U.S. VC Activity still Rocky but Indiana Again Outpaces the Nation

Author: Chelsea Linder, VP of Innovation & Entrepreneurship

Author: Roger Shuman, Director of Venture Engagement

Tech venture capital (VC) investment in Indiana increased in the second quarter of 2024 in both total dollars and number of deals even as the national VC market continued to face challenges.

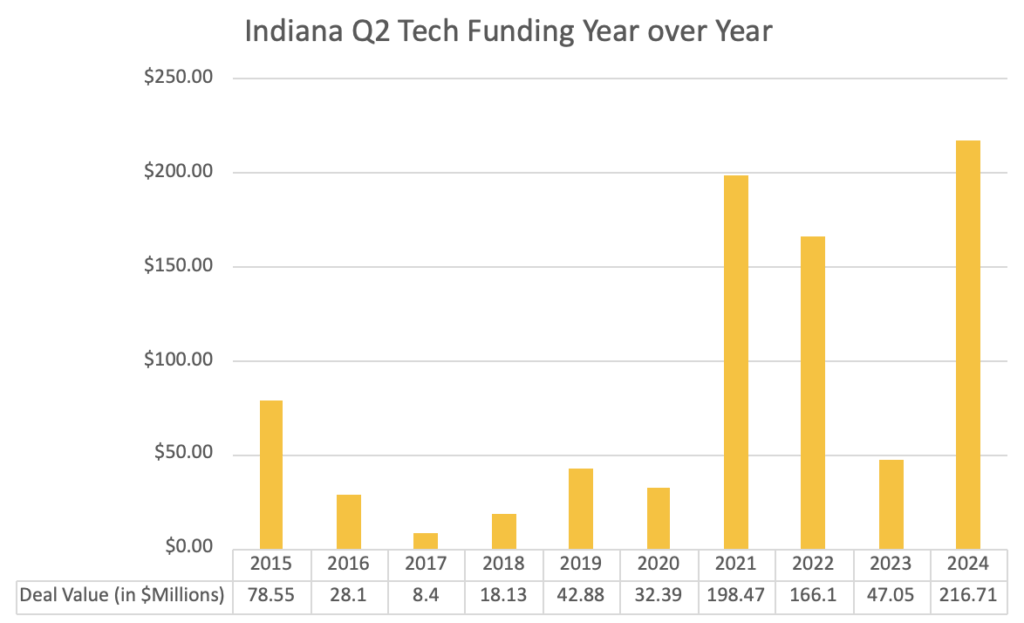

Total tech VC investment in Indiana increased to more than $216 million in Q2. A year-over-year look at the quarter showed a 360 percent increase in investment. Indiana also saw an increase in the number of tech VC deals, with 48 completed in Q2 2024, up from 29 in Q1 2024.

This suggests a growing interest and diversification in Indiana’s startup ecosystem despite broader financial headwinds. Sectors driving this increased deal flow included artificial intelligence and Machine Learning (AI/ML) and Life Sciences which showed continued resilience and innovation.

A decline in VC deals and exits nationally indicates a cautious or bearish outlook among investors, influenced by economic factors such as fluctuating interest rates. The increase in deal numbers within Indiana, however, suggests a potential shift towards exploring more smaller investments and a broader array of sectors than previous years. Indiana’s ability to maintain a vibrant number of deals amidst the nationwide decrease underscores its growing reputation as a nurturing ground for new businesses and innovations.

Moving forward, it will be important to monitor whether this trend continues and how it translates into sustained economic growth and returns on investment.

