Q2 2022 VC Report: Indiana Tech Shows Continued Momentum through Q2

Most of the worldwide venture market remains cautious amid economic uncertainty, but the Indiana tech ecosystem appears to be experiencing stable performance through the second quarter of 2022. In fact, with more than $166 million invested in 24 Indiana tech companies, the quarter garnered the third largest investment ever recorded by TechPoint since 2016.

Fifty percent of venture-backed deals captured 89 percent of total venture invested dollars in Indiana tech, continuing to highlight the importance of transitioning companies from non-venture-backed to venture-backed. It is possible that a number of the deals reported in the second quarter were well advanced through the investor pipeline since late in 2021 and early in 2022. It’s also possible that deals completed prior to the second quarter didn’t get publicly announced or tracked by deal databases until later. However, this typically does not impact the overall market trend analysis.

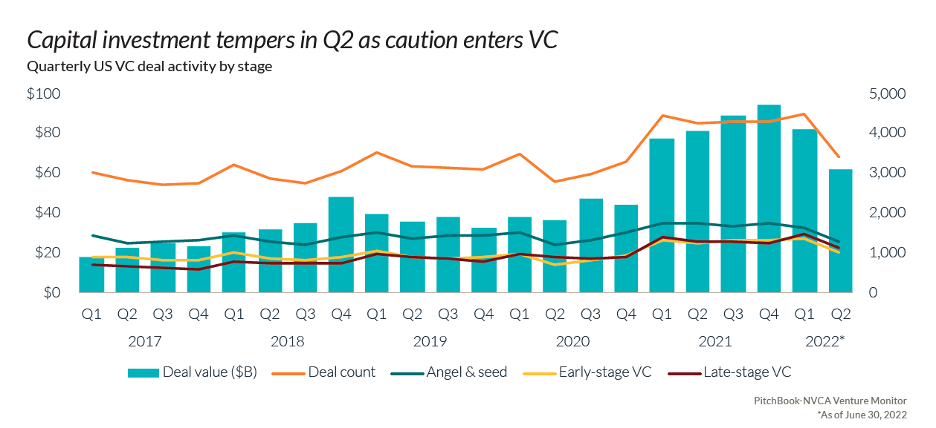

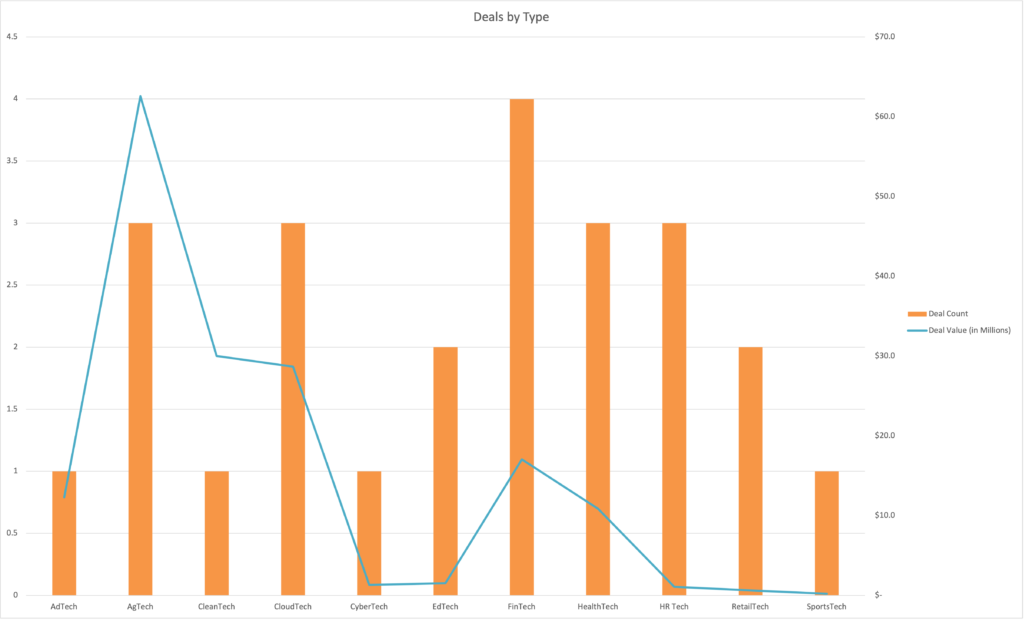

According to the Q2 Pitchbook and National Venture Capital Association (NVCA) Venture Monitor report, the total deal count across the nation has stayed relatively high across all stages, but the overall deal value has declined. This is likely a reflection of the decrease in late-stage deal activities and continued depression of exit activities due to public market uncertainties. Most of the Indiana tech companies are emerging and growing at the front end of the overall venture development pipeline, less impacted by the potential decline in national investor interest in mega rounds (transactional deal sizes over $100 million). Fifty percent of the Indiana tech company deals recorded were in the “Pre-Seed” or “Seed” stage, with another 33 percent noted as “Early Stage.”

