Q1 2023 VC Report: Cautious Movement but Significant Deals Start the Year.

By Ting Gootee, CFA, CAIA and Roger Shuman

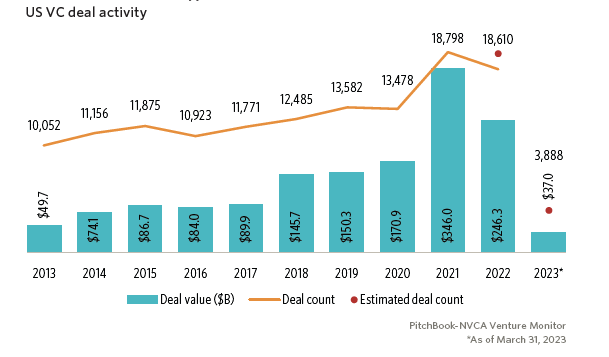

We noted in an earlier report that 2022 was a year of venture market normalization from the 2021 high watermark, and our analysis of Q1 2023 indicates a continued pace toward more cautious deal making. Nationally, according to PitchBook, venture capital (VC) activity dropped in all stages and sectors in the first quarter of 2023. Stage activity was notable for the steep decline in the proportion of angel and seed rounds relative to other rounds of investment. Sectoral activity was more broadly distributed, and quarterly shifts were substantial — software deals dropped 22.9% relative to other sectors — but when compared with long-term averages, most sectors were flat or modestly down relative to each other.

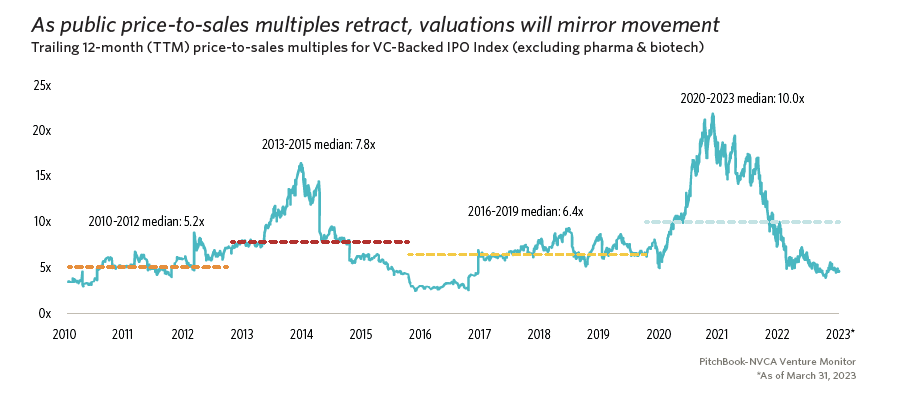

Decreased deal making nationally also corresponds with expected cool-off in valuation that starts to trickle down from the public market to early-stage deals. Investors’ continued flight to quality means founders need to present more market proof points across all stages. As Tomsaz Tunguz noted it in his recent article: “Startups’ plans have shifted aggressively to capital efficiency, without a noticeable impact on ARR growth. We’re all learning to achieve the same with less.”

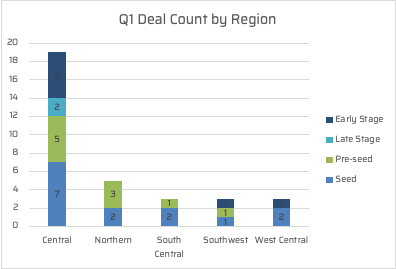

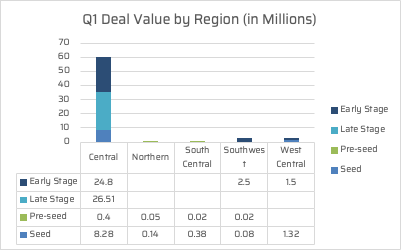

For Indiana tech, 33 deals were tracked in our reporting, totaling $66 million in investments. There were also a dozen deals with undisclosed transactional details that are not included in our reported total numbers here. Additionally, and notably, SIMBA Chain’s $30 million grant from the U.S. Air Force and Surf Internet’s $100 million in debt financing would easily take the quarterly total to nearly $200 million.

Significant deals were made in the quarter by Indiana-based tech companies with Authenticx leading the way via a $21 million Series B round. Elate notched nearly $5 million in Series A funding along with Qualifi’s $4.5 million, while Zylo added another $5 million to its $31.5 Series C raise that was announced in November of 2022.

State-sponsored Elevate Ventures led the way by participating in 19 of the deals during the quarter, including a number of pre-seed investments made through pitch competitions. Other active Indiana-based investors during the quarter include Allos Ventures, High Alpha, M25 (Chicago-based with an Indianapolis office), Flywheel Fund, Sixty8 Capital, NWS Holdings and IU Ventures.

