Indianapolis Tops Global 15 VC Ecosystem by Growth

I’ve spent my professional career working in the world of venture capital, but my interest has reached new heights as I’ve gotten fully grounded as TechPoint’s President and CEO. In the past 20 months or so, I’ve become even more driven to help grow Indiana’s digital innovation economy and overall tech ecosystem.

Indiana’s leading policy makers, economic experts, and business and community leaders have supported the state’s tech ecosystem for years and laid a solid foundation for future growth. New data suggests that now is the perfect time for a full-bore focus on Hoosier startup success across all the major economic sectors.

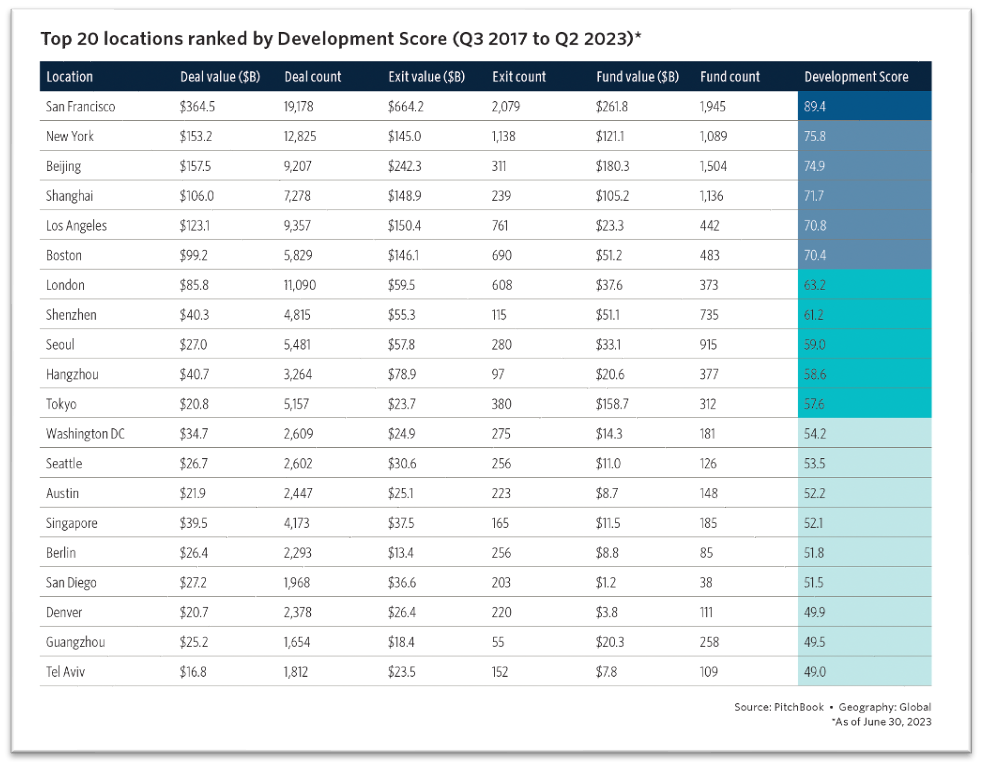

PitchBook – the premier venture capital and private equity date and insight provider – recently debuted its Venture Capital (VC) ecosystem ranking, which bases its marks on a holistic methodology and robust, credible data set. Indiana did not rank in the top 20 for Development scores. Nine U.S. cities made it: San Francisco, New York, Los Angeles, Boston, Washington D.C., Seattle, Austin, San Diego and Denver.