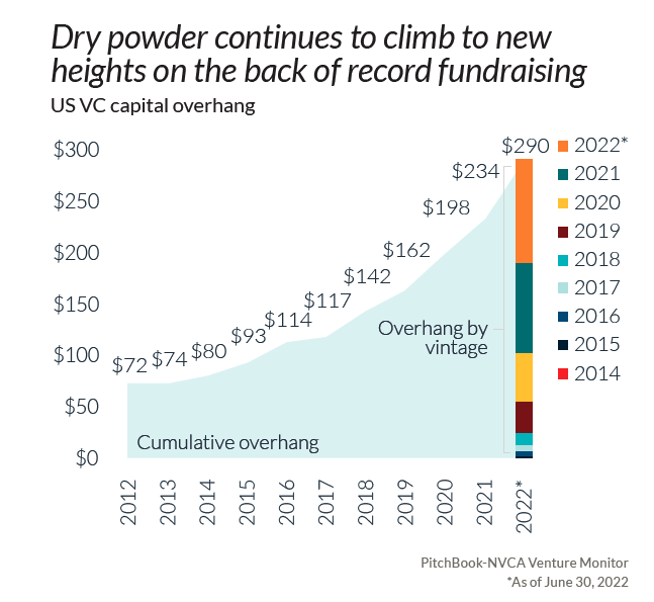

Pitchbook notes strong fundraising activities by VC firms over the last few years. This has resulted in an estimated $290 billion in “dry powder” (money that is intended to be invested), making the current potential down cycle fundamentally different from the drastic lack of liquidity experienced in the 2008-2009 financial crisis when there was less money available for investments. Investors may urge and/or insist that companies be more capital-efficient, but capital IS available.

Indiana tech deal distribution by stage is in the table below.

| Deal Stage | Deal Count | Deal Count % | Deal Value (in Millions) | Deal Value % |

| Pre-seed | 3 | 12.5% | $0.6 | 0.3% |

| Seed | 9 | 37.5% | $18.2 | 10.9% |

| Early-stage | 8 | 33.3% | $18.9 | 11.4% |

| Late-stage | 4 | 16.7% | $128.5 | 77.3% |

| Grand Total | 24 | 100.0% | $166.2 | 100.0% |

Investment stage definitions primarily based on PitchBook with minor adjustments according to Indiana’s venture investors’ mandates.

- Pre-seed – less than $500,000, without identifiable investment by professionally-managed pool of capital primarily for financial returns. Elevate Ventures, given its dual-mandate, will account for a professionally-managed pool of capital only when it’s co-investing with other venture capital firms.

- Seed – $500,000 to $5 million without identifiable investment by professionally-managed pool of capital primarily for financial returns.

- Early-stage – $1-10 million with identifiable investment by professionally-managed pool of capital primarily for financial returns.

- Late-stage – $10 million or more with identifiable investment by professionally-managed pool of capital primarily for financial returns.

