Q3 2022 VC Report: Indiana tech continues to outpace national investment activity

Indiana’s tech ecosystem appears to be outpacing national venture capital (VC) investment activity over the past three quarters as Hoosier companies continue to attract capital at historic levels.

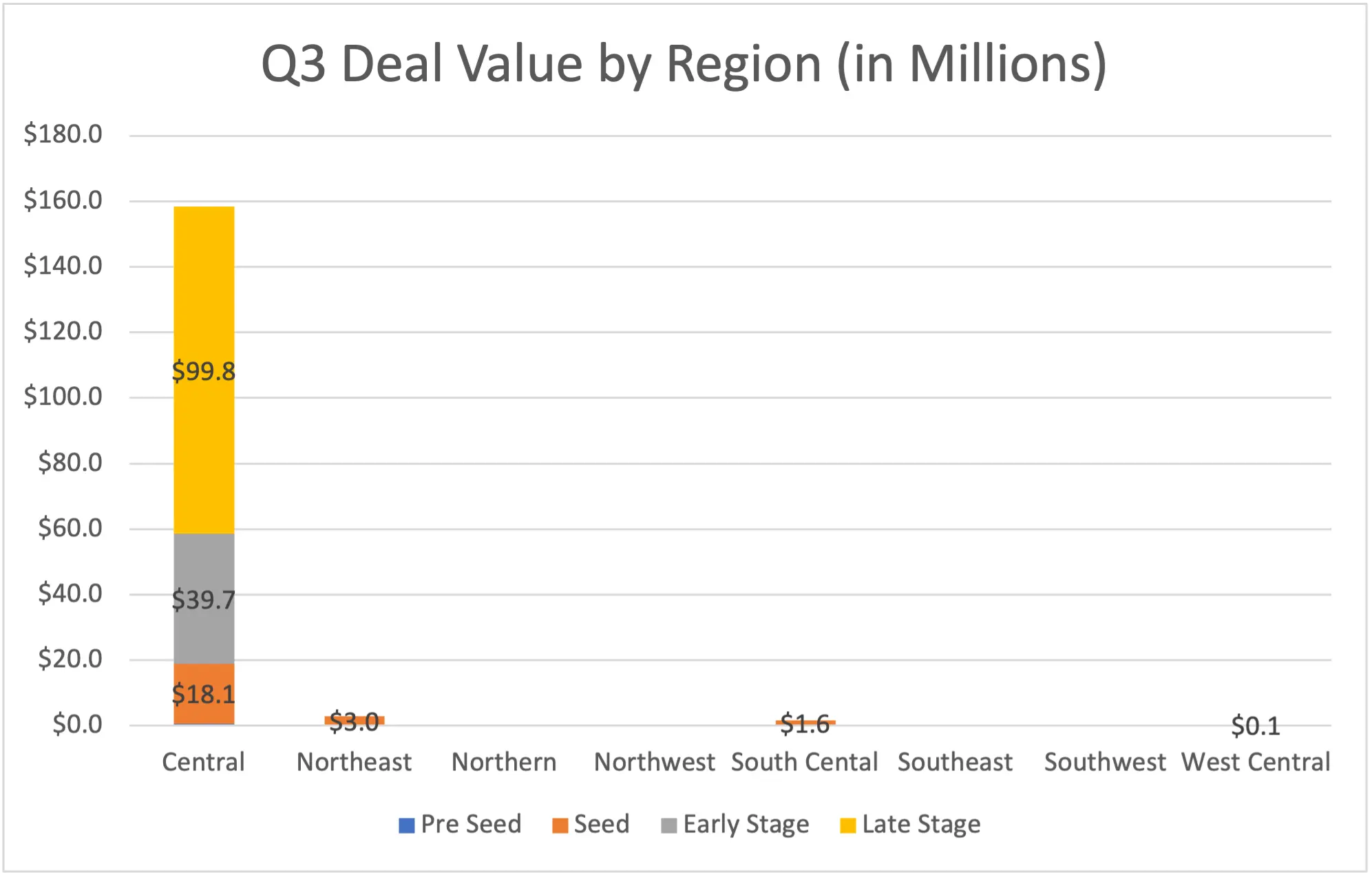

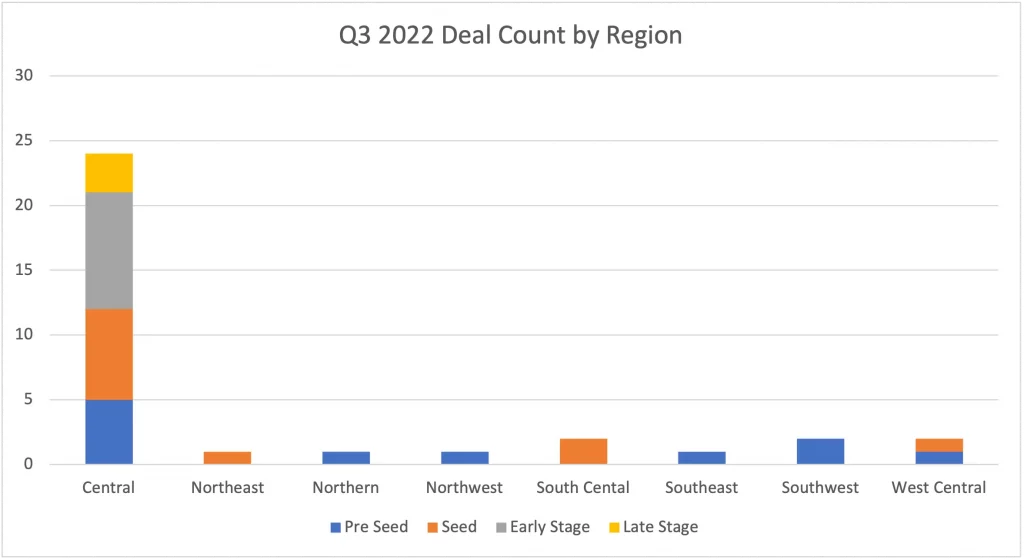

Indiana’s 2022 total third quarter VC investments lagged behind 2022’s second quarter by nearly $6M, but we noted 34 investments in Indiana tech companies with more than $160M invested. That’s the fourth highest total Indiana tech companies have recorded in a single quarter. At more than $378M in investments and counting, 2022 is already the second largest year for Indiana tech company investments since TechPoint has been tracking this metric.