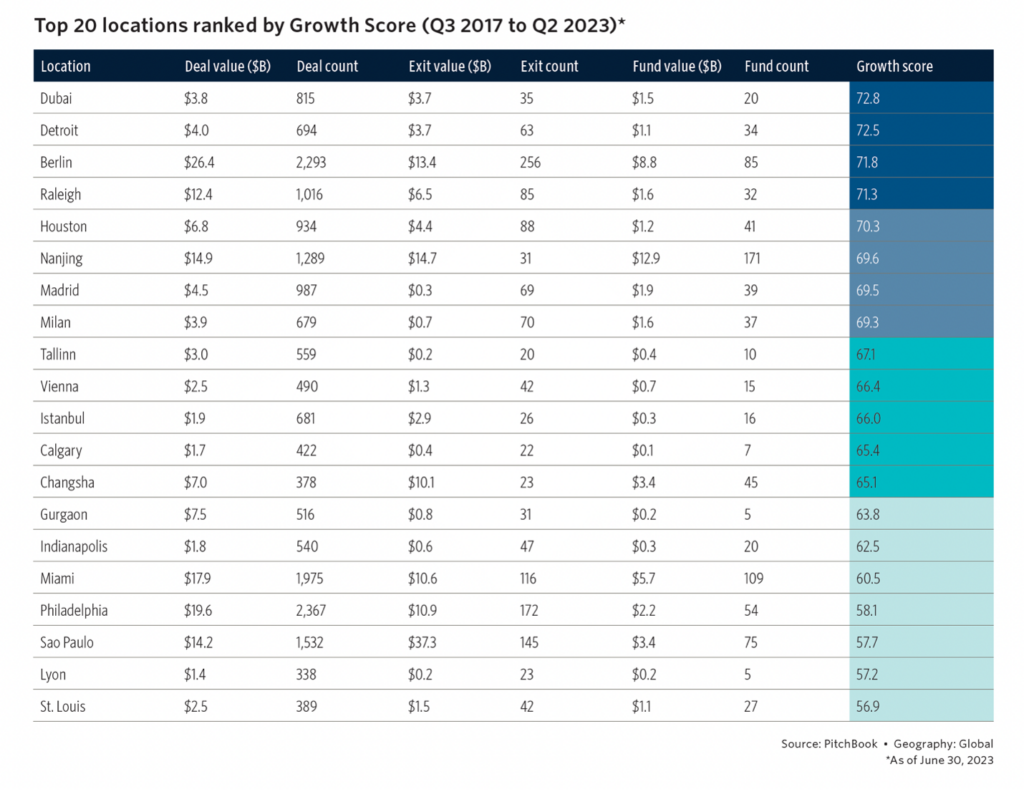

That’s to be expected, as those communities had head starts on Indianapolis and are also larger cities. But Indiana did rank 15th in the world when ranked by growth scores. Six other U.S. cities made that global ranking as well: Detroit, Raleigh, Houston, Miami, Philadelphia and St Louis.

In scouring the PitchBook data, I was reminded of Brad Feld’s reminder in his book, “The Startup Community Way: Evolving an Entrepreneurial Ecosystem,” that a long-term commitment, defined as 20 years from today, is required when building an entrepreneurial ecosystem. “As a startup community leader, you have to stick with it, trust the process and be okay knowing that the outcome might be different from what you expect or hope for,” he wrote. “Startup communities must function on a generational cycle.”

Indiana’s startup community is in that sweet spot now, as huge acquisitions of home grown Aprimo, ExactTarget and Interactive Intelligence date back to 2011, 2013 and 2016, respectively.

PitchBook describes the Great Lakes region, which includes Indiana, as “an investment hotbed for well over a decade,” due to its business-friendly environment and strong base for capital-efficient startups. Growth in the number of venture capital fund managers, particularly first-time fund managers with small assets under management, is logically driven by increases in quality seed and early-stage deal flow. These fund managers are well-positioned to build return-track records and grow their assets under management over time.

While the health and growth of a particular VC ecosystem does not capture the entire venture market, capital remains an important input to venture building and one of an important leading indicators of a robust innovation ecosystem. Indianapolis’ ranking continues to represent the most active sector for venture capital investment and exit activities in our community. For other regions within the state to remain competitive as the next venture capital and innovation hub, I suggest those supporting the Indiana tech ecosystem must keep three key things in mind:

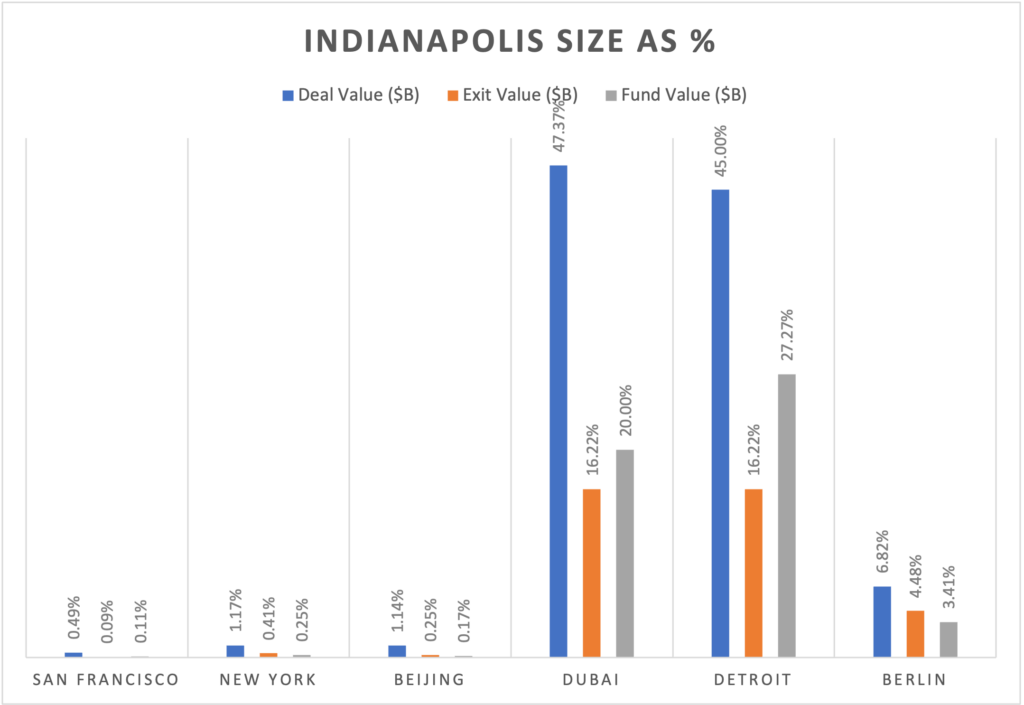

- Overall size matters: three key metrics for overall VC market size are VC investments, exits and venture capital fund values. San Francisco is the unquestioned global leader because it dominates in all three areas. Take deal value as an example: San Franscico generates more than $364B in venture investments in a six-year period, more than New York and Beijing combined. The same also holds true for exit value and exit count. In contrast, Indianapolis captures well less than 1 percent of San Francisco across the board. Compared to the top 3 VC ecosystems by growth, namely Dubai, Detroit and Berlin, Indianapolis captures less than half of their respective sizes in all three areas.