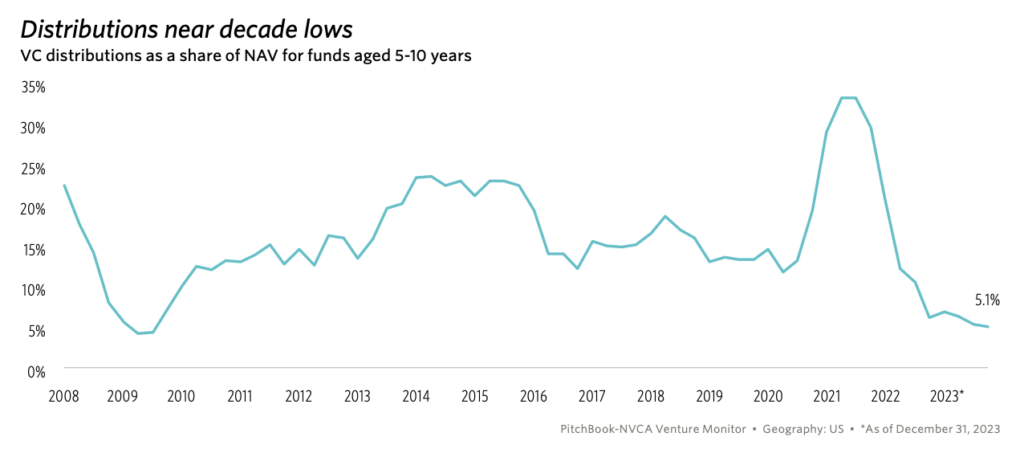

We continue to observe a traffic jam of mature companies that haven’t exited, which is, in turn, limiting distributions to fund limited partnerships (LPs). There were only two tech exits in Indiana in Q2, compared to nine in Q1. This replicates national data where about 7.5 percent fewer exits took place compared to last quarter. This limited exit activity will continue to impact investors and make it more difficult for firms to raise new funds.

According to Pitchbook, total U.S. VC investment reached approximately $55.6 billion in Q2 2024, marking a 36 percent increase from Q2 2023. Deal count was down 15 percent year over year. Similarly, the total exit value in Q2 2024, $23.6 billion, was a 242 percent increase year over year, although there were 13 percent fewer exits.

This downturn in deal count reflects broader market uncertainties and investor caution. Funds increased their focus on supporting existing investments as demonstrated through a consistent increase in average check size compared to this declining deal count.

U.S. VC Deal Activity by Quarter*PitchBook *As of 6/30/2024

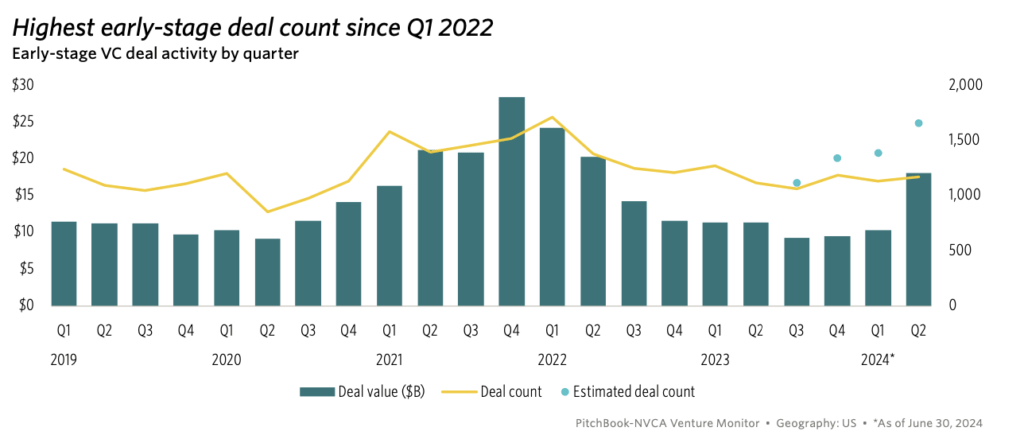

Although overall deal count was down nationally, the quarter saw the highest early-stage deal value since Q1 2022. This was, however, largely driven by one company: Bay area-based Xaira Therapeutics, which raised a $1 billion Series A – the company’s first VC round. Removing this outlier aligns the early-stage deal activity with pre-pandemic levels.

U.S. Early-Stage Deal Activity by Quarter

US VC Exit Activity by Quarter

Source: PitchBook *As of June 30, 2024

While it looks like Indiana’s VC landscape is returning to pre-pandemic levels, it’s interesting to note the difference in the state’s VC activity prior to the proliferation of locally-based investment funds, which began to emerge about 14 years ago. Indiana-based VC funds like Allos Ventures, Elevate Ventures, High Alpha Capital, Flywheel Fund, Visiontech Angels, Ground Game Ventures, Sixty8 Capital, Start Something Ventures, Ivy Ventures and others are actively investing in Indiana companies.

University-based investors like IU Ventures, Purdue Ventures, Notre Dame’s Pitroad Fund and Butler University are also making vital investments into Indiana companies. Indiana-based corporate venture capital funds like HG Ventures, Allegion and NWS Holdings have also made strategic investments into Indiana companies.