Merger & Acquisition (M&A) activity was also slow during the quarter with just three deals noted. The pace of Indiana M&A is consistent with the rest of the nation. Indiana tech deal distribution for Q1 2023 by stage is in the table below.

| Deal Stage | Deal Count | Deal Count % | Deal Value (in Millions) | Deal Value % |

| Pre-seed | 10 | 30% | $0.5 | 1% |

| Seed | 14 | 42% | $10.2 | 15% |

| Early Stage | 7 | 21% | $28.8 | 44% |

| Late Stage | 2 | 6% | $26.6 | 40% |

| TOTAL | 33 | 100% | $66 | 100% |

The stages of venture investment.

Investment stage definitions are primarily based on PitchBook with minor adjustments according to Indiana’s venture investors’ mandates.

Pre-seed

Less than $500,000, without identifiable investment by professionally-managed pool of capital primarily for financial returns (e.g. Elevate Ventures, given its dual-mandate, will account for a professionally-managed pool of capital only when it’s co-investing with other venture capital firms).

Seed

$500,000 to $5 million without identifiable investment by professionally-managed pool of capital primarily for financial returns.

Early-stage

$1 million –$10 million with identifiable investment by professionally-managed pool of capital primarily for financial returns.

Late-stage

$10 million or more with identifiable investment by professionally-managed pool of capital primarily for financial returns.

Regional definitions follow those used by the Indiana Department of Workforce Development.

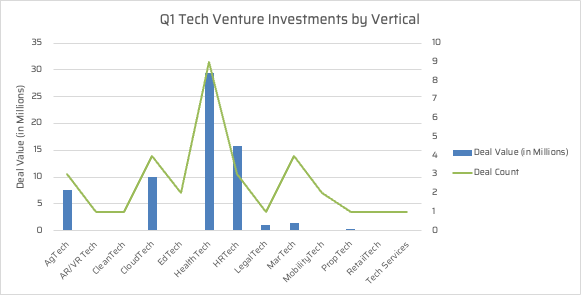

Healthtech, HR tech, Cloudtech and Agtech drove most of Q1’s deal activities, consistent with Indiana’s regional and entrepreneurial strength in those verticals.

How to access capital and other support for your tech startup .

TechPoint offers structured innovation programs to connect founders with capital, talent, domain expertise and potential customers. Please check out Venture Connect, Venture Support, Indiana VCI Marketplace and Indiana CIO Network.

If you represent an investment firm, you should know about the immediate and future opportunities to get more involved in the Indiana tech ecosystem. TechPoint Venture Connect, for example, is a great opportunity for startup and scale-up companies to meet with investors. Send Roger Shuman an email roger@techpoint.org or use this form to indicate interest Our next event will take place in person on July 12-13 2023 in Indianapolis.

What VC data does TechPoint report?

Our data tracking relies on multiple sources of information, including primary data through our deal monitoring activities as well as secondary sources like Pitchbook. We aggregate and cross reference such data to ensure high-quality reporting.

To help ensure quality data, we invite you to share your investment or exit transactional information with us by this form. If you represent one of these Indiana tech companies and it is not yet listed on the TechPoint Tech Directory, please add them today. The listing also enables you to post job openings on the TechPoint Job Board. For additional information and insights on Indiana’s tech sector, be sure to stay connected to TechPoint Index by subscribing to our weekly newsletter.

Continue reading for 2023’s Q1 month-by-month listing of publicly shared investments, grants and acquisitions involving Indiana technology companies.

January 2023.

High Alpha announced the formation of two new studio companies: Colaboratory and Flaunt. Fighting back against the mounting pressure of current market conditions, the rise in digital clutter and fragmented consumer attention spans, Colaboratory was created to power the next generation brand x brand collaborations and partnerships, also known as ‘collabs.’ The company will be based in Minneapolis. High Alpha Studios also announced the launch of Flaunt, a platform that creates a path for brands to get started in the web3 loyalty space and even build on top of existing web3 communities through features that support the creation, integration, distribution, analytics and management of digital assets and their unique benefits.

MathTrack enables schools to have fully-equipped new math teachers by combining training, credentialing and digital curriculum to quickly develop classroom-ready teachers in 30 days. The Indianapolis company raised an undisclosed round led by Stout Street Capital of Denver.

Indianapolis-based Authenticx announced $20 million in Series B funding led by Blue Heron Capital with participation from Beringea, Indiana Next Level Fund/50 South Capital Advisors, High Alpha, Mutual Capital Partners, Signal Peak Ventures, Allos Ventures, Elevate Ventures and M25. The Authenticx platform aggregates, analyzes and activates customer interaction data to surface transformational opportunities in healthcare. Using existing data that’s being stored and ignored by most organizations, Authenticx reveals hidden barriers, motivators and strategies so healthcare organizations can make confident, data-backed decisions.