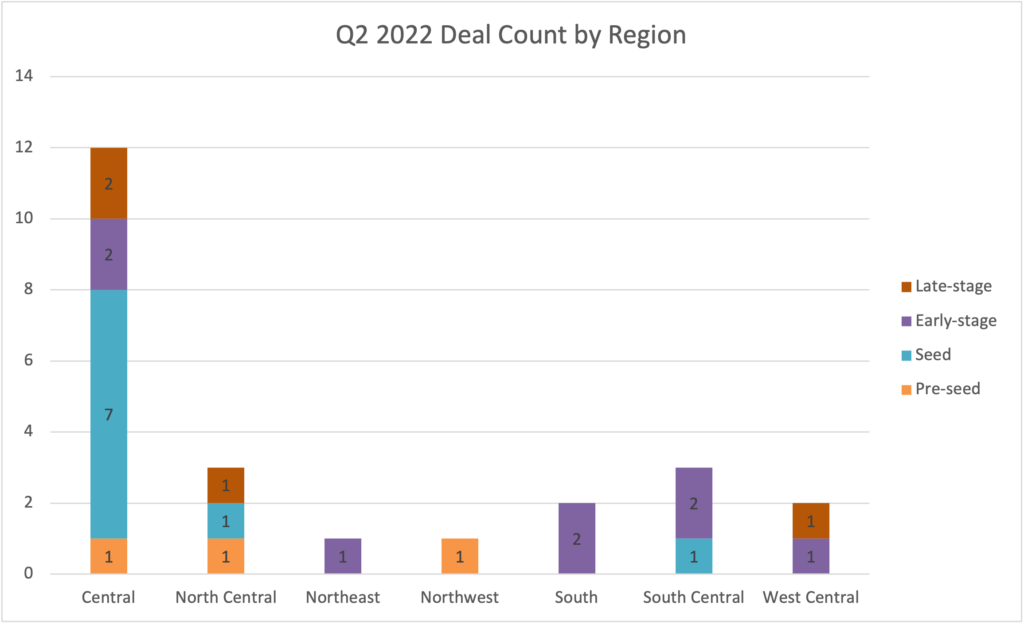

Regional deal distribution puts Central Indiana on top in terms of deal count with 50 percent of the second quarter deals recorded. The West Central region (where Purdue University is located) had only two deals, but garnered 37 percent of the total dollars invested in Indiana because agtech company Solinftec raised $60 million.

Regional definitions follow those used by the Indiana Department of Workforce Development.

There were also eight companies involved in merger and acquisition (M&A) activity, with one company (Greenlight Guru) making two acquisitions, for a total of nine acquisitions in the quarter. It was nearly an even split with slightly more of the Indiana companies being acquired by an out–of-state or other Indiana company. We continue to see more cases where the Indiana tech company is the acquirer rather than the acquiree. Local private-equity backed tech companies like Formstack, Greenlight Guru, OnBoard and Resultant continue to make strategic acquisitions with capital acquired in recent years. Although the amount was undisclosed, Schneider Geospatial’s new investment from Align Capital Partners of Cleveland may have the company poised to make new acquisitions in the coming years. Read more about The Impact of M&A Activity on the Indiana Tech Ecosystem.

Venture Continues to Flow from Indiana and Beyond

The second quarter of 2022 continued to demonstrate robust tech investor activities in Indiana. A total of 24 fund managers publicly shared their investments in Indiana tech companies. Sixty-six percent of these fund managers are from outside Indiana, demonstrating the flow of capital to tech talent and to quality deal opportunities.

Amongst those is Drive Capital, one of the largest venture capital firms in the Midwest, which recently announced raising $1 billion in new funds with more than $2.2 billion in total assets under management since its founding in 2013. Drive Capital made its second Indiana investment in Encamp, alongside Indiana-based investors Allos Ventures and High Alpha. TJ Dembinski, partner at Drive Capital, referenced the firm’s excitement “to partner with Encamp as they continue to empower [environmental, health and safety] teams with their unmatched expertise.”

VC Firms Based in Indiana or with an Indiana Office

- M25

- Purdue Ventures

- Elevate Ventures

- IU Ventures

- Flywheel Fund

- VisionTech

- High Alpha

- Allos Ventures

Regional VC Firms

- Drive Capital

- Align Capital Partners

- Panoramic Ventures

- Innovation Works

- Arthur Ventures

- Service Provider Capital

- Frontier Angels

- RF Investment Partners

Coastal VC Firms

- Lightsmith Group

- Distributed Ventures

- Circularis Partners

- OpenView

- Praxis

Out of the Country

- Unbox Capital

- AGrow Ventures

- Exuberance Capital

How to access capital and other support for your tech startup

As TechPoint’s Senior Relationship Manager focused on venture capital, I work every day to introduce tech entrepreneurs to the investors and support systems they need to get their ideas to market. I want to talk with you if you are the founder of a company or know of an early stage Indiana-based tech company that needs to raise capital.