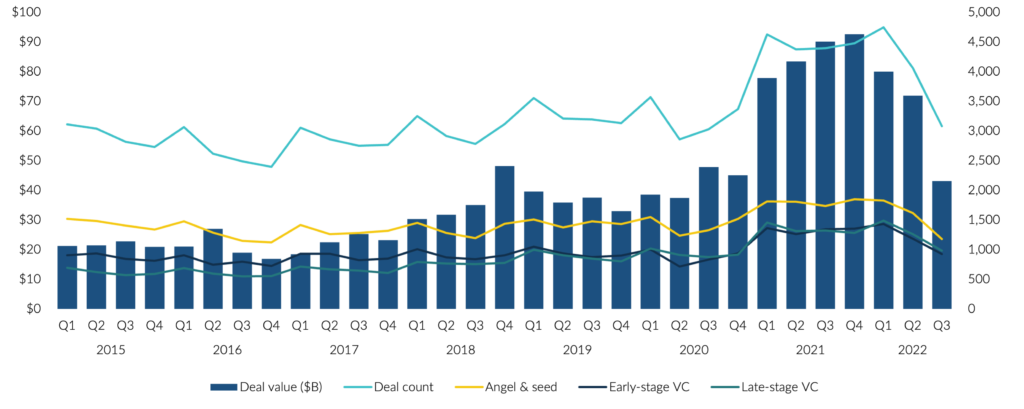

Nationally, deal value and deal count have dropped every quarter since the end of Q4 2021, according to the Q3 PitchBook and National Venture Capital Association (NVCA) Venture Monitor Report. Deals classified as angel and seed, early stage VC and late-stage VC were also down during this same timeframe. The first two quarters remained high nationally compared to previous years, but Q3 is more reminiscent of deal values and deal counts for 2020. This could reflect caution by investors to invest during a recession and/or similar caution by founders who don’t seek capital from institutional investors, fearing they may undervalue the companies in the current economic climate.