Indianapolis-based Qualifi, an on-demand screening platform allowing recruiting teams to phone interview hundreds of candidates in minutes, announced $2.5 million in Series Seed financing. Rally Ventures led the round with participation from repeat investors Techstars, Sixty8 Capital, Elevate Ventures, Debut Capital, and Flywheel Fund, as well as newcomers Northwestern Mutual Black Founder Accelerator powered by gener8tor, Converge, Service Provider Capital and multiple strategic angels.

Adverank, a Zionsville-based AdTech startup, secured a $1 million seed round of funding for its tech-enabled advertising platform. Adverank LLC has developed software to maximize pay per click advertising in the self-storage industry based on daily occupancy results and targets. Funding was received from AVAD Capital, a Dallas-based commercial real estate investment firm with founding roots in the self-storage industry. Adverank executives say the funding will be utilized to further refine the platform in preparation for a later Series A round.

heARasight, a University of Notre Dame student startup, is developing augmented reality smart glasses that employ existing core technologies to deliver subtitles for audio inputs in real-time to empower deaf and hard-of-hearing individuals. This technology is intended to improve speech comprehension and overall quality of life during in-person conversations. The company received a $10,000 investment from Flywheel Fund of Bloomington.

South Bend-based blockchain solutions provider SIMBA Chain was selected for a $30 million Strategic Funding Increase and Tactical Funding Increase Program (STRATFI) grant from the U.S. Air Force (USAF), following up on multiple projects the company has completed for the military branch in recent years. The USAF STRATFI is focused on identifying and advancing technologies that have the potential to secure its future dominance. The $30 million investment reflects a significant budget increase compared to previous blockchain initiatives. It will focus on the development and deployment of blockchain applications in supply chain management. These programs are designed to be used by the Office of the Undersecretary of Defense for Research & Engineering, the USAF, U.S. Navy, U.S. Army, and the Defense Logistics Agency.

OpenText (NASDAQ: OTEX), a Toronto-based company with offices in Indianapolis, announced it has closed the previously announced acquisition of Micro Focus International, a United Kingdom-based provider of mission-critical software technology and services that help customers accelerate digital transformation. The total purchase price was approximately $5.8 billion.

February 2023.

Reflex Pro of Indianapolis raised $95,000 via crowdfunding. Reflex Pro is a neurological testing and clinical support tool for medical practitioners working with concussion patients and more. The company has developed a patented five-second neurological vital testing suite that allows practitioners to instantly access meaningful neurological metrics.

Elevate Ventures announced the 14 winners of its last three 2022 Elevate Nexus pitch competitions. Ten of the companies were in the tech space, resulting in $500,000 in investments in Indiana-based startups. Each winner received an $80,000 seed or $20,000 pre-seed investment to propel them as they create high-growth businesses across the state. Representing a wide range of industries and communities, the winning companies also join Elevate’s venture development portfolio. SAFA (South Bend), Toolsey (Fishers), Uniform Sierra (West Lafayette), Integrate Tech (Bloomington) and Laxis (Newburgh) each received $80,000 while Kinga Safety (South Bend), KLOTO (Fishers), Rouge.ai (Indianapolis), Catena (Newburgh) and Prospect XR (Bloomington) each received $20,000.

Surf Internet of LaPorte, Ind., a fiber-optic high-speed internet service provider in the Great Lakes region, announced $100 million of debt financing from DigitalBridge Credit, a division of DigitalBridge Group, Inc. (NYSE: DBRG). Surf Internet secured the new debt capital to support the company’s mission to transform broadband in the Great Lakes region by expanding its dense fiber networks into more communities. The debt raise comes alongside significant equity investment from the company’s existing sponsors Bain Capital and Post Road Group and management team.

Elate, a cloud-based strategic planning software platform, announced its oversubscribed Series A funding round of $4.9 million. Elate enables companies to connect long-term vision with tactical execution in a simple, intuitive way. WestWave Capital led the Series A funding round, with additional new investment from The Pritzker Group Venture Capital, Hyde Park Angels (HPA) and Capital Midwest Fund. Elevate Ventures also made a significant follow-on investment in the round along with continued participation from Serra Ventures, M25 and the Flywheel Fund. The capital will be used to invest heavily in product development as well as support current and future customers through an expanded go-to-market strategy.