Our capital formation support is also expanding beyond capital connectivities through either events or one-on-one introductions. If you are interested in gaining access to entrepreneurial mentors or receiving feedback on your fundraising activities including deal terms, please do not hesitate to reach out as well. Our team will strive to provide unbiased inputs and connect you to the right mentors to succeed.

If you represent an investment firm, I want to talk to you, too. You should know about the immediate and future opportunities to get more involved in the Indiana tech ecosystem. VC Speed Dating, for example, is a great opportunity for startup and scale-up companies to meet with venture capital firms. Send me an email or use this form to let me know that you’re interested in the event. Our next VC Speed Dating event is in person at The Biltwell event center in Indianapolis on September 1. We will be hosting our event the day after the Venture Club of Indiana Innovation Showcase and the Next Level Fund Summit. It’s a power-packed couple of days for tech companies, entrepreneurs and investors.

What Do We Report?

Our data tracking relies on multiple sources of information, including primary data through our deal monitoring activities as well as secondary sources like Pitchbook, Crunchbase and the National Venture Capital Association (NVCA). We aggregate and cross reference such data to ensure high-quality reporting. We continue to specifically report on the details that are publicly shared by the Indiana companies involved in raising venture capital and M&A activities. In some cases, financial details regarding capital raises are left out of press releases. Additionally, some raises are not publicly shared at all. In such cases, we will not disclose individual deal details that have not been publicly released.

Continue reading for 2022’s Q2 month-by-month listing of publicly shared investments, grants and acquisitions involving Indiana technology companies.

APRIL

Bloomington, Ind.-based Folia announced a $2 million seed round led by IU Ventures with participation from Flywheel Fund and other unnamed investors. Folia’s iAnnotate software allows businesses to read and annotate documents to perform research and analysis.

Prodport, a headless software platform for dynamic and personalized product detail pages, announced $3.6 million of funding from a syndicate of leading investors and entrepreneurs including Praxis (Bay Area), Exuberance Capital (Switzerland) and angel investors. Prodport’s co-founder and CEO, Ohad Hecht of Indianapolis, was the former CEO of Emarsys.

In early 2022, Prevounce relocated to Indianapolis from Los Angeles. In April, the company completed a $4.5 million Series A raise led by angel investors. The company’s platform empowers providers, practices, and other healthcare organizations to easily provide and efficiently bill for preventive services, remote patient monitoring, and chronic care management while remaining compliant with current regulations.

Skyepack has received a significant growth investment from the Purdue Startup Fund, managed by the Purdue Foundry. Elevate Ventures and M25 also invested in this round of funding. Skyepack creates custom digital course materials to prepare students for high-demand, high-wage careers. Skyepack is based in the Purdue Research Park.

“The Dwyer Group of Michigan City, Ind., a subsidiary of Arcline Investment Management, of Nashville, Tennessee, will grow its footprint as part of a $525 million acquisition. Arcline acquired Omega Engineering from Spectris PLC of London, which will join The Dwyer Group of companies. Dwyer designs and manufactures innovative sensors and instrumentation solutions for the IEQ (Indoor environmental quality), building automation, process and environmental markets. Omega is a provider of sensing, control, and monitoring technologies.

Cyberian Technologies, an Indianapolis firm that provides custom managed IT, cloud, consulting and security solutions for businesses in the Indiana market, has been acquired by Houston-based Meriplex. Meriplex has a nationwide presence in managed cybersecurity and IT solutions.

Allegion, a leading global security products and solutions provider, has signed a definitive agreement to acquire Stanley Access Technologies LLC and assets related to the automatic entrance solutions business from Stanley Black & Decker, Inc. (NYSE: SWK) for $900 million in cash. Allegion is based in Ireland and has its Americas headquarters in Carmel, Ind. This marks the second time in the past six months that Stanley Black & Decker has sold off a division of its company.