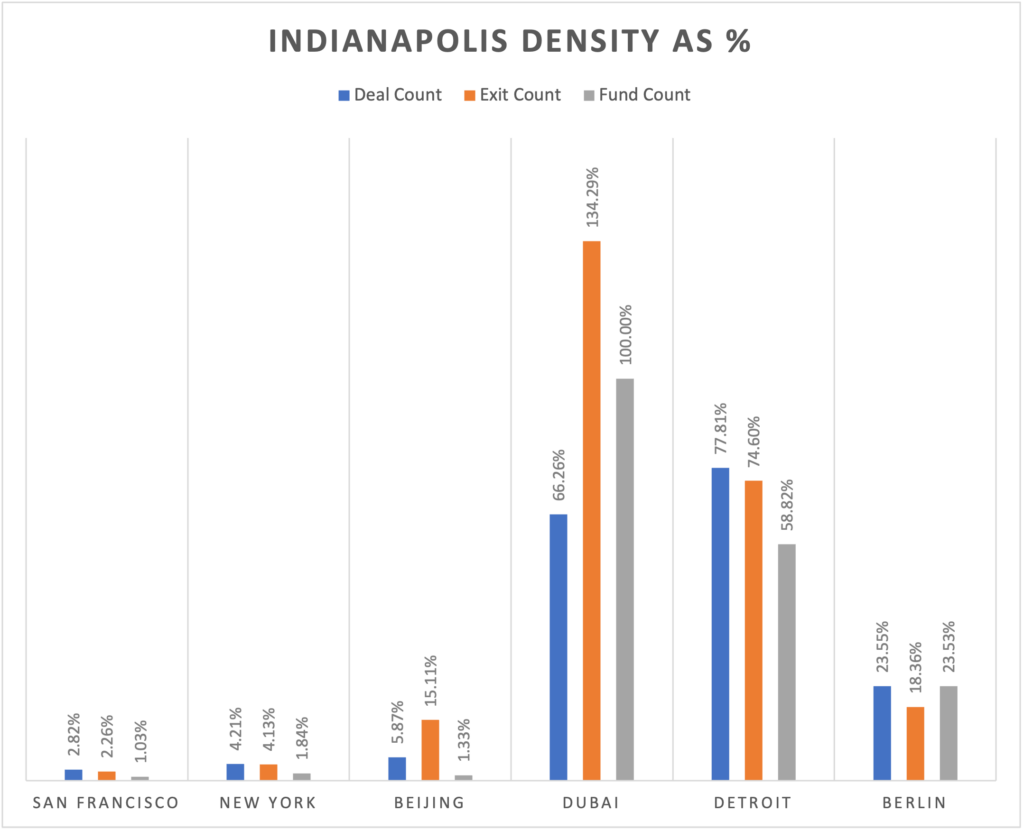

- Density matters for maturity: Besides overall size, density, measured primarily around quantity in deals, exits and the number of funds, are important both for maturity as well as an ecosystem’s potential to reach maturity. This is where Indianapolis has experienced most of the growth. The number of venture capital deals funded, along with the number of increases in venture capital funds and entrepreneurial support organizations, enabled more startup founders to take risks. Investment into entrepreneurial support programs, direct investment and fund-of-funds strategies by the state, the corporate and academic institutions played a key role in building a strong foundation for that venture growth.

- Success matters the most in the end: As PitchBook pointed out, when assessing the maturity of an ecosystem, emphasis is on the ability of startups based in the city to secure capital, grow, successfully exit and create outliers. Mature companies will obtain greater sums of capital, increase their valuation, attract talent and generate returns for investors looking for the best-in-class opportunities. Key indicators of success include mega exit and unicorn (billion-dollar valuation or more) counts, late-stage to early-stage ratio and nontraditional investor participation because they tend to participate in later-stage deals. A healthy pipeline of mature and successful companies is not only necessary to attract large rounds of venture capital investment but also to spin out the next generation of founders, operators, angel investors and fund managers.

That’s certainly the flywheel effect top markets like San Francisco and New York have seen for years. The foundation laid by ExactTarget, Interactive Intelligence and Aprimo has positioned us perfectly to fuel the local flywheel.

In recent months, investors have seeded more startups than ever before as a community, through funds or funding programs supported through public, private and corporate dollars. The newest ConnectIND resources portal now has more than 1,000 entrepreneurship support programs. In the past 20 months, TechPoint has launched an unprecedented level of support for Hoosier innovators and startups via the TechPoint Venture Support platform, which includes the newest service, the Indiana Founders Network.

Indianapolis was the No. 3 city in the Midwest for startups for the second year in a row. Among major U.S. metros, Indianapolis saw one of the largest increases in business openings during the first half of 2023 versus the same period in 2019, at about 77.5 percent.

You can almost hear the startup momentum building. If you’re involved in Indiana VC activities at any level, you can certainly feel it. Now more than ever, we have a set of startups that investors and other stakeholders can focus on developing into the next generation of venture success.

Important questions to ask ourselves:

- Who are the breakout companies that are most likely to mature into rapid revenue growth and mega exits

- How are they positioned to compete for talent, capital and customers at a national and/or global scale

- How can we put some concerted efforts around propelling their growth, right here from our community.

TechPoint will continue to do its part to help fuel and speed up our flywheel in the coming year. We’ll have an exciting announcement in the first quarter, which we hope is just the beginning of our longtime collaborators placing more emphasis on the development of success momentum.