % | Deal Value (in Millions) | Deal Value % |

| Pre-seed | 10 | 30% | $0.27 | 1% |

| Seed | 22 | 67% | $21.4 | 45% |

| Early Stage | 1 | 1% | $17.5 | 37% |

| Late Stage | 3 | 2% | $7.88 | 17% |

| TOTAL | 36 | 100% | $47.05 | 100% |

The stages of venture investment

Investment stage definitions are primarily based on PitchBook with minor adjustments according to Indiana’s venture investors’ mandates.

Pre-seed

Less than $500,000, without identifiable investment by professionally-managed pool of capital primarily for financial returns (e.g. Elevate Ventures, given its dual-mandate, will account for a professionally-managed pool of capital only when it’s co-investing with other venture capital firms).

Seed

$500,000 to $5 million without identifiable investment by professionally-managed pool of capital primarily for financial returns.

Early-stage

$1 million –$10 million with identifiable investment by professionally-managed pool of capital primarily for financial returns.

Late-stage

$10 million or more with identifiable investment by professionally-managed pool of capital primarily for financial returns.

Regional definitions follow those used by the Indiana Department of Workforce Development.

How to access capital and other support for your tech startup

TechPoint offers structured innovation programs to connect founders with capital, talent, domain expertise and potential customers. Please check out Venture Connect, Venture Support, Indiana VCI Marketplace and Indiana CIO Network.

If you represent an investment firm, you should know about the immediate and future opportunities to get more involved in the Indiana tech ecosystem. TechPoint Venture Connect, for example, is a great opportunity for startup and scale-up companies to meet with investors. Fill out this form to indicate your interest in upcoming capital-related TechPoint events.

What VC data does TechPoint report?

Our data tracking relies on multiple sources of information, including primary data through our deal monitoring activities as well as secondary sources like Pitchbook. We aggregate and cross reference such data to ensure high-quality reporting.

To help ensure quality data, we invite you to share your investment or exit transactional information with us by using this form. If you represent one of these Indiana tech companies and it is not yet listed on the TechPoint Tech Directory, please add them today. The listing also enables you to post job openings on the TechPoint Job Board. For additional information and insights on Indiana’s tech sector, be sure to stay connected to TechPoint Index by subscribing to our weekly newsletter.

Continue reading for the Q1 2023 month-by-month listing of publicly shared investments, grants and acquisitions involving Indiana technology companies.

April

FullStack, a professional employer organization (PEO) based in Indianapolis, announced the acquisition of Simple IT, a human-centered technology management company also based in Indianapolis. The acquisition will allow FullStack to provide even more comprehensive HR and technology management solutions to fast-growing businesses in the Midwest.

May

MCARTech of Munster has created a real-time remote monitoring and predictive diagnostic system designed to ensure the best performance from machinery and plant operations. The company raised more than $114,000 via crowdfunding.

Tenon, an enterprise marketing workflow company that launched out of High Alpha Studios, announced a $3M seed round led by High Alpha and ServiceNow Ventures. Built on the ServiceNow digital workflow platform, Tenon will use the funds to expand its team and advance its product, which Co-Founder Ben Person says “provides a single solution for marketing teams to execute campaigns, projects, and marketing work.”

Indianapolis-based Docket was acquired by ServiceCore of Lakewood, Colo. ServiceCore is a provider of cloud-based business management software purpose-built for the liquid waste industry. The details of the acquisition were not disclosed.

June

AfterSchool HQ, an educational technology startup, announced the close of its $3 million seed funding round. The investment will be instrumental in driving the company’s mission to revolutionize after-school program management for youth-serving organizations, making quality after-school education accessible and engaging for children around the country. AfterSchool HQ’s funding round is led by Reach Capital with participation from Black Tech Nation Ventures, Sixty8 Capital, Ruthless for Good Fund, Elevate Ventures, Start Something Ventures, and Flywheel Fund. The funds raised will allow the company to further develop its digital platform, expand its reach, and deliver an enhanced educational experience to its growing user base of youth-serving organizations.