Chuqlab walked away with $60,000 in prize money from its participation in the 22nd McCloskey New Venture Competition held at Notre Dame’s Idea Center. In total, more than $600,000 in cash and prizes was awarded during the event. Chuqlab transcribes jail phone calls and other audio files pertinent to investigations to make them searchable for keywords and phrases to help law enforcement solve past and current crimes as well as prevent future ones. Chuqlab won both the McCloskey Grand Prize ($50,000) and the Schurz Innovation Award ($10,000).

MAY

Solinftec, an agtech company based in West Lafayette, Ind., has secured a $60 million growth investment round led by the Lightsmith Group (New York City). The investment will enable the company to further expand its digital farm operations platform in North America and South America. Lightsmith is joining existing investors in the company, Unbox Capital (Sao Paulo, Brazil), which also participated in the round, and Circularis Partners (Tampa, Florida). Additional undisclosed investors are also participating in the round.

Explore Interactive, a West Lafayette, Ind.-based ed-tech company, has received $1 million in Small Business Innovation Research (SBIR) funding from the National Science Foundation. In addition, Explore Interactive has been awarded $75,000 from Elevate Ventures through the state of Indiana’s SBIR/STTR Phase II Matching Funds Program.

Indianapolis-based Accelerate, an IT managed services company, was acquired by The Purple Guys of Shreveport, Louisiana. Accelerate provided a full suite of IT managed services to businesses in the Indianapolis market, specializing in customized IT solutions, cloud services and cybersecurity since 1995. The Purple Guys company is a leading provider of managed IT services to small and mid-sized organizations. This is The Purple Guys’ fifth acquisition since the formation of its partnership with Kian Capital and ParkSouth Ventures (both located in Charlotte, N.C.) in January 2020.

Smart Apply, an Indianapolis agtech startup whose precision spray technology reduces chemical and water usage by orchards and vineyards by an average of 50 percent, has successfully raised a $1.3 million seed round. The proceeds from the round will be used to build upon the company’s momentum in preparation for a Series A round. Indianapolis-based VisionTech Angels led the round with strong participation from Elevate Ventures, Frontier Angels (Bozeman, Mont.), AGrow Ventures (Israel), and individual angel investors.

Clarksville, Ind.-based Armadillo raised a $3.5 million seed round led by Distributed Ventures of New York City. Armadillo is a tech-driven home warranty company whose digital platform provides affordable, subscription-based protection for home appliances and systems when they break down. They have plans available in all 50 states.

Indianapolis-based Resultant, a consulting firm specializing in technology, data analytics, and digital transformation, announced their planned acquisition of Teknion Data Solutions, a Dallas-Fort Worth, Texas-based, full-service data analytics company. Financial details of the acquisition were not disclosed.

Cloverdale, Ind.-based Standard for Success was acquired by Education Advanced, Inc. of Tyler, Texas. Standard for Success, a company founded by teachers, supported educators and administrators with software, services and solutions. The company was nominated for a Mira Award in 2015. Financial details of the transaction were not shared.

Greenlight Guru, producers of a dedicated Medical Device Success Platform (MDSP), announced its acquisition of Vertex Intelligence, a data science company that partners with organizations to develop custom artificial intelligence and machine learning solutions. As a part of Greenlight Guru, they’ll look to leverage machine learning to improve the medical device industry’s approach to all aspects of quality management. The acquisition is a culmination of the two companies’ 3-year working relationship, with Vertex playing a significant role in Greenlight Guru’s vision of making smart quality real. Founded in 2018 in Zionsville, Indiana, by CEO Tyler Foxworthy and partners Ken Miller and Zach Cardwell, the Vertex team will form the foundation of Greenlight Guru’s in-house data science department.

Vibenomics, a location-based Audio Out-of-Home advertising and experience company that powers audio channels for retailers, raised $12.3 million in Series B funding. The Fishers, Ind.-based company plans to use the funding to support the launch of additional national networks in grocery stores, pharmacies, and convenience stores. The round was led by previous investor, Panoramic Ventures of Atlanta. They were initially introduced to Vibenomics at a TechPoint VC Speed Dating event.