Indiana tech deal distribution by stage is in the table below.

| Deal Stage | Deal Count | Deal Count % | Deal Value (in Millions) | Deal Value % |

| Pre-seed | 11 | 32.4% | $1.0 | 0.6% |

| Seed | 11 | 32.4% | $19.9 | 12.4% |

| Early Stage | 9 | 26.5% | $39.7 | 24.8% |

| Late Stage | 3 | 8.8% | $99.8 | 62.2% |

| GRAND TOTAL | 34 | 100.0% | $160.4 | 100.0% |

The stages of venture investment

Investment stage definitions primarily based on PitchBook with minor adjustments according to Indiana’s venture investors’ mandates.

Pre-seed

Less than $500,000, without identifiable investment by professionally-managed pool of capital primarily for financial returns (e.g. Elevate Ventures, given its dual-mandate, will account for a professionally-managed pool of capital only when it’s co-investing with other venture capital firms).

Seed

$500,000 to $5M without identifiable investment by professionally-managed pool of capital primarily for financial returns.

Early-stage

$1M-10with identifiable investment by professionally-managed pool of capital primarily for financial returns.

Late-stage

$10M or more with identifiable investment by professionally-managed pool of capital primarily for financial returns.

Of the 34 recorded deals in Indiana in its third quarter, 24 (more than 70 percent) took place in Central Indiana. Additional deals were reported in seven other regions. More than $155M (more than 96 percent) of the dollars invested in Indiana tech companies went to Central Indiana firms. Two of these investments (Taranis and Scale Computing) made up $95M.

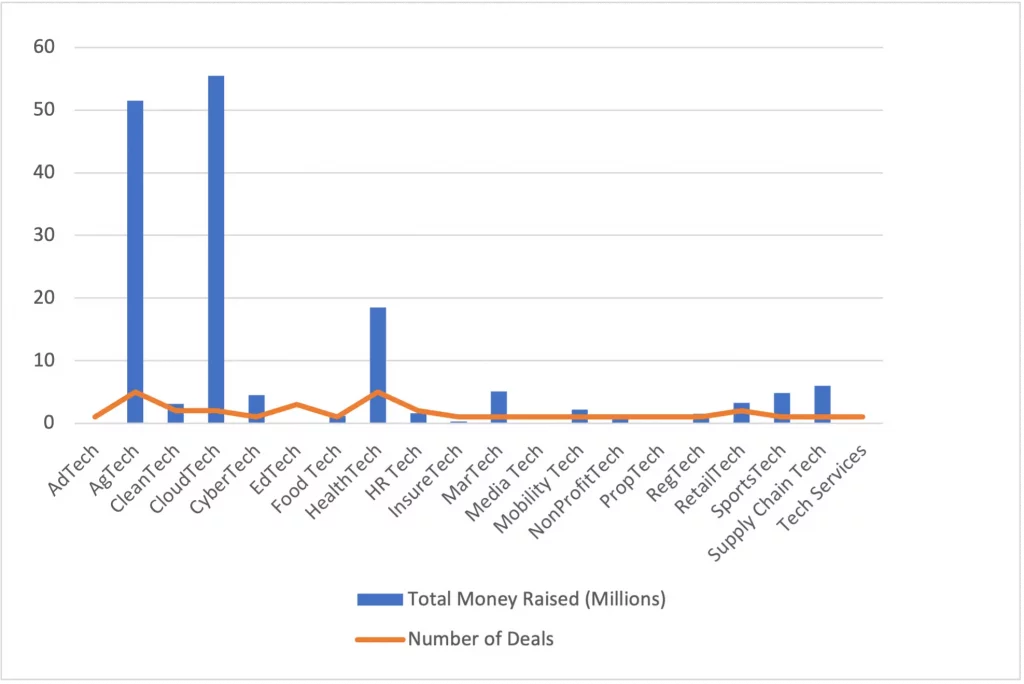

Q3 2022 Deal Count & Amounts Raised by Tech Sector

Only six Indiana tech companies reported merger and acquisition (M&A) activity in the third quarter with all but one involving central Indiana companies. Five of the six companies were acquired by out-of-state firms while one, Abstract Technology Group of Indianapolis, was acquired by an in-state company. As with most acquisitions, financial details were not publicly shared.

