Q3 2023 Indiana Tech Venture Report: Glimmers of optimism in Indiana as the national Q3 venture market continues its correction

Dubbed the “Great Correction” by Joanna Glasner of Crunchbase, the nation’s Q3 2023 venture market remains in a challenging position, and activity in Indiana reflects the struggle. But there was encouragement in the quarterly assessment that showed the number of Hoosier deals dropped, but the amount invested nearly doubled. Deals were spread among a diverse array of verticals including HR tech, ag tech, martech, supply chain tech and cyber security, and merger and acquisition activity increased compared to Q2.

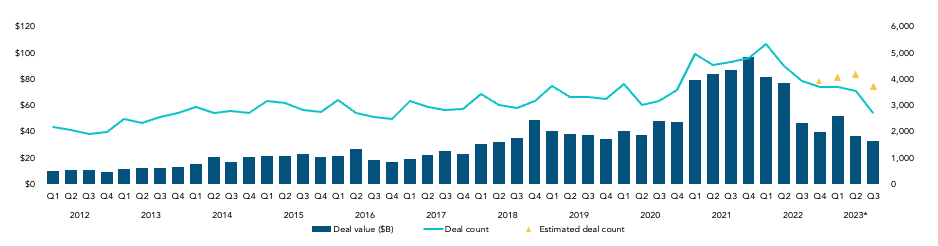

Nationally, the IPO market continued to decrease, valuations continued to be reset, and companies pivoted their models to become leaner and closer to profitability. Global venture funding in July 2023 totaled $18.6 billion — down about 20 percent month over month, and 38 percent compared to the $29.8 billion invested in July 2022, per Crunchbase. Seed stage funding, which had been the most consistent stage for funding, also showed a decline.

National data from Pitchbook’s quarterly Venture Monitor also showed continued decline in both deal count and deal value, with a significant drop in Q3. The Venture Monitor similarly depicted declines in new fund creation, fundraising activity, exit activity, median deal size and pre-money valuations at all stages. This indicates the correction is deepening and beginning to show its effects even at the earliest stages.

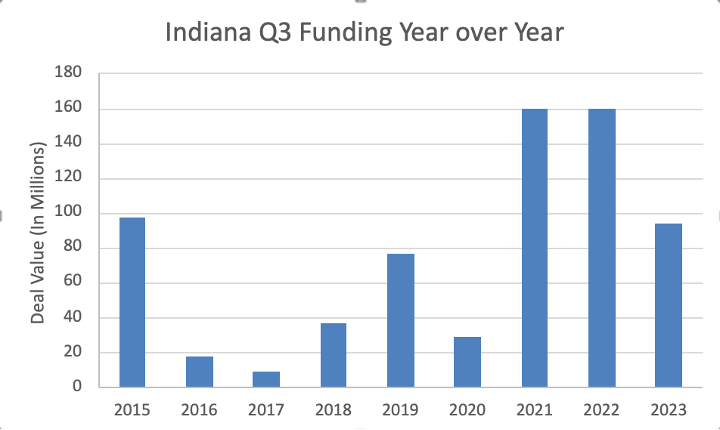

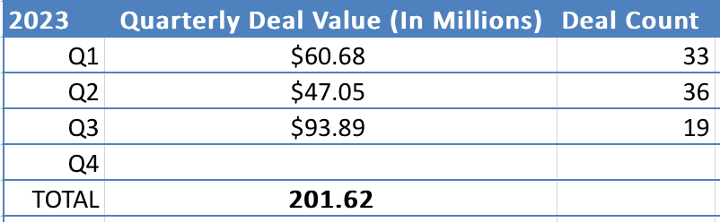

In Indiana, there were 19 tech venture deals recorded in the third quarter of 2023 and a total of more than $93.39 million invested. This is the lowest Q3 funding amount reported since 2020, and about half of last year’s Q3 when $160M was invested. But it is also the fourth largest Q3 funding amount since TechPoint began reporting this data in 2015. Q3 raises in 2022, 2021 and 2015 were higher.

Another glimmer of positivity in the nationwide quarterly malaise, is reflected in the dollar amount of investment. The number of deals dropped by half compared to the previous quarter (36 deals in Q2,) but the amount invested nearly doubled, going from $47 million in Q2 to more than $93 million in Q3. This increase is likely due to a spike in later-stage deals: 72 percent of the Q3 deals were beyond the pre-seed and seed stage.