JUNE

South Bend, Ind.-based startup Groundata has received $20,000 in investment from the Elevate Ventures Community Ideation Fund. The company plans to use the funds for product development and to expand its sales and marketing efforts. Using artificial intelligence and machine learning, Groundata’s platform allows philanthropic funders and their portfolio nonprofits to automate processes, ensuring more transparency and consistency in data collection, analysis and reporting as per environmental, social and governance (ESG) or U.N. Sustainable Development Goals (SDG) standards.

Fueled with growth capital from their $120 million investment in 2021, Greenlight Guru announced their second acquisition of the quarter and third of the year with SMART-TRIAL. Based in Denmark, SMART-TRIAL is the maker of the first and only Electronic Data Capture (EDC) platform designed for medical devices and diagnostics.

Encamp, an award-winning enterprise technology startup for environmental compliance data management and reporting, announced $30M in Series C funding from Drive Capital of Columbus, Ohio. Funding was led with full participation from previous investors, including OpenView (Boston), High Alpha Capital, Allos Ventures, and more. The investment follows a significant year of growth for Encamp, which saw a 500% increase in ARR in 2021. This is Drive Capital’s second investment in Indiana tech as they also participated in ClusterTruck’s Series A Round in 2020. Encamp has now raised more than $50 million in capital.

Holder, a web3 CRM and marketing automation platform, announced its public launch. The platform leverages crypto wallet data, social and community insights and first-party data to help web3 businesses understand their customers and build better relationships. The company is led by CEO and Co-Founder Drew Beechler, and is the first web3 business to launch out of High Alpha.

CSA360, a security management software company, has closed a $1.3 million round of seed funding. Elevate Ventures and various angel investors participated in the round. The company’s software provides a customizable dashboard with more than 17 modules that deliver real-time information on security incidents, as well as tools for communication, staff training and more.

Allied Payment Network, Inc., based in Fort Wayne, Ind., and a provider of online and mobile money movement services to banks and credit unions, announced a significant, undisclosed capital investment from RF Investment Partners, a private investment firm that provides debt and structured equity solutions to growth-oriented companies. RF Investment Partners lists offices in New York, Chicago and Dallas.

Civic Champs, a volunteer management platform, announced today that it raised $615,000 in its pre-seed round. The round included participation from Elevate Ventures, Flywheel Fund, Innovation Works (Pittsburgh), IU Angels, The Richard King Mellon Foundation (Pittsburgh) and various angel investors including Jay Love, founder of Bloomerang. Civic Champs is a web-based and mobile platform that automates volunteer management for nonprofit organizations.

Schneider Geospatial, a provider of GIS and related solutions to state and local governments, announced a significant growth investment from Align Capital Partners (ACP), a Cleveland, Ohio area growth-oriented private equity firm with a focus on govtech companies. “We are excited to continue our partnership with our amazing clients,” said Jeff Corns, CEO of Schneider Geospatial. “ACP’s investment allows us to accelerate several of our growth initiatives, which will result in even better solutions and services to our clients. Our talented team is excited to continue this next phase of the company’s growth.”

ExtraDent, an Indianapolis-based software solutions provider for the dental industry, was acquired by DentalXChange of Irvine, Calif.. Founded in 1989, DentalXChange has earned industry-wide acclaim and recognition for pioneering the web-based dental Electronic Data Interchange solutions industry. Financial details of the deal were not shared.

Decimal, a technology platform for SMB (small-and-medium-sized businesses) accounting operations, announced a $9.2 million seed fundraising round led by Arthur Ventures (Minneapolis), with participation from Service Provider Capital (Golden, Colo.) and a handful of individual angel investors. The capital raised will be used to accelerate growth and platform development. This is the second Indiana tech company investment for Arthur Ventures, as they invested in 250ok (acquired in 2020). Service Provider has invested in eight other Hoosier-based technology companies.

TechPoint has reported tech investments and M&A activity involving Indiana technology companies since 2014. Share your funding deals with us by contacting Roger Shuman. If you represent one of these Indiana tech companies and it is not yet listed on the TechPoint Tech Directory, please add them today. The listing also enables you to post job openings on the TechPoint Job Board. For additional information and insights on Indiana’s tech sector, be sure to stay connected to TechPoint Index by subscribing to our weekly newsletter.

To see how the second quarter of 2022 compares to recent years, see TechPoint’s VC reports for 2021, 2020, 2019, 2018, 2017 and 2016.