Venture Continues to Flow from Indiana and Beyond

Of these publicly announced deals, Indiana-based VC firms, or those with Indiana offices, were involved in 10 capital raises across the state with Elevate Ventures leading the way through its state-sponsored funds, participating in eight of the deals. Other Indiana investors included Purdue Foundry of West Lafayette, Hageman Group of Carmel, M25 of Indianapolis and Chicago, along with High Alpha and Allos Ventures of Indianapolis. Thirteen firms or corporate investors from outside of the state also participated in capital raises involving Indiana companies, ranging from coast-to-coast and including Kern Venture Group (Bakersfield, Calif.), Solidea Capital (New York City), Render Capital (Louisville, Ky.), Mountain Group Partners (Nashville, Tenn.), CareSource (Dayton, Ohio), Mercury Fund (Houston), TDF Ventures (Chevy Chase, Md.), Fulcrum Equity Partners (Atlanta), Valor Ventures (Atlanta), Mutual Capital Partners (Westlake, Ohio), Morgan Stanley Expansion Capital (New York City), Micron Ventures (Boise, Idaho), Finistere Ventures (San Diego), Presidio Ventures (Santa Clara, Calif.), and Cavallo Ventures (San Francisco). With Solidea Capital’s most recent investment, the firm has now participated in seven Indiana technology company raises including Saaslio, SafeKeeping, Preventia, Slice and Chuqlab. Thirteen firms from outside the U.S. participated in Taranis’s $40M Series D raise.

How to access capital and other support for your tech startup

As TechPoint’s Senior Relationship Manager focused on VC, I introduce tech entrepreneurs to the investors and support systems they need to get their ideas to market through events like Venture Connect (formerly VC Speed Dating) and TechPoint Pitch Nights or via one-to-one connections.

I want to talk with you if you are the founder of a company or know of an Indiana-based tech company looking to scale. Our team will strive to provide unbiased inputs and connect you to the right resources and mentors to succeed.

If you represent an investment firm, I want to talk to you, too. You should know about the immediate and future opportunities to get more involved in the Indiana tech ecosystem. TechPoint Venture Connect, for example, is a great opportunity for startup and scale-up companies to meet with investors. Send me an email or use this form to let me know that you’re interested in the event. Our next event will take place virtually in February 2023.

What VC data does TechPoint report?

Our data tracking relies on multiple sources of information, including primary data through our deal monitoring activities as well as secondary sources like Pitchbook, Crunchbase and the NVCA. We aggregate and cross reference such data to ensure high-quality reporting. We continue to specifically report on the details that are publicly shared by the Indiana companies involved in raising venture capital and M&A activities. In some cases, financial details regarding capital raises are left out of press releases. Additionally, some raises are not publicly shared at all. In such cases, we will not disclose individual deal details that have not been publicly released.

Continue reading for 2022’s Q3 month-by-month listing of publicly shared investments, grants and acquisitions involving Indiana technology companies.

July 2022

Modicus Prime received a pre-seed investment from Valor Ventures of Atlanta. The company is building the first AI/ML real-time platform for quality control in biopharma manufacturing. Research from Washington University and others estimates that $25B-$50B is lost annually due to destroyed biopharma products after manufacture. One prominent example is the 60 million doses of the J&J covid vaccine destroyed in 2021. Such losses are preventable with Modicus Prime’s technology, which detects anomalies in real time. Financial details of the round were not shared.

Parker Technology announced a series seed round of $2.2M, led by Elevate Ventures and several other investors. The influx of capital will be used for accelerating sales and marketing and scaling operations to support the brand.. Parker Technology is a software and services company that helps parking facilities provide an excellent customer experience, by resolving issues for parking guests when they fail in the face of automated payment kiosks.

