How Early-Stage Technology Companies Can Get Immediate Tax Savings Using R&D Credits

Congress, with the passage of the Protecting Americans from Tax Hikes Act of 2015 (PATH Act), enables small businesses to use research and development credits (R&D credits) to offset payroll tax liabilities and Alternative Minimum Tax (AMT) liabilities. Before the enactment of the PATH Act, R&D credits could only offset income tax and thus went largely unused by early-stage companies.

Qualifications

- An “early-stage company” is a company that has had gross receipts for five or fewer years.

- Early-stage companies can now offset up to $250,000 of the employer’s portion of FICA tax annually with R&D credits generated in 2016.

- The company cannot exceed $5 million of gross receipts in the year it elects to apply the R&D credits to its FICA tax liability.

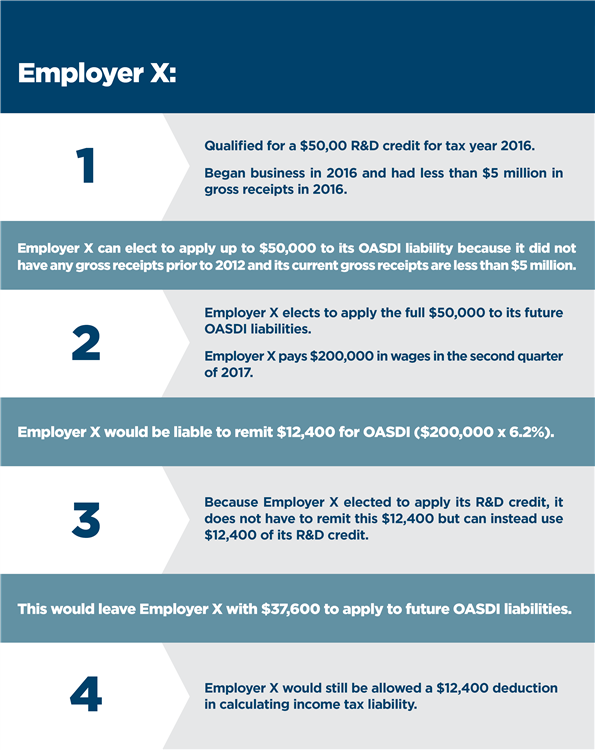

For example:

- If a company received the R&D credit for activities in 2016, did not have any gross receipts before 2012, and had less than $5 million of gross receipts in 2016, the company can elect to offset its FICA tax liability by the amount of its R&D credit, up to $250,000.

- If the credit exceeds the company’s FICA tax liability, any excess can be carried forward to offset future FICA tax liabilities until the R&D credit amount is exhausted.

The new credit only offsets the employer’s portion of the Old-Age, Survivors, and Disability Insurance (OASDI) portion of FICA tax. This amounts to 6.2 percent of wages. The employer must still pay the Medicare portion of the FICA taxes. The employer will still be allowed to take a payroll tax deduction for the full amount of the FICA tax. It should be noted that an entity can only make this election for up to five years.

AMT Offset

A taxpayer may be able to use the R&D credit to offset AMT liability. This provision applies to taxpayers other than publicly traded corporations. To be eligible to use a R&D credit to offset an AMT liability, a taxpayer’s average gross receipts over the last three years must not be in excess of $50 million. Control group rules require some entities to be examined as a whole when determining the average gross receipts. Additionally, a partner or S-Corporation shareholder are eligible for this AMT offset. The partners or shareholders must meet the gross receipts test separately at the individual level.

To find out how your technology company can leverage these credits, contact Tim DuVall in Katz, Sapper & Miller’s Technology Industry Services Group.

About the Authors

This post was written by Tim DuVall and Stephen Schnelker of Katz, Sapper and Miller.

Tim DuVall is a partner in Katz, Sapper & Miller’s Business Advisory Group and partner-in-charge of the Life Sciences and Technology Industry Services Groups. Tim provides business, tax and accounting consulting services to a wide variety of industries.

Tim DuVall is a partner in Katz, Sapper & Miller’s Business Advisory Group and partner-in-charge of the Life Sciences and Technology Industry Services Groups. Tim provides business, tax and accounting consulting services to a wide variety of industries.

Stephen Schnelker is a member of Katz, Sapper & Miller’s Tax Services Group. Stephen’s primary responsibilities include analytical research, compliance, and providing planning services to clients in the areas of individual and business taxation.