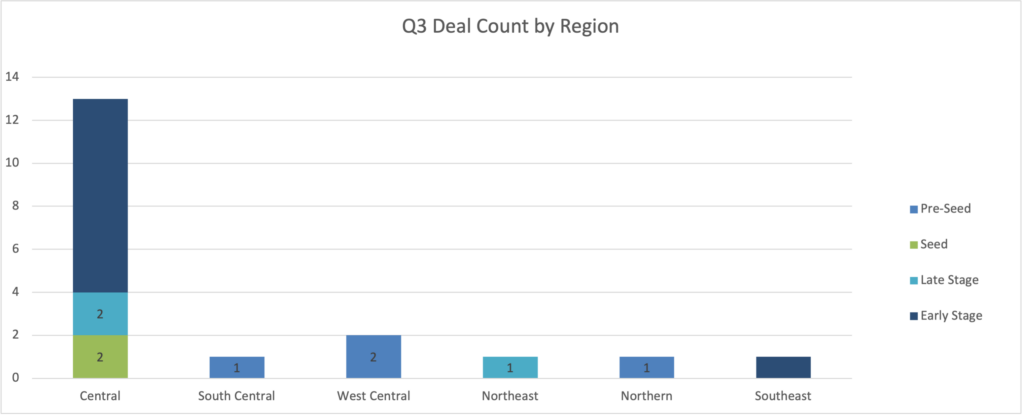

This quarter we observed a decline in the distribution of deals across the state. More than 70 percent of the deals involved Central Indiana tech companies, with the other deals equally spread across regions. Northeast Indiana saw one significantly sized round, which increased its overall deal value compared to other regions.

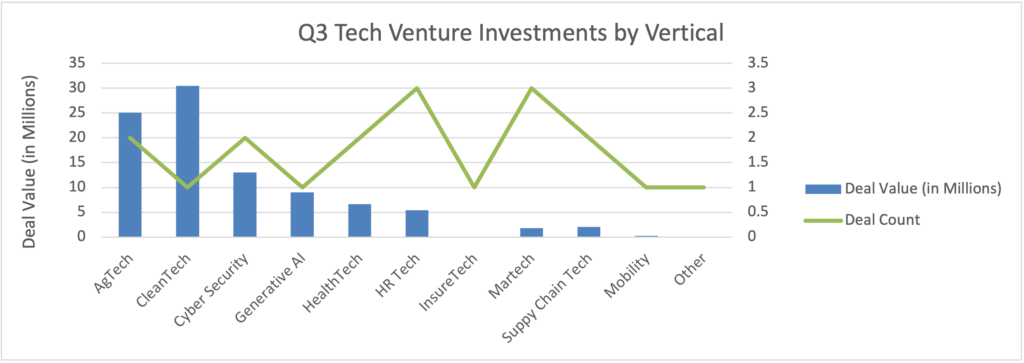

We are pleased to note, however, that the types of businesses receiving capital were quite diverse. No single sector dominated the count this quarter with deals spread out among verticals including HR tech, ag tech, martech, supply chain tech and cyber security. Investment in artificial intelligence-focused companies was not as extreme as anticipated nationally nor in Indiana.

Seven of this quarter’s deals had undisclosed investor lists. Based on the data available, Elevate Ventures, Indiana’s primary venture development organization, led the way again this quarter in terms of deal count with three, compared to last quarter’s 16 investments. No other investors appeared to record more than one deal this quarter.

Merger and acquisition activity continues to be slow but was higher in Q3 compared to Q2. Seven deals were recorded this quarter, compared to four in Q2. Six of these were Indiana companies acquired by out-of-state entities. Indianapolis-based Overfuel acquired Washington state-based 321 Ignition.

As a reminder, this data does not fully report all that was invested in Indiana tech companies, as some companies do not disclose the financial terms of their capital raises. Two of the quarter’s 19 deals did not include financial details.

Indiana tech deal distribution for the third quarter by stage is noted in the table below.

| Deal Stage | Deal Count | Deal Count (%) | Deal Value (in Millions) | Deal Value (%) |

| Pre-seed | 4 | 21.05% | 0.53 | 0.56% |

| Seed | 2 | 10.53% | 0.80 | 0.85% |

| Early Stage | 10 | 52.63% | 37.06 | 39.47% |

| Late Stage | 3 | 15.79% | 55.50 | 59.11% |

| TOTAL | 19 | 100% | 93.89 | 100% |

The stages of venture investment

Investment stage definitions are primarily based on PitchBook with minor adjustments according to Indiana’s venture investors’ mandates.

Pre-seed

Less than $500,000, without identifiable investment by professionally-managed pool of capitalfor financial returns

Seed

$500,000 to $5 million without identifiable investment by professionally-managed pool of capital for financial returns.

Early-stage

$1 million –$10 million with identifiable investment by professionally-managed pool of capital for financial returns.

Late-stage

$10 million or more with identifiable investment by professionally-managed pool of capital for financial returns.

Regional definitions follow those used by the Indiana Department of Workforce Development.