RxLightning, creator of the industry’s first comprehensive platform for streamlining specialty medication access and affordability, announced a $17.5 million Series A investment to support the company’s growth and further remove barriers to life-saving therapies. The round was led by LRVHealth, with participation from McKesson Ventures and existing investors Novartis (dRx Capital), Onco360 (BrightSpring Health Services), Hearst Ventures, and HealthX Ventures. This investment brings RxLightning’s total capital raised since inception to $20.5 million. In an unprecedented fasion, RxLightning won two TechPoint Mira Awards in 2022 and again in 2023.

Titlewise raised capital twice during the second quarter including an $80,000 investment from Elevate Ventures as the company won the Southern Indiana Elevate Nexus spring pitch competition. The rest of their investments were not disclosed. The Clarksville company has created a title abstraction software platform.

The Indianapolis Business Journal reports that Demandwell raised a $1.5 million seed round led by High Alpha. The Indianapolis-based MarTech company plans to invest the money into AI technology to grow their business.

Bountiful, a referral-as-a-service platform, announced its launch out of High Alpha studios. The platform revolutionizes how companies hire by activating personal and professional networks to drive quality job candidates and build better and more diverse teams. Backed by High Alpha and Acadian Ventures, Bountiful is led by CEO and Co-Founder Scott Sinatra, a serial entrepreneur and former senior vice president of worldwide sales at Glassdoor. He’s joined by Chief Technology Officer and Co-Founder Nick Kirkes, a former engineering leader with experience building products for world-class technology companies such as Zoom and Salesforce.

Elevate Ventures awarded $640,000 in investments into 14 Indiana-based startups via their Elevate Nexus Spring Pitch Competitions held throughout the state. Each company received a $20,000 or $80,000 investment to propel them as they build high-growth businesses. The $20,000 winning companies were GemViz (Warsaw), neli (Fort Wayne), Speak2Day (South Bend), Drive Now App (Terre Haute), HUMN Capital (West Lafayette), Lead My Care (Ellettsville), Miller Co Medical Devices (Spencer), Soloist (Bloomington) while the $80,000 winning companies were MPB Essential Technology (Merrillville), Rides2U (South Bend), Contango (West Lafayette), ReproHealth Technologies (Indianapolis), TitleWise (Clarksville) and Utilize (Evansville). All winning companies from regional pitch competitions, including past winners, are eligible to apply to compete for a share of $320,000 during the Elevate Nexus statewide competition, which will take place August 29, 2023, during Rally, a cross-sector innovation conference, in Indianapolis.

Baker Hill, a provider of cloud-based, end-to-end loan origination, risk management, and analytics software based in Carmel, announced that Flexpoint Ford, a Chicago-based private equity firm specializing in investments in the financial services and healthcare industries, agreed to acquire the company. Baker Hill is a portfolio company of The Riverside Company. The transaction is expected to close pending receipt of customary regulatory approvals. Financial details were not disclosed.

Blueprint Stats of Bloomington was acquired by Sports Information Services (SIS), a sports data and analytics provider based in Allentown, PA. The acquisition combines SIS advanced data, analytics and AI engines with Blueprint Stats’ innovative stat-taking technologies to enable an end-to-end data and analytics offering across baseball, football, and basketball. Blueprint Stats was founded in 2017 by Hunter Hawley and Josh Johnson, with a robust set of tools and services enabling on-demand sports analysis for teams of all levels of sport. They have partnered with SIS since the summer of 2022, which led to the acquisition. Financial details of the acquisition were not announced.

TechPoint has reported tech investments and M&A activity involving Indiana technology companies since 2014. Share your funding deals with us by contacting Roger Shuman via email at Roger@TechPoint.org. If you represent one of these Indiana tech companies and it is not yet listed on the TechPoint Tech Directory, please add them today. The listing also enables you to post job openings on the TechPoint Job Board. For additional information and insights on Indiana’s tech sector, be sure to stay connected to TechPoint Index by subscribing to our weekly newsletter.

Most of TechPoint’s quarterly and year-end VC reports can be found by clicking on the word