Scale Computing, a developer of edge computing, virtualization and hyperconverged solutions, raised $55M, led by funds managed by Morgan Stanley Expansion Capital. The company will use the new funds to expand its leadership position in edge computing, including investments in people, R&D, and restructuring of debt. Jeff Ready, Scale’s founder and CEO, reported in the IBJ that the company is heading towards an Initial Public Offering.

Intertwined Finance announced a $30,000 pre-seed investment from Paul Saunders, President of eLuxury.com, and ePackageSupply.com, and software investor Luke Bucshon, formerly at Vista Equity Partners. Intertwined Finance was named the University of Evansville Changemaker Challenge Champion and an Innovate WithIN State Finalist. The company, co-founded by three 17-year-old high school students from Signature School in Evansville, is developing a financial literacy education web application for use in high schools.

Verility Inc. closed a $3.5M Series A round led by Mountain Group Partners of Nashville, Tenn. The round includes a previous investment from Purdue Foundry. Verility has created an AI-enabled, smartphone-based product called Fertile-Eyez. The technology platform provides fertility analysis products which enable livestock producers and breeders to accelerate reproductive performance.

Alithya Group inc. (NASDAQ: ALYA) of Montreal confirmed the closing of its previously announced acquisition of Datum Consulting Group, LLC of Indianapolis. Datum provides IP enabled digital transformation services for data rich insurers and other regulated entities such as state governments. Datum employs over 150 professionals and supports its global clients from the U.S. , Europe, India and Australia. Financial details of the acquisition were not publicly shared.

Resolv, a Jeffersonville, Ind. mental healthcare application designed for teenage girls, was acquired by Mindfully for an undisclosed amount on July 15, 2022. Mindfully is a Fairfield, Ohio, healthcare company that offers mental health, peer support, counseling and psychiatry services.

Acrisure, a fast-growing fintech leader based in Grand Rapids, Michigan, announced that it has acquired Catalyst Technology group, a Managed Service Provider based in Indianapolis. Catalyst offers small-and-medium size businesses enterprise-class IT support with a specialty in streamlining processes for greater customer ease. Financial details were not disclosed.

Körber, an international technology group based in Hamburg, Germany, has signed an agreement to purchase a portion of enVista, a supply chain and enterprise technology consulting firm based in Carmel. Körber will take over enVista’s “Enspire Commerce” platform, including its order management system, and its freight audit and paymentservice. Financial details were not disclosed.

August 2022

Market Wagon secured funding from Kern Venture Group of Bakersfield, Calif.. The terms of the investment were not shared.

Membershine raised $1.04M in Seed 1 funding. The raise includes funding from Elevate Ventures with participation from other, undisclosed investors. The Fishers company produces member management software geared toward small to large organizations.

Slice secured an undisclosed raise from Solidea Capital of New York City. The company’s software helps writers and teams produce better content faster, by allowing them to stay focused on their ideas–and away from internet rabbit holes.

Trava, an integrated cyber risk management and insurance platform, announced a $4.5M raise. This second round of seed funding was led by Mercury Fund, based in Houston, with participation from Elevate Ventures, TDF Ventures (Chevy Chase, Md.), High Alpha Capital, and M25 (Chicago and Indianapolis).

Atarraya, creator of Shrimpbox, the first sustainable ‘plug-and-play’ shrimp farming technology and the aquaculture equivalent to agriculture’s vertical farming, announced its U.S. launch and a $3.9M Series A funding round led by Jeffrey Horing and other angel investors, including Mark K. Gormley, Geoffry Kalish, Robert Stavis and Robert Goodman. Atarraya will use the new funds to scale its proprietary Shrimpbox technology globally and to launch its U.S. headquarters in Indianapolis.

CareSource, a national managed care organization, announced a $1M investment in 120Water, a digital water solution that helps utilities and state and local agencies manage critical water programs that protect public health. CareSource’s investment, which is part of a $3M round that included participation from Elevate Ventures, Allos Ventures and other existing investors, was made through the CareSource Diversity and Social Impact Fund.

MetaCX raised $5.1M from a group of angel investors in the form of a convertible note. This capital will be converted to equity when the company raises another round, expected to take place in 2023. The company’s Business Value Network allows users to manage the expected value from their business relationships.