Continue reading for the Q3 2023 month-by-month listing of publicly shared investments, grants and acquisitions involving Indiana technology companies.

July

Arrive, the smart mailbox company formerly known as Dronedek, raised $1.3 million from 428 investors via crowdsourcing. The Indianapolis company is pioneering technology to revolutionize last-mile delivery and pickup. The company’s smart Mailbox-as-a-Service platform and infrastructure solutions empower Autonomous Delivery Networks to operate more efficiently with secure and climate-assisted cargo space, smart alerts and chain of custody.

In the past year, Indianapolis-based Torchlite pivoted to become a Partner Relationship Management (PRM) platform. The company announced significant technology enhancements to its PRM platform in August, and also raised $1 million in capital to fuel this new direction. The raise included Elevate Ventures, NWS Holdings (Indianapolis), Excelsior Venture Capital (Park City, Utah), Render Capital (Louisville) and other investors.

Deere & Company (aka “John Deere” NYSE: DE) acquired Smart Apply, Inc. (also known as Smart Guided Systems), a precision spraying equipment company based in Indianapolis. The company developed the Smart Apply Intelligent Spray Control System, an upgrade kit that can improve the precision and performance of virtually any air-blast sprayer used in orchard, vineyard, and tree nursery spraying applications. Smart Apply helps growers reduce chemical use, airborne drift, and run off, while optimizing high-value crop yields and meeting sustainability objectives. John Deere has worked with Smart Apply since 2020.

August

Stamus Networks, raised a $6 million Series A round led by First Analysis on August 8, 2023. Elevate Ventures, SmoothBrain (Chicago) and VisionTech Partners (Indianapolis) also participated in the round. The funds will be used to advance product innovation, elevate customer experience and effectively scale go-to-market resources and programs. The Indianapolis company helps enterprise security teams know more, respond sooner and mitigate risk with insights gathered from cloud and on-premise network activity

NeurAxis, Inc. (NYSE American: NRXS), a medical technology company commercializing neuromodulation therapies that address chronic and debilitating conditions in children and adults, announced the pricing of its underwritten initial public offering of 1,098,667 shares of common stock at an initial public offering price of $6.00 per share. The gross proceeds from the offering, before underwriting discounts and commissions and estimated offering expenses payable by the company, are expected to be approximately $6,592,000. NeurAxis is located in Versailles, Ind.

Hubstaff, an HR Tech Software-as-a-Service (SaaS) platform, received a growth investment from WestView Capital Partners, a Boston-based private equity firm focused exclusively on middle-market growth companies. “We are excited to partner with WestView and leverage their deep experience as software and human capital technology investors to support us in the next phase of our company’s journey,” said Jared Brown, Co-Founder and CEO of Hubstaff. “WestView’s investment marks the beginning of an exciting next chapter for Hubstaff. With the support and experience of WestView, we are poised to accelerate our growth and to continue executing on market tailwinds and the significant opportunities we have ahead of us. WestView’s collaborative partnership approach aligns well with our philosophies at Hubstaff and we are confident we have found the ideal partners for this next phase in our growth.”

Cake, an Indianapolis-based digital marketplace company that allows insurance agencies to buy and sell “slices” of insurance books of business, completed the 101 Weston Labs InsurTech accelerator in the Raleigh-Durham area. The accelerator is a project of the Independent Insurance Agents of North Carolina (IIANC), and features insuretech companies focused on innovating in areas like AI, data analytics, process automation, cyber liability, quoting and more.

Sortera Technologies, Inc., an innovative material sorting company with a recycling platform powered by artificial intelligence, data analytics and advanced sensors closed a $30.5 million Series C funding round led by RA Capital Management-Planetary Health with participation from certain funds and accounts advised by T. Rowe Price Associates, Inc., the Mineral Resources Group, which is a part of Mitsubishi Corporation’s Business Incubation Unit, and Macquarie GIG Energy Transition Solutions. Additional existing investors include Assembly Ventures, Breakthrough Energy Ventures, and Chrysalix. This funding will fuel the Markel, Ind. company’s growth in the domestic upcycling space. Additionally, it will help to affirm the company’s commitment to solutions that create new upcycling streams, enable a circular economy, and contribute to a more sustainable future.

Centric Consulting, an international business and technology consulting firm with headquarters in Dayton, Ohio, acquired The Mako Group, a leading cyber risk management firm based in Carmel, Ind. This move allows the company to offer clients a holistic suite of services, combining cyber risk management with existing business and technology services.