Zylo, the Indianapolis company from High Alpha that created the SaaS Management category, announced an additional $5 million in Series C funding from MassMutual Ventures. “By enabling organizations to manage their growing SaaS portfolios and derive the greatest value from their SaaS investments, Zylo is solving a problem that nearly every organization faces – and one that’s become more apparent in the current economic climate,” said Chuck Svirk, Partner at MassMutual Ventures. “Zylo has emerged not only as the category creator, but the clear category leader setting the standard for SaaS Management technology today.” Zylo announced the first tranche of its $31.5M Series C raise in November. Baird Capital’s Venture Team led the C round, which also included Spring Lake Equity Partners and existing investors Bessemer Venture Partners, Menlo Ventures and High Alpha, as well as strategic partner and investor Coupa Ventures.

Studio Science, a leading design and innovation consultancy based in Indianapolis, announced an undisclosed growth capital investment from Inoca Capital Partners. Studio Science will use the funds to support the expansion of its core design and consulting practice areas and the build-out of the company’s growing e-commerce experience business.

March 2023.

The Yard, a Franklin, Ind., company that offers a virtual defined space where users can meet up with their friends, play any video game they want to play, learn and advance, or just have fun and hang out, raised more than $30,000 via crowdfunding.

AgriNovus reports Insignum AgTech, an Atlanta, Ind.-based company whose technology enables plants to use their pigment to communicate health problems, closed on an undisclosed round of pre-seed investment funding. Investors include Ag Ventures Alliance, Countryside Angels, Elevate Ventures, and continued support from private angel investors.

Rides2U of South Bend recently announced a new capital raise to scale its business. The amount of the most recent raise was not disclosed, but the company noted that it has raised $100,000 to date. The company’s ride-sharing platform is built around ensuring the safety and trustworthiness of its drivers and their vehicles.

Recovery Force Health, a Fishers-based medical technology company focused on data-driven, wearable devices, announced the close of a $1.25 million investment round with Elevate Ventures. Recovery Force Health has developed a cordless, lithium-ion-powered, compression and mobility device called the MAC System for patients in the hospital and those recovering at home. The MAC System is cleared as an FDA Class II device prescribed by healthcare professionals to stimulate blood flow in the lower extremities and assist in the prevention of DVT in at-risk patients.

Blue Agilis Corporation, a Carmel-based healthcare tech company, announced the close of an undisclosed seed funding round with a $42.5 million post-investment valuation, thanks to an investment from one of the nation’s largest payers. The funding will enable the company to aggressively pursue growth opportunities and advance AI and machine learning capabilities within their Blue Agilis Platform. Blue Agilis is an all-in-one technology platform that leverages AI-technology and provider practice insights to improve value and decrease cost.

Athian, an Indianapolis cloud-based carbon marketplace for the livestock industry, announced a seed investment from Tyson Ventures, the venture capital arm of Tyson Foods, Inc. This latest investment, along with previous investments from Elanco Animal Health Incorporated (NYSE: ELAN) and Newtrient LLC, will fast-track the launch of the first-of-its kind transactional carbon credit inset program for the livestock sector that will provide producers economic incentives for on-farm sustainability practices, while helping improve the sustainability of the food system and reduce climate warming. The Indianapolis Business Journal reports the total amount of the seed round to be $5 million.

GemViz LLC, a Warsaw, Ind. med-tech start-up, announced an investment from Elevate Ventures’ Community Ideation Fund. The investment will provide GemViz with the necessary resources to further develop its platform designed to securely integrate all available patient data sources. The product has the potential to improve diagnostic accuracy and optimize treatment plans.

Vibenomics of Fishers was acquired by Mood Media of Austin, Texas. Mood Media is an experiential media company that maximizes customer experience and provides value for businesses and brands worldwide. The Vibenomics platform provides in-store digital advertising via a single, all-in-one retail media network, empowering retailers to digitize their on-premise experience and advertisers to connect with customers via display, audio and experiential channels. Financial terms of the transaction were not disclosed.

Fresh off of their investment from Inoca Capital, Studio Science of Indianapolis announced the acquisition of Indianapolis-based RevTech360, a digital transformation solutions provider focused in MuleSoft and Salesforce. The acquisition further strengthens Studio Science’s rapidly-growing Salesforce Commerce Cloud services. Financial details of the acquisition were not shared.

TechPoint has reported tech investments and M&A activity involving Indiana technology companies since 2014. Share your funding deals with us by contacting Roger Shuman via email at Roger@TechPoint.org. If you represent one of these Indiana tech companies and it is not yet listed on the TechPoint Tech Directory, please add them today. The listing also enables you to post job openings on the TechPoint Job Board. For additional information and insights on Indiana’s tech sector, be sure to stay connected to TechPoint Index by subscribing to our weekly newsletter.

Most of TechPoint’s quarterly and year-end VC reports can be found by clicking on the word, “Capital” on the TechPoint Index.