“Sales Fixes Everything, Right?” (WRONG!)

Author: Greg Stanley is founder and President of Accelerant Consultants

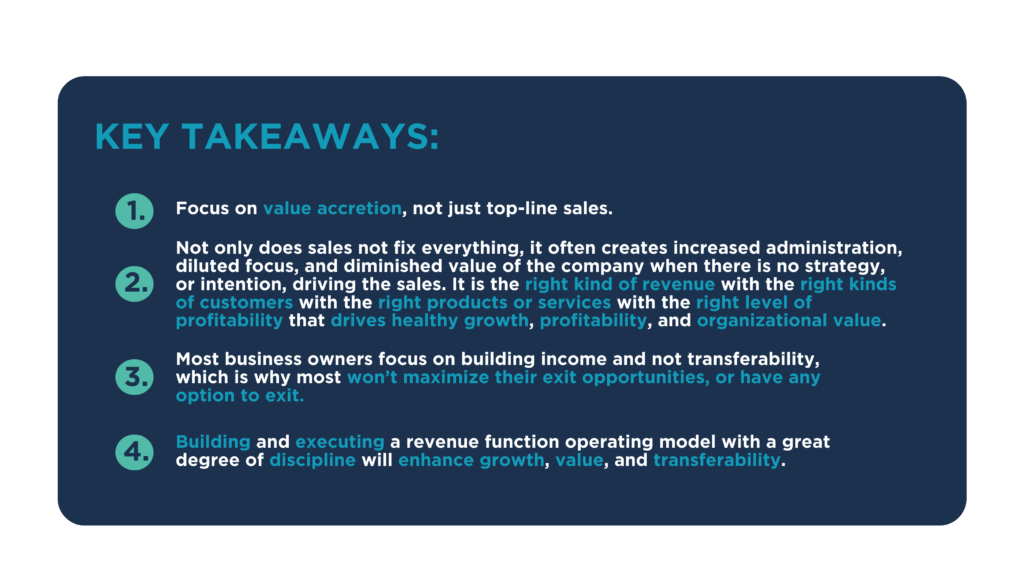

There is an adage many business owners live by, which is “sales fixes everything.” It makes sense, right? Nothing happens until a sale is made. As long as top-line revenue grows by any means necessary, bills are being paid, machines are running, and cash flow remains steady, everything is right in the world.

While this may be necessary when business owners are in “start-up mode” and struggling to pay rent and payroll, the longer business owners subscribe to this theory, the more both transferability and even viability, are threatened.

The Revenue vs. Value Conundrum

As a business owner, it is easy to confuse top-line revenue with organizational value. These concepts are entirely different, and they also oftentimes conflict with each other. Chasing revenue for its own sake incurs a significant opportunity cost by diverting focus from what truly creates value.

The first step in determining how to align your business with value creation is to understand where net profit is derived and eliminate the practice of putting all revenue in a pot, stirring it up, and hoping at the end of the year, a black number emerges. To determine net profit, it is necessary to assess revenue generation through an estimated profit and loss across three dimensions:

Through this process, it’s extremely common to realize that a company’s believed-to-be most important customer (based on top-line revenue) is essentially losing money with each transaction.

Additionally, taking on any customer who can “fog a mirror and write a check” can be highly dilutive to the company’s ability to build value. A recent project for a roughly $100 million distributor revealed that the bottom 50 customers produced an average gross profit of $26.

It was quickly apparent that after costs such as inventory carrying, bad debt write-offs, sales commissions, and administration were loaded, the business was losing money on every single one of these customers. As the analysis dug deeper, we learned the organization had approximately 300 customers that were causing the company to lose money on each transaction as well as draining the company’s resources, attention and focus from other much more highly profitable customers.

In their quest for top-line growth, the company leaders came to understand that not all dollars were created equal, and not all customers were good customers.

Building a Transferrable Asset

As Stephen Covey wisely advised in his Seven Habits of Highly Effective People, we need to “Begin with the end in mind.” This means considering exit options when founding a business, understanding what the market values, based on your exit strategy, and making intentional, conscious decisions every day that make your business both valuable and transferable. In a recent panel discussion, an entrepreneur who had gone through a successful exit explained this concept perfectly when he said, “I wanted to be able to build a business I could run forever, or transfer tomorrow if the right opportunity presented itself.”

The goal of running a business should not be to build a lifestyle business that creates a nice income but has no sustainable value. Often, though, this is what business owners do. A Key Bank study estimated that between 2022 and 2030, approximately 250,000 U.S. business owners would attempt an exit. Eighty percent of those businesses were projected not to be “market ready.” In other words, 80 percent of businesses—many of which owners likely spent years or decades building with immense effort and sacrifice—would either be sold at a steep discount or, worse, face closure, leaving owners to lock the doors for good on their final day.