Austin, Texas-based Enverus announced its acquisition of CRCL Solutions, a provider of cloud-based algorithms and modeling for wind and solar generation forecasts based in South Bend. The Enverus energy-dedicated SaaS platform offers real-time access to analytics, insights and benchmark cost and revenue data sourced from 98 percent of U.S. energy producers and more than 35,000 suppliers. “By combining CRCL’s core technology with Enverus’ data resources, CRCL can improve its current product offerings and create entirely new energy forecasting products that were previously not possible,” noted Thomas Sherman, co-founder of CRCL. “We believe Enverus is a perfect partner to develop the next generation of wind and solar forecasting.” Financial details of the acquisition were not disclosed.

Nextlink Internet of Hudson, Texas has acquired Echo Wireless, an ISP located in Vincennes, Ind. The acquisition allows Nextlink to instantly grow in the rural Indiana market. Echo Wireless has been providing Internet connections to rural communities in Knox, Davies, and Lawrence counties since 2007. The financial details of the transaction were not shared.

September

Bloomington-based Traduality received a $100,000 investment as a recent participant of the gener8tor Milwaukee startup accelerator program. Traduality’s marketplace connects organizations and individuals in need of any translation-related service directly to vetted freelance translators at a fraction of the price and half the time. The company offers access to more than 20 different translation related services in any language, using supportive AI to triple translators’ productivity.

ConverSight, a unified decision intelligence solution provider, raised $9 million in Series A funding. The round was led by Surface Ventures (New York City) with participation from Techstars, Augment Ventures (Ann Arbor, Mich.), Elevate Ventures and existing investors. ConverSight plans to use the new funding to fuel its go-to-market teams in addition to continuous product innovation and feature expansion.

MIS Solutions, a Cincinnati based IT company purchased CCR Technology Partners, an IT services firm based in Fishers, Ind. The acquisition marks a significant milestone for MIS Solutions’ expansion into the Indiana market and beyond. Financial details of the acquisition were not disclosed.

Desi, a new student-to-student ride-sharing platform specifically designed to create a safe and affordable experience for college campuses, raised $300,000 in a pre-seed round with contributions from PivotNorth Capital (Atherton, Calif.), Wray-Cho Investment Company (Austin, Texas) and the Notre Dame Venture Capital Club. The company was created by three University of Notre Dame students and will initially focus on the campuses of Notre Dame, St. Mary’s and Holy Cross colleges as these three institutions have a history of working together and sharing resources.

Overfuel, an Indianapolis-based digital retail platform designed exclusively for the automotive industry, acquired 321 Ignition of Bellevue, Wash., a mobile-first car-buying website platform. The combined resources will enable rapid innovation and product development, giving dealerships powerful options when it comes to choosing a technology partner. Financial details of the acquisition were not disclosed. The company also raised $500,000 from Elevate Ventures.

Genasys Inc. (NASDAQ: GNSS), a protective communications systems and solutions company based in San Diego, entered into a definitive agreement to acquire Evertel Technologies, a cross-agency collaboration platform for public safety. Genasys (not to be confused with “Genesys”) will be acquiring Evertel in a cash and stock deal for a total consideration of $5.8 million. Evertel was originally founded in Las Vegas and was acquired by Word Systems of Indianapolis in 2021.

TechPoint has reported tech investments and M&A activity involving Indiana technology companies since 2015. Share your funding deals with us by contacting Roger Shuman via email at Roger@TechPoint.org. If you represent one of these Indiana tech companies and it is not yet listed on the TechPoint Tech Directory, please add them today. The listing also enables you to post job openings on the TechPoint Job Board. For additional information and insights on Indiana’s tech sector, be sure to stay connected to TechPoint Index by subscribing to our weekly newsletter.

See prior quarterly reviews and the 2022 Indiana Tech Venture Report here.

How to access capital and other support for your tech startup

TechPoint offers structured innovation programs to connect founders with capital, talent, domain expertise and potential customers. Please check out Venture Connect, Venture Support, Indiana VCI Marketplace and Indiana CIO Network.

If you represent an investment firm, you should know about the immediate and future opportunities to get more involved in the Indiana tech ecosystem. TechPoint Venture Connect, for example, is a great opportunity for startup and scale-up companies to meet with investors. Fill out this form to indicate your interest in upcoming capital-related TechPoint events.

What VC data does TechPoint report?

Our data tracking relies on multiple sources of information, including primary data through our deal monitoring activities as well as secondary sources like Pitchbook. We aggregate and cross reference such data to ensure high-quality reporting.

To help ensure quality data, we invite you to share your investment or exit transactional information with us by using this form. If you represent one of these Indiana tech companies and it is not yet listed on the TechPoint Tech Directory, please add them today. The listing also enables you to post job openings on the TechPoint Job Board. For additional information and insights on Indiana’s tech sector, be sure to stay connected to TechPoint Index by subscribing to our weekly newsletter.