Carmel-based Olio Health announced a $13M Series A growth investment led by Fulcrum Equity Partners of Atlanta with participation from Mutual Capital Partners of Westlake, Ohio. Olio offers a workflow and collaboration platform for the post-acute care and population health industry that provides real-time communication, collaboration, and cost savings to risk-bearing entities and PAC providers. This funding round will be used to further accelerate Olio’s rapid growth through product development and key hires across multiple departments.

Transcriptly received $20,000 from Velocities and Elevate Ventures. The Columbus, Ind., company is a K-12 EdTech start-up working to demystify school data.

Vergence Solutions, an Indianapolis based IT consulting firm, has acquired Abstract Technology Group of Lafayette. Abstract Technology Group provides comprehensive IT solutions including Application Development and Managed Services for small to medium-sized businesses. Financial details of the acquisition were not disclosed.

Hitachi, Ltd. acquired Flexware Innovation of Fishers, a manufacturing systems integrator founded in 1996. Flexware Innovation was a strategic acquisition for Hitachi due to their focus on data and digital technology in the manufacturing space. Financial details of the acquisition were not shared publicly.

September 2022

Traction Ag Inc., the first cloud-based farm management software that delivers financial solutions to growers across the Midwest, announced $3M in Seed funding. The company will use this investment to bring added functionality and value to its integrated farm accounting and operations application. The funding round includes participation from Hageman Group, Allos Ventures and Elevate Ventures.

Taranis, a provider of AI-powered crop intelligence, announced a $40M Series D raise. The round was led by Inven Capital, a climate tech fund based in Prague, Czech Republic, with worldwide participation from new investors Seraphim Space Investment Trust (London) and Farglory Group (Taiwan), and backing from existing investors: Vertex Growth (Singapore), Viola Ventures (Israel), Vertex Ventures Israel, La Maison Partners (Paris), Hitachi Ventures (Munich), K3 Ventures (Singapore), UMC Capital (Taiwan), OurCrowd (Israel), Micron Ventures (Boise, ID), iAngels Ventures (Israel), Presidio Ventures (Santa Clara), Cavallo Ventures (San Francisco), Finistere Ventures (San Diego) and angel investor Eyal Gura (Israel). This latest round brings Taranis’ total funding to $100M.

Co-Founder Chris Baggott and CEO Meredith Sandland announced the launch of their new venture, Empower Delivery. Born from ClusterTruck, the vertically-integrated virtual restaurant and ghost kitchen, Empower Delivery is a software company that enables delivery-centric restaurants to profitably and sustainably serve off-premise demand. The company closed a seed round led by Allos Ventures along with High Alpha Capital and several original investors in ClusterTruck. Details of the round were not publicly shared.

Three Indiana-based tech companies received funding as part of Elevate Ventures Elevate Nexus Statewide Pitch Competition. Adapta, an edtech company based in South Bend, received $40,000 in pre-seed funding. The company provides an advanced testing platform, powered by artificial intelligence, to help teachers personalize education. Leaftech Ag of Wilkinson received $100,000 in Seed Funding. The company offers a handheld digital lab that geolocates and analyzes a plant’s leaf for nutrient composition. Quantum Research Sciences of Lafayette also received a $100,000 Seed investment. Quantum’s platform solves complex industrial problems that require quantum computing, artificial intelligence and machine learning expertise.

TitleWise of Clarksville, Ind. was one of eight companies to win the 2022 Render Competition held by Render Capital of Louisville. The company received a $100,000 investment award TitleWise offers a powerful web-based tool for creating digital reports and databases specifically designed for real estate title abstractors.

TechPoint has reported tech investments and M&A activity involving Indiana technology companies since 2014. Share your funding deals with us by contacting me via email. If you represent one of these Indiana tech companies and it is not yet listed on the TechPoint Tech Directory, please add them today. The listing also enables you to post job openings on the TechPoint Job Board. For additional information and insights on Indiana’s tech sector, be sure to stay connected to TechPoint Index by subscribing to our weekly newsletter.

Review the Q2 2022 VC Report, and to see how the third quarter of 2022 compares to recent years feel free to review TechPoint’s VC reports for 2021, 2020, 2019, 2018, 2017 and 2016.