Furthermore, some out-of-state funds are making regular investments into Hoosier-based tech companies. Funds like Armory Square Ventures, M25 and Render Capital have offices and/or investors based in the state to be closer to the opportunities. Existing and new accelerators like gener8tor, The Heritage Group Accelerator and Techstars Sports also continue to fuel the growth of tech startups throughout Indiana.

Entrepreneurial support organizations like TechPoint are working to identify and fuel growth. Since 2022, TechPoint has refined and operationalized its efforts by focusing on the activities that make the biggest impact.

Venture Connect continues to be a valuable resource to connect early-stage founders with investors while exposing investors to the opportunities in Indiana. To-date in 2024, 69 companies seeking support and 35 investors have participated in Venture Connect. A new effort to engage founders earlier in the process has begun and is anticipated to increase participation.

More than 100 early-stage companies have accessed TechPoint help via Venture Support. The program offers an initial 30-minute virtual meeting where founders outline their product and service concepts and identify areas where they need support. Subject matter experts provide guidance and connections to help the founders scale their operations.

The Indiana Founders Network provides year-round peer-to-peer support for founders. More than 100 members have joined the continuously growing group. This type of hyper-focused grassroots programming didn’t exist prior to the pandemic. In addition to the supportive programs, TechPoint is “walking its tech talk” by leaning in to data to measure its work and then putting its focus where it can drive the most impact.

Specifics on Indiana’s Q2 Activity

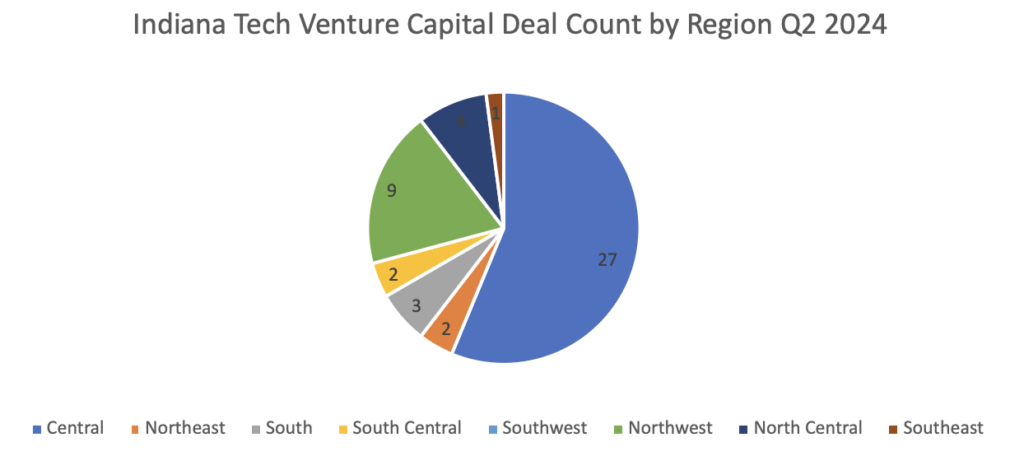

The majority of VC deals closed in Q2 were in Central Indiana followed by Northwest Indiana. There remains a healthy distribution of deals in other regions.

The industries where tech businesses received capital were diverse across sectors, with Life Sciences and AI/ML seeing the most activity. The increase in AI/ML investments this quarter demonstrates an increased interest in AI innovation and adoption across the state.

| Vertical | Deal Count | Deal Value ($M) |

| AgBioScience | 2 | 10.89 |

| Manufacturing / HardTech | 3 | 6.4 |

| EdTech & Workforce Tech | 4 | 1.96 |

| Life Sciences | 11 | 124.2 |

| E-Commerce | 1 | 0.05 |

| Tech Services | 5 | 0.13 |

| Martech | 2 | 1.6 |

| Fintech | 2 | 1.65 |

| Artificial Intelligence & Machine Learning | 9 | 56.85 |

| SaaS | 7 | 12.73 |

| Real Estate Technology | 1 | 0.25 |

Eleven of this quarter’s tech deals had undisclosed investor lists. Based on the available data, Elevate Ventures remained the most active investor in the state, making 23 tech investments this quarter. Flywheel Fund, High Alpha, and Ground Game ventures all made multiple investments at the pre-seed and seed stages.