The Critical Role of the Revenue Function

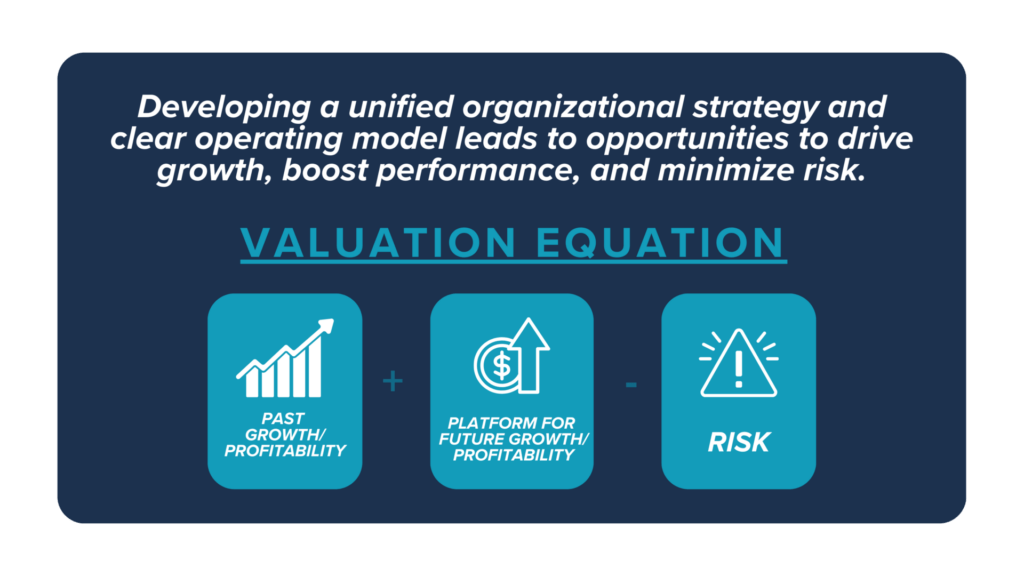

In its simplest form, the valuation of a business comes down to the formula below.

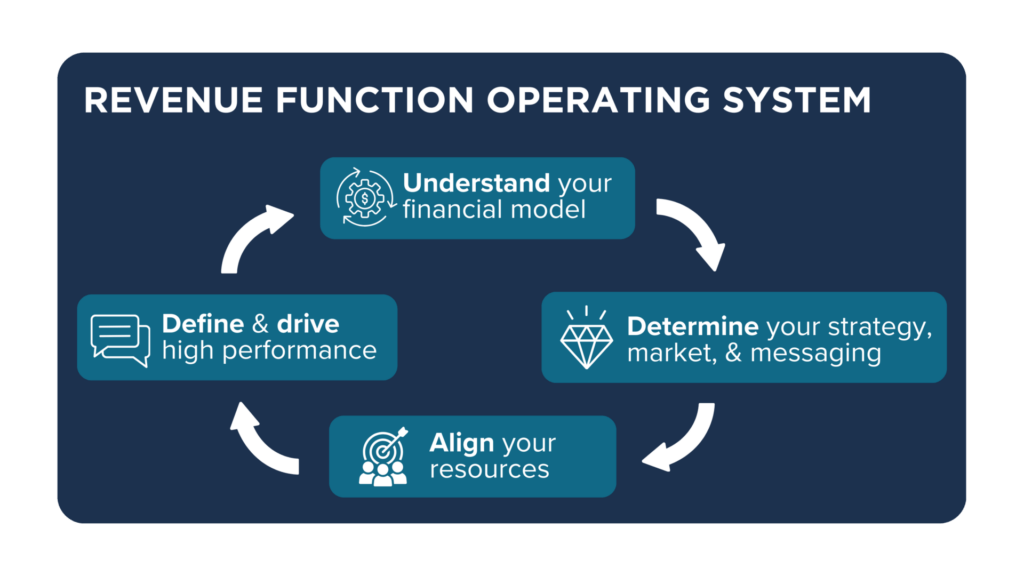

While risks within a business’s financials, management team, HR, or IT can certainly diminish its value, it is the strategically aligned, efficient, effective, and intentional revenue function that ultimately commands a premium at exit. This ensures that the single opportunity a business owner has to exit their business is as impactful and rewarding as possible. Once the financial model is understood, all other decisions relative to the revenue function operating model should be fully aligned to value creation. Accelerant Consultants has developed the Revenue Function Operating System™ to help business owners optimize revenue functions, maximize valuation, and produce more—and more meaningful—options to exit when the opportunity arises.

Determine the strategy, market, and messaging

Once the financial model is established, it should serve as a guide to determine the attributes that define a desirable customer, as well as attributes which disqualify a company from being pursued. Based on target modeling, differentiating and compelling market messaging can be developed.

Align the resources

Sales team members are often the highest-paid employees in a company, yet receive the least training, guidance, and oversight of any functional area. It is imperative to build a highly connected continuum between a job description, key performance indicators, compensation, and management and accountability to ensure alignment to value creation. Every marketing investment should be analyzed to confirm it is driving the right kinds of revenue opportunities with the right kinds of targets, and not just proliferating the company’s brand with no tangible results.

Defining and Driving High-Performance

In the sports world, a coach doesn’t drive high performance simply by setting a goal of points scored. Every role is meticulously developed, expectations for training and on-field performance are set, and the focus turns to tactical execution, as both positive and constructive, feedback is given in the moment during the course of the game. The best athletes want high performance defined, they want to be held accountable, they want to be coached, and they want to seek self-improvement. The best employees do, too. It’s up to business leaders to build operating models and expectations, and to demand high performance.

-30-

Greg Stanley is founder and President of Accelerant Consultants