The table below notes Indiana tech deal distribution for Q2, 2024 by stage. We saw significant investment activity at the early stages, which is again aligned with the national trend. PitchBook also noted the average deal size at these early stages in increasing, with the fewest number of sub-$1 million first-time deals since 2015. This is another indicator of risk mitigation on the investor side.

Indiana Q2 2024 Tech Investments by Stage

| Deal Stage | Deal Value ($M) | Deal Count |

| Pre-Seed | 3 | 25 |

| Seed | 13.84 | 9 |

| Early-Stage VC | 30.28 | 8 |

| Late-Stage VC | 169.59 | 5 |

The stages of venture investment: Investment stage definitions are primarily based on PitchBook with minor adjustments according to Indiana’s venture investors’ mandates.

Pre-seed: Less than $500,000, without identifiable investment by professionally-managed pool of capital for financial returns

Seed: $500,000 to $5 million without identifiable investment by professionally-managed pool of capital for financial returns.

Early-stage: $1 million –$10 million with identifiable investment by professionally-managed pool of capital for financial returns.

Late-stage: $10 million or more with identifiable investment by professionally-managed pool of capital for financial returns.

Continue reading for the Q2 2024 month-by-month listing of publicly shared investments, grants, and acquisitions involving Indiana technology companies.

April

| Traction Ag of Auburn, developers of a farm accounting and management solution uniquely built for the cloud that integrates actual accounting numbers with field operations, announced a $10 million Series A round led by Cooperative Ventures and joined by Plymouth Growth and existing investors. “From the very beginning, our priority at Traction Ag has been to deliver value to farmers and give them peace of mind when making decisions,” said Traction Ag CEO Dustin Sapp. “This round of funding will enable us to scale faster, reaching even more farmers with our decision-making solutions that drive real value at the farm gate.” |

| Indianapolis-based Tenon Software, Inc, an innovative marketing solution built on ServiceNow, secured an $8 million Series A investment, co-led by High Alpha and StepStone Group, with continued investment from ServiceNow Ventures. The funding will support the expansion of the Tenon team and accelerate the company’s product roadmap, expanding from marketing work management into marketing automation to unify the complete marketing lifecycle. The company is also the 2024 Mira Awards Startup of the Year. |

| Elate, a cloud-based strategic planning software company headquartered in Indianapolis, announced its oversubscribed Series A funding round of $4.9 million led by enterprise startup Bay Area investor WestWave Capital. Co-founded by Chief Executive Officer Brooks Busch and Chief Operating Officer Abby Parker, Elate enables companies to connect long-term vision with tactical execution in a simple, intuitive way. “Elate is redefining the way companies go about strategic planning by simplifying the experience for employees and surfacing insights for strategy and operations leaders that show results in a measurable way,” said Busch. “With this investment, and the team we have in place, I am more confident than ever Elate has the ability to become the most dynamic and comprehensive platform to drive the future of strategic planning forward.” |

| Indianapolis-based Neurava announced an oversubscribed Seed round of $2.26 million led by Life Science Angels with a second strategic investment from UCB, and support from Purdue Innovates, Elevate Ventures, Rivermount Ventures, and First Leaf Capital. The Indianapolis-based company is developing novel and innovative wearable devices for the estimated 3.5 million Americans and 65 million people worldwide with epilepsy to mitigate the risk of SUDEP, or Sudden Unexpected Death in Epilepsy. Neurava Co-Founder and CTO, Vivek Ganesh, stated, “This funding will allow us to complete a pivotal usability study at leading clinical institutions in adults and pediatric patients with epilepsy. We will also set up manufacturing partners and submit for FDA clearance, in advance of our Series A round of funding.” Neurava Co-Founder and CEO, Jay Shah, stated, “We are honored to be backed by our investors. We look forward to working with them to continue growing Neurava. Our vision is to improve the lives of those impacted by epilepsy, and with this investment, we are one step closer to making this a reality.” |

| Backstroke, which offers a generative AI messaging platform set to revolutionize email, SMS, mobile push, and customer marketing for B2C brands, raised $2 million in a seed round co-led by High Alpha and Ground Game Ventures, and with participation from Allos Ventures. The Indianapolis company is led by CEO and Founder R. J. Talyor and Lead Data Scientist and Founder Allyson Talyor, Ph.D., a husband-and-wife team. Before starting Backstroke, R. J. Talyor was one of the first 50 employees at email marketing trailblazer ExactTarget, where he led messaging product teams through the company’s $2.5 billion acquisition by Salesforce (NYSE: CRM) in 2012. R. J. later founded Pattern89, a creative AI platform that was acquired by Shutterstock, Inc. (NYSE: SSTK) in 2021. |

May

| AZIsotopes of Bunker Hill reportedly raised $58.33 million in venture funding from undisclosed investors. AZIsotopes is a nuclear medicine and radionuclide manufacturing company specializing in developing and producing medical isotopes and research. |

| Wavelogix, a West Lafayette-based startup manufacturing novel concrete strength sensors, secured $3 million in Series A funding from Rhapsody Venture Partners, a Cambridge-based VC firm that specializes in hard-tech investments. Jason Whaley, General Partner at Rhapsody Venture Partners, said, “Wavelogix’s solution is transformative for concrete construction. Short-term, their solution will allow accelerated project timelines and eliminate costly quality control errors. Beyond this, Wavelogix will enable data-driven decision making and optimization of concrete mix designs, which will reduce carbon footprints, eliminate waste, and lead to more durable structures.” |

| University of Notre Dame startup Intrepid Phoenix Ventures, which focuses on substance use disorder recovery software, closed a $2 million investment from Red Rock Equity Group on April 17. “We had a $400,000 round open but Red Rock Equity was so impressed with our business plan and our mission that they decided to fund our operations for the next two to three years,” says Larry Smith, Founder, president and CEO of Intrepid Phoenix Ventures. “We’ve hired sales executives to build up our business development efforts and a product director,” Smith says. “We’re also boosting our investment on the digital side, from our new website to social media marketing. And as far as the product is concerned, we are investing in our application with a major software development project improving the look and feel of both the phone app and clinician desktop. We believe our software tool empowers individuals to live sober, healthy and happy lives.” |

| South Bend-based CR3 Markets raised $250,000 from the 1842 Fund, a VC fund associated with the University of Notre Dame. CR3 Markets enables commercial real estate asset management firms and developers to efficiently raise capital from the public for their properties, from industrial warehouses to multifamily apartments to any type of asset. In doing so, CR3 Markets enables anyone, from everyday investors to large institutions, to purchase and sell shares of a commercial real estate project via one’s traditional brokerage account, such as Fidelity or Schwab. |

June

| Sortera Technologies raised $44.4 million to expand its first plant and begin developing a second. This funding milestone will significantly enhance the company’s mission of revolutionizing the metals recycling industry. Sortera won the “Deal of the Year” Mira Award for their $30.5 million Series C raise–the Indiana tech sector’s largest capital raise of 2023. |

| Ultratech Capital Partners announced a follow-on investment in Ixana, a West-Lafayette-based company developing AI and Semiconductors to enable high speed human-computer interfaces. Additional investors and the actual raise amount were not shared. |

| Day1, a Notre Dame-based startup, empowers users to discover and collaborate on grants using AI. The company did not formally disclose their total capital raise but were the recipient of $100,000 investment plus a broad package of benefits and support from Render Capital of Louisville. |

| Tempesta Media of Michigan City received an investment from TinySeed, a leading B2B SaaS seed-stage venture capital accelerator. Through this year-long remote partnership, Tempesta Media will receive capital and gain invaluable guidance and resources from a world-class group of former founders. The program will be leveraged to accelerate growth for Tempesta Media. The invested amount was not disclosed. |

| Integrate School received a $100,000 investment from Butler University as part of the Butler Accelerator for Education and Workforce Innovation, a partnership that includes gener8tor and TechPoint. This Bloomington-based company provides a platform for teachers and afterschool program leaders to prepare lesson plans with just a few clicks of a button so they can spend more time with students. |

———

TechPoint has reported tech investments and M&A activity involving Indiana technology companies since 2015. Our innovation and entrepreneurship program portfolio has grown. Below are many ways you can engage with us as entrepreneurs, operators or investors:

Share your funding deals with us by emailing Roger Shuman at Roger@TechPoint.org.

Post job openings on the TechPoint Job Board.

Access industry expertise and additional connectivity through Venture Support

Share with your peers through the Indiana Founders Network

Gain executive insights from Indiana CIO Network

Monetize your Indiana Venture Capital Tax Credit through the VCI Marketplace

Stay connected to the TechPoint Index by subscribing to our weekly newsletter for additional information and insights on Indiana’s tech sector.

See prior quarterly reviews and the 2023 Indiana Tech Venture Report here.